Content

Failure to Comply With Terms and Conditions and Termination. TaxSlayer reserves the right to change any information on this Website including but not limited to revising and/or deleting features or other information without prior notice. Clicking on certain links within this Website might take you to other web sites for which TaxSlayer assumes no responsibility of any kind for the content, availability or otherwise. (See “Links from and to this Website” below.) The content presented at this Site may vary depending upon your browser limitations. You may not download and/or save a copy of any of the screens except as otherwise provided in these Terms of Service, for any purpose.

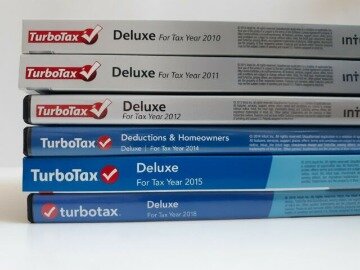

Last year, about 28 million federal tax returns were filed electronically using TurboTax, compared with 7 million each for H&R Block software and TaxAct. Block has been offering dissatisfied TurboTax Deluxe customers a free download of its Deluxe software, which normally sells for $44.95 and still allows E-filing of Schedules D and C.

Please check the contact us link in your my account for the support center hours of operation. Usually, email responses can be expected within 24 to 48 hours. TaxSlayer makes it easy to prepare and e-file your state return. TaxSlayer guarantees 100% accurate calculations or we will reimburse you any federal and/or state penalties and interest charges.

We will automatically transfer information from your federal tax return to your state tax return. Double-check your entries to be sure you entered all of your information correctly. This ensures your return is processed by the IRS and state without delay. We stand behind our always up-to-date calculations and guarantee 100% accuracy, or we will reimburse you any federal or state penalties and interest charges.

Last year about 28 million taxpayers e-filed using TurboTax, compared to the seven million who used the Block product. In the center of the page there is a menu – Benefits, Reviews, Tax Forms, Requirements. When you click on Tax Forms, you will see the list of supported tax forms. Website was user friendly and return was processed fast compared to other sites. We guarantee you will receive the maximum refund you are entitled or we will refund you the applicable TaxSlayer purchase price paid.

The CD/download versions contain all the tax forms you need. TT Deluxe CD/download does have Schedule D and anything else you need for handling your investments.

Taxslayer Terms Of Service

Everyone gets free, unlimited phone and email support. And if you need more help, we have you covered from Ask a Tax Pro to Audit Defense. We make switching easy — we’ll autofill your income, wages, and more when you upload a prior year return and import your W-2. You can file confidently with our always up-to-date calculations and 100% accuracy guarantee. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

The purpose of the schedule is to calculate the self-employment tax you must pay. However, when you fill out your 1040, the IRS allows you to deduct some of these payments. You use Schedule C to report profits or losses from a sole proprietorship. A sole proprietorship is any business you operate and control that is not set up as a legal business entity such as a corporation or partnership. However, if you operate your business as a single-member LLC, you still need to complete the schedule. It does not have to be a business with employees or an office, but it can. It just means you’re the boss, and there’s no one above you writing your paychecks or withholding taxes from your pay.

Over 10 Million Federal And State Returns Filed This Year

You agree that all information you provide any merchant or information or service provider through the Site for purposes of making purchases will be accurate, complete and current. The merchants and information and service providers offering merchandise, information and services through the Site set their own prices and may change prices or institute new prices at any time. You agree to pay all charges incurred by users of your account and credit card or other payment mechanism at the prices in effect when such charges are incurred. You also will be responsible for paying any applicable taxes relating to purchases through the Site. This year, those who need to file a Schedule D or E must trade up to TurboTax Premier, while a Schedule C or F requires the even more expensive TurboTax Home & Business. “We heard our customers loud and clear. They want their TurboTax desktop product to do what it has always done – handle the same tax situations as it did in years past,” said Sasan Goodarzi, general manager of Intuit’s TurboTax business. “Keeping the promise we made is part of our continuing commitment to earning our customers’ trust and loyalty. As is delivering a great experience to our desktop customers and ensuring they get their biggest possible tax refund.”

People who need advanced tax software, which can run $100 or more elsewhere, can especially benefit from the price difference, particularly when adding a state return. We’ll guide you through the entire filing process to help you file quickly and maximize your refund.

TaxSlayer.com’s “Free” products are excluded from this guarantee. To qualify for the guarantee, the larger refund or smaller tax due cannot be attributed to variations in data you provided TaxSlayer.com for tax preparation, or for positions taken by you or your preparer that are contrary to the law. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.com. Click here to learn how to notify TaxSlayer if you feel like you are entitled to a refund. Comparison pricing and features of other online tax products were obtained directly from the TurboTax®, H&R Block®, TaxAct®, Jackson Hewitt®, and Liberty Tax® websites on March 1, 2021. Filing with all forms, including self-employed. Cost of filing state with complex federal return.

In most cases, people who fill out Schedule C will also have to fill out Schedule SE, “Self-Employment Tax.” In the 2014 version, those who need to e-file a Schedule D or E have to trade up to TurboTax Premier, while a Schedule C or F requires the even more expensive TurboTax Home & Business. H & R Block has attempted to capitalize on the discontent by offering its product free to angry purchasers of TurboTax Deluxe. If you get a larger refund or smaller tax amount due from another tax preparation engine with the same data, we will refund the applicable purchase price you paid to TaxSlayer.com.

In return, they’ll be sent a link good for one free download of H&R Block Deluxe + State. “The consumer has said pretty clearly they want the features and functionality they are used to receiving in the product they are used to working in. That is what H&R Block is providing with our Switch to Block offer,’’ he wrote. If you’re looking for a cost-friendly online tax filing software, TaxSlayer doesn’t disappoint. It’s possible to file both your state and federal return for free and the paid versions are priced lower than some of TaxSlayer’s main competitors.

Turbotax Guarantees

It announced this afternoon that it will provide users of its TurboTax Deluxe desktop product free upgrades this year and will next year reverse changes it made that limited the usefulness of the 2014 version. You want to safeguard your tax return, just in case. In the event of an IRS audit, TaxSlayer will help you resolve the matter as quickly as possible. By using this site you acknowledge and agree that TaxSlayer provides listing prices only as a guide. Pricing is determined at the time or print/e-file and is subject to change at any time without prior notice. They cover the terms and conditions that apply to your use of this website (the “Website,” or “Site”). (“TaxSlayer”) may change the Terms of Service from time to time.

To use this option you must be filing a Federal return and receiving a refund from your federal return to cover the expenses listed above. Our Simply Free Edition is excluded from this guarantee. To qualify for the guarantee, the larger refund or smaller tax due cannot be attributed to variations in data you provided TaxSlayer for tax preparation, or for positions taken by you or your preparer that are contrary to the law. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer. Click here to learn how to notify TaxSlayer if you believe you are entitled to a refund. For those who do not qualify the price to file a federal tax return is $17 and the state is $32.

- TaxSlayer makes it easy to prepare and e-file your state return.

- When you purchase the TurboTax software , it says that it “comes with 5 free federal e-files.” This is actually an IRS rule, not a TurboTax one.

- In fact, the IRS requires intermediaries like TurboTax to capture and retain e-filers’ Social Security numbers.

- For those who do not qualify the price to file a federal tax return is $17 and the state is $32.

- Filing with all forms, including self-employed.

It was a short jump from there to practicing, teaching, writing and breathing tax. Intuit made the change, according to spokesperson Julie Miller, “because we aspire to deliver the best, Interview-based experience for a customer’s unique tax situation.” Pulling the forms from that package meant that some taxpayers paid less for their software . Other customers, however, were forced to pay more for the upgrade. Credit Karma Tax offers a free way to file both your federal and state taxes.

Rated 4 6053 Out Of 5 Stars By Our Customers

If you sold any investments (stocks, bonds, mutual funds, options, etc.) then you’ll have to file a Schedule D – which also means you’ll need TurboTax Premier. Each one includes tech support but only Premier and Home & Business include phone support and guidance from Certified Public Accountants. In all the questions and answers below, you can always use a more expensive version of TurboTax. For example, if you sold stock, you’ll need TurboTax Premier or better, which only includes TurboTax Home & Business. You can always do your taxes withCredit Karma Tax. The free version is very powerful (it includes taking a photo of your W-2 to get the information in) but it’s very basic. It’s only meant for the simplest of tax situations.

Many sole proprietors are able to use a simpler version called Schedule C-EZ. This form omits a lot of the detail in the full Schedule C and just asks for your total business receipts and expenses. However, you still need to complete a separate section if you claim expenses for a vehicle. It’s unclear how much the brouhaha, and Intuit’s mishandling of it, has hurt TurboTax’s market leading position.

Perfect For Independent Contractors And Small Businesses

The IRS only allows you to prepare and electronically file up to five federal and state tax returns. If you are self-employed, it’s likely you need to fill out an IRS Schedule C to report how much money you made or lost in your business. This form, headlined “Profit or Loss From Business ,” must be completed and included with your income tax return if you had self-employment income.

You are responsible for paying any additional tax owed. All prices here, and on all outward facing TaxSlayer.com sites, are subject to change at any time without notice.