From understanding financial statements to maintaining regulatory compliance, this article will cover all the critical components to ensure the financial health of your practice. CareCloud is a comprehensive medical accounting software that caters to the financial needs of healthcare institutions, delivering an integrated patient experience. By combining financial tasks with patient management, it ensures a smooth, consistent experience for patients, which is crucial for today’s healthcare facilities. WRS Health provides robust practice management and medical billing software specifically designed for medical specialties. It centralizes billing operations and integrates them seamlessly with electronic health records and practice management systems, which is why it is excellent for specialty medical practices. This includes tracking all financial transactions, maintaining separate records for business and personal expenses, and regularly reconciling bank accounts.

Multiview Corporation – Best for hospitals and health systems

Vyde is a licensed accounting firm (CPA) based in Provo, Utah, and members of the AICPA. We provide professional accounting services to businesses and individuals, with a focus on small business bookkeeping and taxes. The income statement, also known as the profit and loss statement, provides an overview of the practice’s revenues and expenses over a specific period. It helps in assessing the practice’s profitability and identifying areas for cost reduction.

Getting Familiar With Your Financial Statements

- When you started your medical practice, you likely took on far more responsibility than you imagined.

- However, we can also make accrual adjustments like tracking accounts receivable and accounts payable with our specialized accounting add-on.

- This platform integrates with various EHR systems, enhancing data consistency and reducing the need for manual data entry.

- Depreciation tracking should begin by creating an inventory of all assets owned by the organization.

- When you’re ready to take some of those responsibilities off your plate, accounting and bookkeeping should be your top priority.

This involves billing, coding, accounts receivable management, insurance claim processing, and ensuring timely collection of payments. Most healthcare providers use cash basis accounting to manage and track their financials. Medical accounting software is a specialized tool used by healthcare professionals, medical practice managers, and financial administrators to manage the financial aspects of their operations.

How Much Does a CPA or Accountant Cost?

Its capabilities, such as budgeting, forecasting, and reporting, contribute to efficient financial management and make it particularly effective for larger health organizations. I picked Striven because it presents a comprehensive solution to medical practice management. Its range of capabilities, from appointment scheduling to billing, makes it distinct from other tools.

Whatever you can do to optimize your accounting from the start will pay dividends indefinitely, so be as diligent as much as possible from day one. Preventing accounting problems from occurring is much more effective than fixing them later. Not only can this stress relationships with business partners, but it can also put you in danger of an IRS audit and make it difficult to get a business loan or line of credit. While this might seem like a mundane administrative task, it’s crucial for preventing and detecting fraud and errors.

Streamlining Accounting Processes

Health care accountants also have extensive knowledge of billing processes and reimbursement rates that can be beneficial when negotiating contracts with insurers or other third-party payers. Regular internal and external audits are essential to identify and address potential financial discrepancies and risks. Effective risk management strategies should be in place to detect and prevent fraud, errors, and mismanagement.

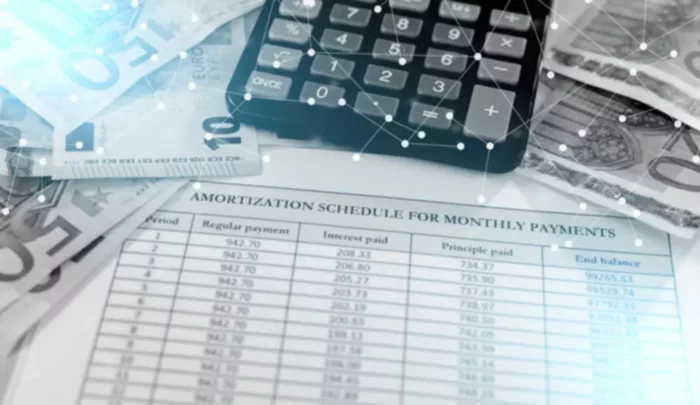

After a thorough evaluation, I’ve curated this list of the 12 best medical accounting software, handpicked to solve your specific challenges. The operating margin measures the practice’s profitability by comparing operating income to total revenue. A higher operating margin indicates better financial health and efficiency in managing operational costs. The cash flow statement tracks the flow of cash into and out of the practice, helping in managing liquidity and ensuring that the practice can meet its financial obligations.

Health care accountants and accounting professionals are responsible for accurate billing, budgeting, and negotiating contracts with third-party payers. Health care and medical accounting professionals also help organizations with regulatory compliance while providing accurate financial reporting to stakeholders. Prolonged delays in receivables can significantly affect the practice’s liquidity and ability to cover operational expenses.

To make matters worse, the unique nature of the healthcare industry creates financial issues beyond what most business owners face. This method helps health care facilities obtain a more accurate picture of the transactions that may occur within a given time frame, like a quarter or fiscal year. This accuracy is the reason why large health care facilities will use this method in their accounting practice.

Best practices include maintaining accurate financial records, ensuring regulatory compliance, managing cash flow effectively, and engaging professional accounting services. Accurate record-keeping, regular reconciliation of bank accounts, and staying updated with regulatory changes are also vital. A crucial aspect of medical accounting is managing the flow of funds from patient services.