Content

It’s where you declare income from things like interest, dividends, capital gains and more. For some kinds of income, you’ll have to attach other supporting tax forms as indicated. Add up all forms of income you’ve listed and write the sum on Line 9. Maybe the estate includes a property that’s being rented out and so brings in rental income. If you’re the executor of an estate that has $600 or more of income or has a beneficiary who is a resident alien, you must file Form 1041. If the estate is distributed to beneficiaries before it can take in $600 or more of income, and none of those beneficiaries are resident aliens, filing Form 1041 is not necessary.

In general, an estate must pay quarterly estimated income tax in the same manner as individuals. For more information on when estimated tax payments are required see the Form 1041 instructions. For more information on how to make estimated tax payments for an estate see IRS Form 1041-ES, Estimated Income Tax for Estates and Trusts.

When you report these amounts on your 1040, you’re able to take advantage of the lower rates of tax that apply to qualified dividends for the amounts reported in box 2b. Some of the other income categories reported on the K-1 include interest earnings, long-term and short-term capital gains, ordinary business income, and rental real estate income. Since the trust and estate must report all income, deductions are available for amounts that must be distributed to beneficiaries. Form 1041 allows for an “income distribution deduction” that includes the total income reported on all beneficiary K-1s. You must prepare a Schedule B attachment for Form 1041 to take the deduction.

My Father Died In 2020 At Age 68 I Was Named As The Beneficiary Of His Ira. Is This A Tax

To prevent trusts from being used as tax shelters, higher tax rates kick in at much lower income levels than for individuals. If the estate was large enough to be subject to federal estate tax, you can deduct the portion of the federal estate tax attributable to the IRA. In addition, you don’t have to pay tax on the portion of withdrawals attributable to nondeductible contributions that your mother made to the IRA . If it’s a Roth IRA, the inheritance is federal-income-tax-free if the account was opened more than five years before you take any withdrawals. If it’s a traditional IRA, however, you will usually owe income tax as you withdraw money from the account. Keep in mind, however, that the income an estate reports on a 1041 is unrelated to the estate tax. The income tax covers the earnings of estate assets, whereas the estate tax covers the value of the assets.

Not every estate is required to file Form 1041 for income earned. If the estate has no income producing assets or the annual gross income is less than $600, no return is necessary. The only exception is if one of the beneficiaries is a non-resident alien.

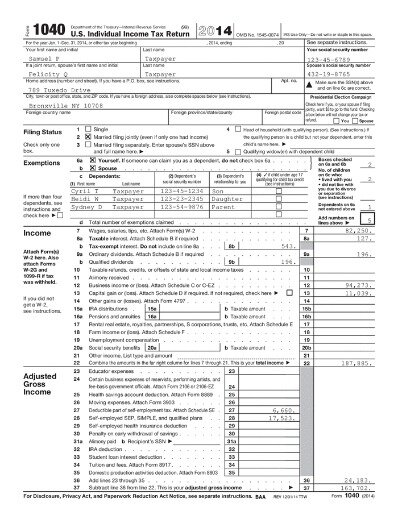

Federal Form U.S. Income Tax Return for Estates and Trusts can be electronically filed starting with tax year 2011. For instructions on electronically filing business returns, click here. You must file a tax return for the trust depending on the type of trust established, or if it is not required to distribute all of its income to your son each year, or if its gross income is $600 or more.

Most deductions and credits allowed to individuals are also allowed to estates and trusts. A trust or decedent’s estate is allowed an income distribution deduction for distributions to beneficiaries.

Turbotax Guarantees

If your mother paid tax each year as the interest accrued on the bonds, you only need to report the interest earned after her death.

The Schedule K-1 you receive details your share of the trust’s income, deductions and credits, which you report on your tax return. Hello, I’m Scott from TurboTax with some important information about fiduciary income tax returns. For calendar year estates and trusts, file Form 1041 and Schedule K-1 on or before April 15 of the following year. For fiscal year estates and trusts, file Form 1041 by the 15th day of the 4th month following the close of the tax year. The second page of Form 1041 provides detailed instructions for calculating charitable deductions and income distribution deductions , as well as instructions on tax computation. The bottom section of page two is a series of yes-or-no questions about the income sources and business dealings of the estate or trust. If you’re not sure about the answers to these questions, don’t guess.

The estate tax return is generally due four months after the close of the tax year. For example, if you authorize a payment for repairs to real estate in the trust—those costs are deductible on the 1041. One interesting feature of the 1041 is that you can deduct some or all of the payments you make to beneficiaries. Suppose the trust document requires that all dividends be paid to beneficiaries or provides you discretionary authority to do so. In this case, the beneficiaries will report the dividend income on their personal returns. You still report the dividend income on the 1041—but you also report a deduction for the beneficiary distributions in a later section of the return.

Free Fed & State, Plus Free Expert Review

Inheritance isn’t usually considered income, but certain types of inherited assets can have tax implications. Before you spend or invest your inheritance, read more inheritance taxes and exemptions. If you’re designated the executor of someone’s estate, you may need to file Form 1041 to declare the income from that person’s estate . A financial advisor can help you maximize an estate plan for your loved ones. To file IRS Form 1041, the executor needs to obtain a taxpayer identification number for the estate. 1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4/1/19 through 4/17/19.

- The executor then has up to 12 months to file the income tax return.

- Have you been appointed as trustee of a trust or the administrator of an estate?

- As a trustee or administrator, you are the fiduciary of the trust or estate.

- However, filing a tax return for either of these entities requires you to prepare Form 1041, which many refer to as a fiduciary income tax return.

- Before the assets were passed on to the beneficiaries, they earned $1,200.

The decedent and their estate are separate taxable entities. Before filing Form 1041, you will need to obtain a tax ID number for the estate. An estate’s tax ID number is called an “employer identification number,” or EIN, and comes in the format X. You can also apply by FAX or mail; see How to Apply for an EIN.

The executor, however, can file an election to choose a fiscal year, which means the tax year ends on the last day of the month before the one year anniversary of death. The executor then has up to 12 months to file the income tax return.

Simple trusts must distribute all of the income earned to its beneficiaries and cannot accrue income. Simple trusts also cannot designate a charity as its beneficiary or distribute its corpus .

You’ll subtract deductions from income and then use Schedule G of Form 1041 to calculate the tax owed. You can then subtract any tax payments that have already been made or withheld, any penalty owed or the amount overpaid .

Just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. On Form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees, fiduciary fees anditemized deductions. Form 1041 is used to report income taxes for both trusts and estates. That is different than the estate tax return which is Form 706. For estate purposes, IRS Form 1041 is used to track the income an estate earns after the estate owner passes away and before any of the beneficiaries receive their designated assets.

At that point, it’s the trust that owns the property, not you. The Schedule K-1 form may report information other than your share of income . Box 9, for example, shows the amount of depletion, depreciation and amortization deductions allocated to you.

And when the stocks pay dividends or tenants pay rent—the income belongs to the trust. But the IRS doesn’t allow a trust or estate to receive the income tax free. This is where the 1041 comes in—you need to report this rental and dividend income on the return. Hello, I’m Tammy from TurboTax with some information about fiduciary income tax returns. If you are the beneficiary of a trust, you are responsible for paying tax on your share of the trust income that’s distributed to you.

As a trustee or administrator, you are the fiduciary of the trust or estate. This means that you are the person responsible for overseeing the estate or trust—which includes filing all necessary tax returns. The IRS requires the filing of an income tax return for trusts and estates on Form 1041—formerly known as the fiduciary income tax return.

If the stock falls in value before you sell it, you would have a tax-saving capital loss. The same concept applies to a decedent’s estate that isn’t immediately distributed to heirs at the time of death. Estate tax on the transfer of assets from the decedent to beneficiaries and heirs is reported on IRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return.

Pay

One thing to remember as a fiduciary is that you are responsible for filing the 1041 on behalf of the trust or estate. Any taxes due are usually paid out of the trust or estate property. Once you’ve declared the income of the estate or trust, you’ll enter deductions.

In that case, the income total does not matter, and a return must be filed. The executor or personal representative of the estate must file the tax return. For tax years 2010 and prior, federal Form U.S. Income Tax Return for Estates and Trusts was not supported for electronic filing. An estate or trust return prepared for any of these tax years must be printed and mailed to the Department of Treasury.

Income distributions are reported to beneficiaries and the IRS on Schedules K-1 . IRS Form 1041 is also used to report any income a trust earns over $600. Like the estate, however, Form 1041 must be filed regardless of the amount of income earned if there is a beneficiary that is a nonresident alien. If you’re filing a 1041 on behalf of an estate or trust, our TurboTax Business product will walk you through it, step by step. The TurboTax Home and Business edition does not support a Form 1041 Estate and Trust tax return. Trusts have their own income tax rate schedule for income the trustee chooses to retain rather than distribute to beneficiaries.

The TurboTax personal editions, such as Premier, and the TurboTax Business Edition is separate software and would be separate purchases. single taxpayers need more than $85,525 of taxable income to be in the 24% bracket for 2020. If you withdrew just $5,000 (one-tenth of the account), you deduct 10% of the estate tax bill attributable to the IRA.

However, trusts and estates can also take deductions to reduce their taxable income. TurboTax Deluxe helps you find all the money-saving tax deductions related to your estate and trust income. Although you have to pay federal income tax as you pull the money out of the IRA, you also get an income tax deduction for that $22,500. If so, that wipes out your tax liability for that interest when you cash in the bonds. Did you receive a payment or other property from an estate or trust during the year? If so, here’s what you need to know about how it affects your taxes. When you create a trust, it’s likely that you will be transferring personal assets to it such as real estate and investments.