Content

Prohibit insurance plans from excluding coverage for children with preexisting conditions. The Obamacare Act understands that many people may be hesitant to get insurance and to comply with a law that is so new to them, which is why the tax for violating the law for the first year is the smallest tax.

- On the negative side, the Obama Health Care Reform Plan is expensive.

- Insurers are required to implement an appeals process for coverage determination and claims on all new plans.

- Authorization had to be given so DHHS could pay insurers from “general government revenues”.

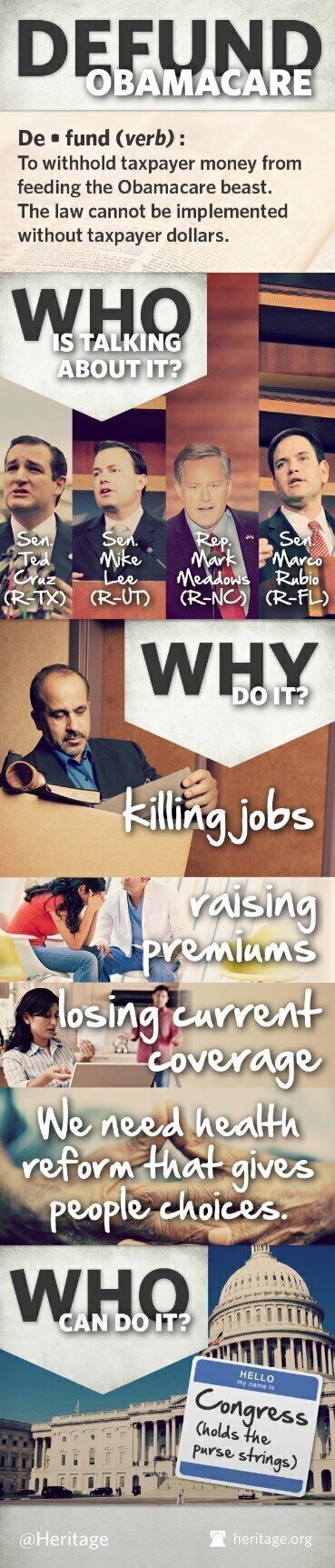

- Opposition and efforts to repeal the legislation have drawn support from sources that include labor unions, conservative advocacy groups, Republicans, small business organizations and the Tea Party movement.

- Again, the eligible individual or family must purchase a silver level plan in order to receive the cost-sharing subsidy.

- The term emerged in March 2007 when healthcare lobbyist Jeanne Schulte Scott wrote, “We will soon see a ‘Giuliani-care’ and ‘Obama-care’ to go along with ‘McCain-care’, ‘Edwards-care’, and a totally revamped and remodeled ‘Hillary-care’ from the 1990s”.

CBO expected the exchanges to remain stable (i.e., no “death spiral” before or after Trump’s action) as the premiums would increase and prices would stabilize at the higher (non-CSR) level. Several insurance companies who sued the United States for failure to pay cost-sharing reduction payments won several cases in 2018 & 2019. The Judiciary decided the insurance companies are entitled to unpaid CSR payments. When you enroll in a health insurance plan, you typically pay a monthly premium to keep that plan.

Financial assistance to make insurance more affordable and increase insurance coverage is a key element of the ACA. Premium tax credits and cost-sharing reductions of varying levels are available to individuals and families with low to moderate incomes, making coverage and care more affordable.

In Nebraska, PLWH newly covered by Medicaid expansion in were four times more likely to be virally suppressed than PLWH who were eligible but remained uninsured. As an early adopter of Medicaid expansion, Massachusetts found a 65% rate of viral suppression among all PLWH and an 85% rate among those retained in healthcare in 2014, both substantially higher than the national average. As well, expanded Medicaid has led to a 6.6% increase in physician visits by low-income adults, as well as increased usage of preventative care such as dental visits and cancer screenings among childless, low-income adults.

It had been passed by the House as a revenue-related modification to the Internal Revenue Code. The bill became the Senate’s vehicle for its healthcare reform proposal, discarding the bill’s original content. The bill ultimately incorporated elements of proposals that were reported favorably by the Senate Health and Finance committees.

Medicare

From 2008 to health insurance premiums rose by an average of 10% per year. Expanded Medicaid coverage of PLWH has been positively associated with health outcomes such as viral suppression, retention of care, hospitalization rates, and morbidity at the time of hospitalization. An analysis of Behavioral Risk Factor Surveillance System survey data found a 2.8% annual increase in viral suppression rates among all PLWH from 2010 to 2015 due to Medicaid expansion.

A 2013 study estimated that changes to the health system had been responsible for about a quarter of the recent reduction in inflation. Paul Krawzak claimed that even if cost controls succeed in reducing the amount spent on healthcare, such efforts on their own may be insufficient to outweigh the long-term burden placed by demographic changes, particularly the growth of the population on Medicare. A 2016 DHHS study found that states that expanded Medicaid had lower premiums on exchange policies, because they had fewer low-income enrollees, whose health on average is worse than that of those with higher income. to 10 million people had gained Medicaid coverage, mostly low-income adults.

That’s because Obamacare says that companies must spend at least 80% of premiums on providing actual medical services. If they spent it on advertising or executive salaries, they have to pay the excess back to policy-holders.

Citizens whose insurance coverage would cost more than 8% of household income and are exempt from the penalty. The mandate was intended to increase the size and diversity of the insured population, including more young and healthy participants to broaden the risk pool, spreading costs. Insurers must spend at least 80–85% of premium dollars on health costs; rebates must be issued if this is violated.

Turbotax Guarantees

Innovations were limited to health savings accounts , medical savings accounts or flexible spending accounts, which increased insurance options, but did not materially expand coverage. Health care was a major factor in multiple elections, but until 2009, neither party had the votes to overcome the other’s opposition.

The CBO reported in March that the healthcare exchanges were expected to be stable. In May the House voted to repeal ACA using the American Health Care Act. The individual mandate was repealed starting in 2019 via the Tax Cuts and Jobs Act.

This can either be done directly on Healthcare.gov or you can work with a licensed insurance broker who will help you fill out all of the paperwork. In the near future, people will also be able to fill out an applicable for insurance through a participating insurance brokerage company’s website instead of only on Healthcare.gov. The tax is assessed for every month in the year that you are without insurance and not approved for an exemption. For instance, if you are without insurance for half of the year, you will be assessed half of the total tax penalty. Americans have been inundated with information about the Affordable Care Act, or Obamacare, since President Obama signed it into law on March 23, 2010. Most of the information disseminated in the media regarding the details of Obamacare is very confusing. Another obvious trend is that there is a focus with TV news reporting to really sensationalize the stories that are most polarizing, or put another way, angers people on both the “Right” and the “Left”.

Whether or not the President’s Health Care Reform in its current state is sustainable remains to be seen. Some pointed out that the previous system also had socialist aspects. Even for-profit private health insurance companies socialize risk and redistribute wealth from people who have it to those who need it .

Get Healthcare News, Wellness Tips, And Coverage Resources

Provide tax credits to certain small businesses that cover specified costs of health insurance for their employees, beginning in tax year 2010. Provisions included in the ACA are intended to expand access to insurance, increase consumer protections, emphasize prevention and wellness, improve quality and system performance, expand the health workforce, and curb rising health care costs. The most that a person can make in order to receive financial help from the federal government is 400% of the federal poverty line. The following is a simple chart to follow to determine whether your income and family size is within the range that may allow you to receive federal assistance to pay your insurance bill.

The CBO estimated that the repeal would cause 13 million fewer people to have health insurance in 2027. Taylor, president of Unite Here sent a letter to Reid and Pelosi stating, “ACA, as implemented, undermines fair marketplace competition in the health care industry.” Opposition and efforts to repeal the legislation have drawn support from sources that include labor unions, conservative advocacy groups, Republicans, small business organizations and the Tea Party movement. These groups claimed the law would disrupt existing health plans, increase costs from new insurance standards, and increase the deficit.

Starting with 2019 taxes, the individual mandate penalty was reduced to zero dollars, essentially removing the requirement that many Republicans had opposed. By 2018, the number of Americans covered under the ACA had dropped from 17.4 million in 2015 to 13.8 million, according to a report from healthcare research organization KFF. In addition, the ACA requires most insurance plans, including those sold on the Marketplace, to cover at no cost to policyholders a list of preventive services.

Aca Text

Now that you’re signed up, we’ll send you deadline reminders, plus tips about how to get enrolled, stay enrolled, and get the most from your health insurance. Subscribe to get email updates with important deadline reminders, useful tips, and other information about your health insurance.

If you don’t sign up within your approved window, then you’ll have to pay the penalty fee for not getting coverage. If you qualify for an exemption from the mandate or you think you might, make sure to apply. Many of the exemptions can only be applied for during tax season. The federal marketplace offers links to the appropriate forms for filing for an exemption. The fee is prorated based on the number of months that you didn’t have coverage for the year, minus three months. In other words, you need to have health insurance for at least nine months of the year to avoid the penalty. If you enroll in health insurance through your job, then you’ll follow your company’s enrollment guidelines, which may differ from the national sign-up period.

Anyone can compare plans on theexchanges, which are websites run by the state or the federal government. These exchanges also let people know when they qualify for tax credits. Obamacare is paying for most of the cost of operating these exchanges. What happens to the people whose jobs don’t provide health insurance and people without jobs? Some of them are poor enough to qualify for Medicaid, paid for by state and federal governments.

Smaller businesses that employ fewer than fifty full-time workers (or the equivalent in part-time workers) are not obliged to offer health insurance under Obamacare. Nonetheless, special tax breaks may be available to small businesses that do offer coverage. A health insurance exchange website operated under the United States federal government under the provisions of the Patient Protection and Affordable Care Act, designed to serve the residents of the thirty-six U.S. states that opted not to create their own state exchanges. Department of Health & Human Services, the Affordable Care Act “puts consumers back in charge of their health care. Under the law, a new Patient’s Bill of Rights gives the American people the stability and flexibility they need to make informed choices about their health.” Cost-sharing subsidies are still available for eligible Marketplace enrollees. Although the federal government will no longer be reimbursing insurers for these subsidies, insurers are required by law to reduce cost sharing for lower-income enrollees. In states that expanded Medicaid, tax credit eligibility effectively ranges from 138% to 400% of the poverty level (because almost all people with incomes below 138% of poverty are eligible for Medicaid and therefore are not eligible for subsidized Marketplace coverage).

However, between March 2010 and 2014, the number of part-time jobs declined by 230,000 while the number of full-time jobs increased by two million. In the public sector full-time jobs turned into part-time jobs much more than in the private sector.

Health Insurance Marketplace Subsidies

Another study using National Cancer Database data from found a 5.5 percentage point decrease in late-stage (stages III/IV) cervical cancer diagnosis for women aged 21–25 after DCE, and an overall decrease of 7.3 percentage points in late-stage diagnosis compared to those aged 26–34. A study using SEER Program data from 2007 to 2012 found a 2.7 percentage point increase in diagnosis at stage I disease for patients aged 19–25 compared with those aged 26–34 for all cancers combined. In many states income thresholds were significantly below 133% of the poverty line. Many states did not make Medicaid available to childless adults at any income level. Because subsidies on exchange insurance plans were not available to those below the poverty line, such individuals had no new options. Absent children, able-bodied adults were not eligible for Medicaid there.