Account reconciliations, perhaps the most important bookkeeping step, involve verifying account balances in your accounting software to source documentation pulled from your bank. Fortunately, some payroll software, such as Gusto, integrates with accounting software and automatically syncs the payroll journal entry. However, you must first correctly configure the integration so that accurate information gets pushed to your accounting software.

Bookkeeping For Marketing Agencies: Everything You Need To Know

Simply put, ROI is expressed as the ratio of net income (sales) from a marketing activity or campaign to its cost through the evaluation of data-driven results. However, marketing should also consider qualitative ROI when assessing the long-term impact of a campaign, especially one aimed at increasing brand awareness. When acquiring new customers, it is important to have a realistic schedule to see the results.

Petty cash book

Accrual accounting, on the other hand, records revenue and expenses when they are earned or incurred, regardless of when the money is received or paid out. This method can be more complex, but it provides a more accurate representation of a company’s financial health. By leveraging financial data, you can confidently make strategic decisions that drive growth and maximize profits.

How can marketing agencies use financial data to identify areas for growth and improvement?

Bookkeeping software benefits marketing agencies by streamlining financial processes, reducing errors, and saving time. It provides real-time insights into cash flow, expenses, and revenue, allowing you to make informed decisions. Join the growing community of efficient agencies using bookkeeping software.

- Tracking your agency’s WIP balances can prevent cash flow and capacity issues, since WIP represents labor costs incurred but not yet recouped.

- If you’re like most marketing agencies, you’re probably more interested in creating compelling campaigns and generating leads than keeping track of your finances.

- You’re simply categorizing transactions as money enters or leaves the bank account.

- It forces you to think hard about the steps you could take if you had to, in an emergency, and to shake out any inefficiencies.

- These are typically used to assess performance, calculate key performance indicators (KPIs), and make strategic decisions, especially in a marketing agency.

- It provides real-time insights into cash flow, expenses, and revenue, allowing you to make informed decisions.

Your accounting system should facilitate both the tracking of billable expenses and the invoicing of those expenses back to clients. Failing to bill back project expenses erodes project profitability and could create cash flow problems for your agency. Annual financial statements help the marketing agency assess its profitability within a specific period. Key financial metrics can provide valuable insights into your business’s financial health and performance.

Analyze financial statements

To recap briefly, though, management accounts are a scaled- down, real-time version of your final accounts, issued during the accounting period, not after year-end. Alternatively, you could work with a professional to build a streamlined accounting system for your agency, saving you the time and stress of figuring everything out on your own. We’ll discuss your current setup and identify next steps in building a system that works for your agency, no matter where it is in its development.

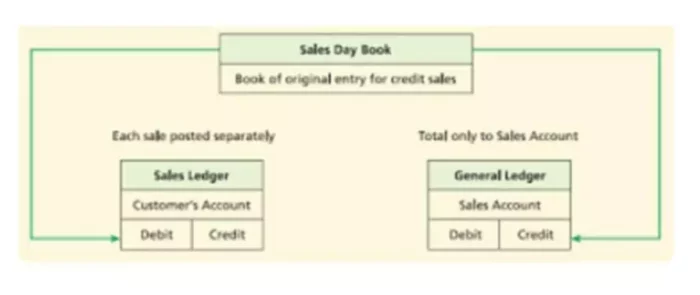

The second step to setting up accounting for your marketing agency is to choose between cash or accrual accounting for your bookkeeping. As a partial check that the posting process was done correctly, a working document called an unadjusted trial balance is created. Column One contains the names of those accounts in the ledger which have a non-zero balance. If an account has a debit balance, the balance amount is copied into Column Two (the debit column); if an account has a credit balance, the amount is copied into Column Three (the credit column). The debit column is then totalled, and then the credit column is totalled.

Your contracts and invoices should establish clear payment terms and create a sense of urgency around payment. I created this walkthrough for busy agency owners who aren’t sure where to begin or what comes next. No matter how big or small your agency is, in this article I’ll show you the steps for building a financial infrastructure that positions your agency for growth.

An agency would recognize accrued revenues in order to align revenues and expenses, such as salary costs, with the time period in which they were earned or incurred. If you’re in the marketing agency industry, you must build the right accounting platform to create a great brand. A Marketing agency relies on providing the services they sell but needs to be more disciplined in managing its accounts, budgets, and cash flow. We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month. There are many accounting software options available, each with their own features and benefits. When choosing a software, consider factors such as cost, ease of use, and integration with other software your business may use.

You’ll also need to match vendor bill payments, whether those are cleared checks or electronic payments, to open bills in the accounting system. Most cloud accounting software integrate with banks, allowing you to automatically import transactions without the need to manually import transactions to the accounting software. Automatic imports are a huge time saver so you should take advantage of them as much as possible. The chart of accounts is the list of categories to which transactions will be coded.

Or if expenses are higher than anticipated, you can investigate why and either cut the expenses or revise your budget as appropriate. If you’re not reviewing the agency’s statements on a regular basis, then you’re not making adequate use of the accounting system you’ve worked hard to build. To be forward thinking about your agency’s finances, you’ll need to add a few additional steps to your agency’s accounting cycle. Regular bookkeeping will keep your agency’s books accurate and up-to-date, providing a solid foundation for advanced financial analyses. Account reconciliations are important because they validate the accuracy of your agency’s financials. By frequently reconciling your agency’s accounts, you’ll catch small errors as they happen and prevent larger ones later on.

Even if you bill on a fixed-fee basis, you still need to ensure that you recover the underlying labor cost. Otherwise you might be doing too much work for too little pay and not realize it. For instance, although a particular client generates more revenue than any other client, they may also demand more resources relative to other clients. Project A, on the other hand, is profitable but at risk of being delivered late and thus harming your client relationship. By reviewing the project financials, you can reallocate resources from Project B to Project A and speed up the deliverables.