Content

You are likely subject to this tax if you have investment income and your modified adjusted gross income exceeds certain thresholds. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required.

- Students will need to contact WGU to request matriculation of credit.

- This link is to make the transition more convenient for you.

- It is generally paid by high earners with significant investment income.

- Emerald Cash RewardsTMare credited on a monthly basis.

If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Get a big jumpstart on your taxes by snapping a photo of your NEW 1099-NEC non-employee compensation form. Find out about reporting income earned through investments, like interest, dividends, and capital gains. There are still a couple of ways investors can benefit at tax time. As a result, many people who thought they were receiving a tax break for their investment expenses had actually lost the deduction or were getting a minimal benefit.

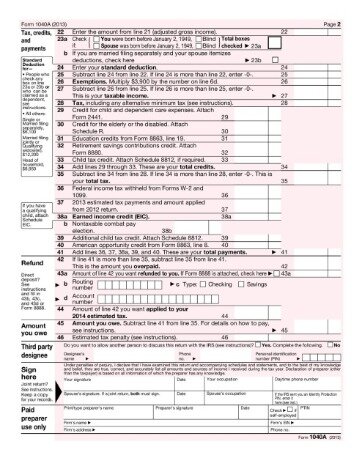

It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details. TurboTax®offers limited Audit Support services at no additional charge. If you earn income from any of your investments this year, you may have to pay the net investment income tax, in addition to the regular income taxes you owe. You won’t know for sure until you fill out Form 8960 to calculate your total net investment income.

May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17).

Many investment tax forms sound pretty similar. Make sure you know which ones you need and what to do with them. Part one of Form 8960 lists the various types of earnings considered investment income.

They speak the tricky language of taxes and can help you better understand your return. If your MAGI is above the threshold, but you don’t have investment income, you will not be subject to the NIIT.

You would be able to deduct the full $80 of investment interest if you itemize. Investment interest expenses are an itemized deduction, so you have to itemize to get a tax benefit. If you do, enter your investment interest expenses on Line 9 of Schedule A. But keep in mind that your deduction is capped at your net taxable investment income for the year.

Get More With These Free Tax Calculators And Money

This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block.

The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account.

In summary, Peter, it’s not the currency your investments are in or even the country they are in that matters for a Canadian resident. You’re taxed on that income regardless.

For example,rental income, royalty income, business income, and net capital gains will already be a net amount after deductions or losses have been taken into account. If your net investment income is less than the portion of your MAGI over the tax thresholds, you would pay 3.8% of this amount instead. So now you have to compare your MAGI to your net investment income for the year.

Not Sure Where To Start? We’ll Find The Tax Prep Option For You

But there are some exceptions. Net investment income can be capital gains, interest, or dividends. It can include income produced by rental properties, capital gain distributions from mutual funds, and even royalty or annuity income and interest on loans you might have extended to others. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit. Additional fees may apply from WGU.

Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Terms and conditions apply. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return .

Filing Taxes While Holding U S. Investments In Canada

A bond represents a loan made to a corporation or government in exchange for regular interest payments. The bond issuer agrees to pay back the loan by a specific date. Bonds can be traded on the secondary market. Income you can receive by investing in bonds or cash investments. The investment’s interest rate is specified when it’s issued. From mutual funds and ETFs to stocks and bonds, find all the investments you’re looking for, all in one place. Form 5498-ESA, which includes information about contributions to education savings accounts .

You would owe no tax and would not be required to file a return if you’re single and earned $12,400 in 2020 because the $12,400 deduction would reduce your taxable income to $0. But you would have to file a tax return if you earned $12,401 because you’d have to pay income tax on that additional dollar of income. File IRS Form 8960 with your tax return if you’re subject to the net investment income tax. The form comes complete with instructions to help you determine what you owe, and it should be used by both individuals and estates and trusts. Grantor trusts and trusts that are exempt from income taxes, such as charitable remainder trusts, are exempt from the net investment income tax. In most cases, taxes on grantor trusts are payable by the individual—the grantor—who formed and maintains them. If your MAGI is above the threshold amounts mentioned above, you may need to prepare Form 8960 to see what your net investment income is.

Services And Information

See Cardholder Agreement for details. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021.

Along with the Affordable Care Act, this Act reformed the health care market by requiring individuals to obtain health insurance or pay a tax penalty. Tax-exempt interest is not included in net investment income. Gains realized from the sale of a personal residence are spared as well when the gain is excluded from income for income tax purposes.

Consult your own attorney for legal advice. See Peace of Mind® Terms for details.

Due to the large volume of comments we receive, we regret that we are unable to respond directly to each one. We invite you to email your question to , where it will be considered for a future response by one of our expert columnists. For personal advice, we suggest consulting with your financial institution or a qualified advisor. Jason Heath is a fee-only, advice-only Certified Financial Planner at Objective Financial Partners Inc. in Toronto, Ontario. He does not sell any financial products whatsoever. At $100,000 of income, the Canadian dividend tax rate range is 15% to 29%, versus 36% to 46% for U.S. dividends. For perspective, the tax rate for a Canadian dividend for someone earning $50,000 of income ranges from 8% to 19% depending on your province or territory of residence.

This compares to 28% to 37% for U.S. dividends. Of note is that Canadian dividends qualify for a reduced tax rate due to something called the dividend tax credit. U.S. dividends are taxed at a higher rate (unless you own Canadian companies that are listed on a U.S. stock exchange – many companies are inter-listed). Unless you are a U.S. “person”, Peter – generally a citizen or resident – your only tax obligations to the Internal Revenue Service would be withholding tax. The IRS, the U.S. taxation authority, requires tax withholding on certain types of income based on the country of residence of a foreign person. Canada and the U.S. have a tax treaty called the Convention Between Canada and the United States of America originally signed in 1980 with various protocols since then.

There are several other forms you might receive from Vanguard. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period.

Year-round access may require an Emerald Savings®account. he Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY. Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. Small Business Small business tax prep File yourself or with a small business certified tax professional.

Only individuals whose incomes exceed certain levels must file tax returns. However, income isn’t the only factor involved. Numerous other circumstances can affect your filing status, too, and there are some situations in which you’d want to file even if you’re not technically required to. This suggests that the tax revenue is used to fund Medicare, but the revenue raised by this tax actually goes into the nation’s General Fund. In fact, you can be subject to the net investment income tax even if you’re exempt from the Additional Medicare tax because these two taxes apply to different types of income.

Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money Service Terms and Conditions, the Ingo Money Privacy Policy, and the Sunrise Banks, N.A. Privacy Policy.