Content

If the hold is because you filed before mid-February, there is no need to worry. The hold is not a result of mistakes or problems with your return. But if you filed later than that, the hold could also be because the IRS has questions or needs more information, in which case, you should receive a letter explaining what it requires. Go beyond taxes to build a comprehensive financial plan. Find a local financial advisor today. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

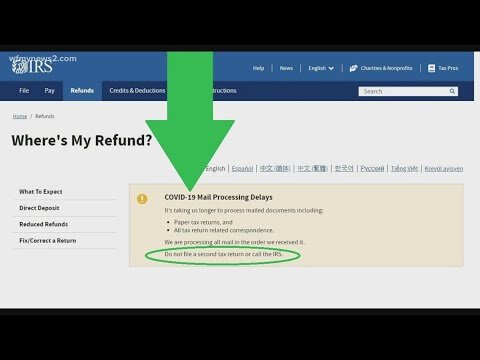

The best way to check the status of your refund is to click on the Where’s My Refund? Taxes are due on Thursday, April 15, 2021.

Handling A Refund Delay

And it is serious money – the IRS estimates it paid out of $1.3 billion in fraudulent tax refunds last year. The backlog of unprocessed returns from last year still numbers in the millions. That’s likely to increase for the current tax season “until IRS addresses its backlog of unprocessed and suspended returns,” the GAO added. Electronic filing is the process of submitting tax returns over the internet using tax preparation software. If your tax return has numerical errors or other mistakes, that can slow the pace of your refund. When an error is detected, your return is earmarked for human review, meaning an IRS employee must comb through it to find the mistake. That can add days or weeks to the processing time.

Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . CAA service not available at all locations. When taxpayers e-file their returns, the e-file process catches many return errors and rejects the returns at the time of filing. If you mail your return instead of e-filing it, the IRS is more likely to identify an error after the fact. If you’re a criminal looking to get the most money possible, you’ll likely want to file a return with these tax credits on it. These are likely the most common tax credits taken by criminals, since they are what’s known as Refundable Tax Credits. That means, even if you owe no taxes because of low or moderate income, you could still receive a refund for these tax credits.

- This can be a daunting task because refund holds can feel like audits.

- Calling Taxpayer Assistance will not speed up the processing of your return.

- But the delay in the tax deadline meant the IRS had to pay interest going back to that April 15 filing date even though it had given taxpayers more time to file.

- If you lost your job during the coronavirus-caused recession, you may need to spend the refund on essentials.

- Here are four things that can help keep your “Where’s my refund” worries under control.

Learn more from the tax experts at H&R Block. Ever wondered if the IRS can take your paycheck, get your financial information or call you directly? If the IRS changes your return, you’ll get a letter asking you to correct the error within 60 days.

How Long It Takes The Irs To Process A Tax Refund

Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation.

If you don’t provide enough explanation and information, the IRS change is final. At that point, you would have to amend your return and follow up with the IRS to get your refund.

Available only at participating H&R Block offices. H&R Block does not provide immigration services.

One reason for this is because the IRS may still be making changes to their processes. That could include updated security measures or process tweaks due to changes in the tax code. And if the IRS needs to update or make changes, it probably won’t make them until just before tax time. This could be especially true in 2020 because of President Trump’s new tax law.

Filing your tax return electronically and requesting direct deposit is the fastest way to obtain your refund and helps prevent filing errors, such as incorrect math. There is NO ADVANTAGE to filing a paper Form IL-1040. The average refund amount issued so far this year is $2,880 — down 7.8% from $3,125, according to the IRS. The IRS is averaging issuing 2.072 million refunds per day, the Detroit Free Press reports, compared to 1.44 million refunds on average per day for the first 26 days of the 2020 filing season. In most cases it is faster to file your return electronically. The IRS receives these returns faster than ones that were mailed in, which shortens the time in between when you submitted your return and when you’ll receive your refund. The IRS typically sends out refunds on a schedule.

Get More With These Free Tax Calculators And Money

Your return is now in the hands of the IRS. They typically take the next to review your information to make sure it is correct. If your personal information matches their records and you haven’t taken any credits or deductions that require further review, they will accept your return. You should receive an email notification once your return is accepted.

But for some filers this year, your early tax return will be delayed because of new laws designed to stop identity theft. In a response to the findings, the IRS pointed to the delay in the tax filing deadline as one reason for the increase in interest payments. The agency must issue refunds within a 45-day window after the April 15 filing date, or else it owes interest on the refund. But the delay in the tax deadline meant the IRS had to pay interest going back to that April 15 filing date even though it had given taxpayers more time to file. Many things can hold up the processing and delivery of your tax refund. For example, it could be delayed if you filed your return too early or waited until the last minute.

Tips For Catching Up On Your Taxes

Penalties kick in only if you owe the IRS. If you owe, the IRS will assess two different penalties plus interest. There’s a failure-to-file penalty (up to 5% per month that you are late, up to a maximum of 25%). Then there’s the failure-to-pay penalty (generally 0.5% of your unpaid taxes, per month, up to 25%). The wage and income transcript will not show any information related to state and local tax withholdings.

If your tax return is correct, it’s just a matter of explaining everything to the IRS. If you want to get started on your taxes early, check out our picks for the best tax software for early tax filers. The IRS is still estimating that 90% of people should receive their refunds within 21 days. If you file early, the IRS will hold your refund until February 15, and then begin processing your refund. So, you could see a delay until the middle to end of February.

More In File

Respond to letters from ADOR with the requested information as quickly as possible so ADOR’s tax experts can complete the review and issue the refund. Make sure key information like tax identification numbers, social security numbers, routing numbers or account numbers are correct in all the appropriate boxes. Do not staple any items to the return.