Unlike many other small businesses, auto repair shops must navigate a complex landscape of fluctuating costs, diverse revenue streams, and specialized financial obligations. This complexity necessitates a nuanced approach to financial management that goes beyond basic bookkeeping. Effective bookkeeping in the automotive business demands great care to labor costs, inventory management, and payment flows. Auto repair shops should capture every transaction with precision, guarding all financial data is up-to-date, and reflective of the shop’s current economic state.

Simple Financial Reports For Powerful Business Insights

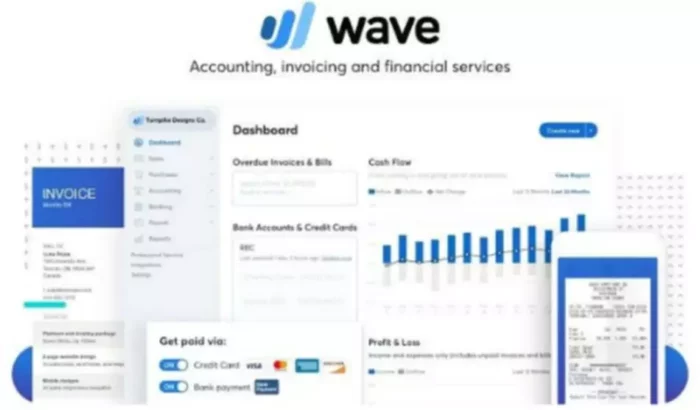

Also, regularly reviewing financial performance with a consultant specializing in automotive dealerships can uncover hidden opportunities for increasing profitability. Once you’ve chosen an accounting software program, you’ll need to set it up. This process will vary depending on the software you choose, but typically you’ll need to enter your business information, such as your name, address, and tax ID number. You’ll also need to create accounts for your income, expenses, and assets.

Common Tax-Deductible Expenses in Services for Automotive

Now that you have specified your bookkeeping method, you need to be able to calculate your total job cost for your customer’s tasks. This allows you to manage the profitability of the new jobs you receive in your auto repair shop. If you are the owner of an auto repair shop and need to know worthwhile information about bookkeeping, then you are at the right place. Auto repair shops usually face various challenges as they work between parts manufacturers and vehicle owners. The owners of auto repair shops certainly need to adapt to the newest vehicle technologies and software every year for maximum efficiency. Modern vehicles are equipped with complex electronic systems that require specialized diagnostic tools to identify issues.

Check-In on Your Business Anywhere

- Clover works with many accounting software programs, so payment transactions processed through Clover feed directly into your accounting system.

- When tax time comes around, the integration of Clover and QuickBooks for your auto repair shop can help make your life much easier.

- When a vehicle owner needs you, the ultimate profit of a job depends on whether you give them a quote or an estimate.

- One of the primary approaches to beekeeping in auto repair shops is to make records of all the invoices and receipts you receive from vendors as detailed as possible.

- Experience automatic synchronization of your transactions, invoices, and expenses between the software platforms.

Also, it helps you make filing your tax returns easier as you do not have to remember all your trading history during the last year. Monitoring financial ratios and key performance indicators (KPIs) is essential for assessing the overall performance of an auto repair shop. Financial ratios, such as the current ratio and debt-to-equity ratio, provide insights into the shop’s liquidity and financial stability. These ratios can help identify potential issues before they become critical, allowing for timely corrective actions. For example, a declining current ratio may indicate liquidity problems, prompting a review of cash flow management practices.

Properly categorizing these expenses can significantly impact the shop’s tax liability. For instance, capital expenditures on equipment can often be depreciated over several years, providing long-term tax benefits. Utilizing accounting software like QuickBooks can help automate this process, ensuring accurate and timely expense tracking. FreshBooks focuses on providing software for time tracking, reporting, invoicing, and other accounting tasks to service-based businesses — and auto repair shops certainly fit that bill.

Incorporating Aspects of Bookkeeping Services

Payment flexibility isn’t just about accepting multiple forms of payment. Portable devices like Clover Flex and Clover Go allow you to accept payments offsite. Or, you can send an invoice or payment request for completed services by email and let your customers pay you directly online.

This means that payroll management is not just about meeting minimum wage requirements but also about offering competitive salaries and benefits to attract and retain skilled workers. Furthermore, ongoing training and certification for employees represent additional costs that must be factored into the financial planning process. Keeping clear records is another aspect that many merchants struggle to master. Accounting can require a lot of data entry—an error-prone process made difficult by oil-stained receipts or cash payments accepted during late-night service calls. Get equipped with a wealth of knowledge on automotive repair shop accounting, payroll, taxes, and more. The best accounting software will vary based on your shop’s specific size, setup, and needs – along with your own preferences.

When tax time comes around, the integration of Clover and QuickBooks for your auto repair shop can help make your life much easier. QuickBooks generates reports and tax documents from your business’ data, making year-end reporting much simpler. As the owner of a small to mid-size auto repair shop, it’s your responsibility to keep your bookkeeping under control. When you don’t take accounting seriously, you can struggle to track whether or not projects are successful, lose track of billable hours, and make it difficult to handle taxes correctly. Bookkeeping is a must for all businesses, but auto repair shops are particularly prone to the need for detailed record-keeping. You have to keep track of a lot of moving pieces ranging from technicians, inventory, parts, and more.

Implementing the right tools and accounting best practices can help you improve accounting for your auto repair shop and let you get back to doing what you love. Integrating this program with auto repair shop software compounds the value of both by providing financial insights into operations and operational insight into finances. Quickbooks for auto repair is a good example of this potential, especially when it’s integrated with Shopmonkey.

Unlock your auto repair shop’s full potential by integrating Quickbooks with your shop management software. Enjoy a seamless, user-friendly experience that speaks directly to the needs of hardworking shop owners like you. Master financial control, simplify taxes, and access powerful tools that drive success in the auto repair industry. Join countless satisfied shop owners who’ve taken their businesses to new heights with accounting software for auto repair shops.

At the same time, Xero doesn’t skimp when it comes to accounting features. With Xero, you’ll benefit from automatic billing and invoicing, bank reconciliation, short-term cash flow/business snapshots, and much more. Automotive accounting is a pivotal aspect of managing a successful automotive dealership. It not only ensures compliance with financial regulations but also provides key details that drive business decisions. By effectively serving automotive clients, these specialized accounting practices help dealerships improve workflows. The two most widely used accounting methods are cash basis and accrual (traditional) basis methods.

Integrating QuickBooks for your auto repair shop on your Clover POS streamlines that process, instantly and automatically pulling data from your daily transactions. Clover works with many accounting software programs, so payment transactions processed through Clover feed directly into your accounting system. This data fuels more accurate reporting on your business’s financial health, too. Supercharge your shop’s efficiency with time-saving shortcuts and powerful tools integrated right into your auto repair software. Streamline daily operations, reduce manual tasks, and increase your team’s work performance, all within a single Quickbooks automotive accounting software.