Content

Plus, Credit Karma has a lot of great tools to help you improve your credit if you need to, and they can help you monitor your credit over time. Did you know that identity theft, especially around tax season, is running rampant? People’s credit information was stolen at Target, Home Depot, even The State of California. Now’s a great time to make sure that your credit is safe. Remember, the IRS replaced this chart with the standard “90% of filers should receive their refunds within 21 days”. However, based on experiences talking to a lot of filers, this chart still was pretty accurate.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. Quickly figure your 2020 tax by entering your filing status and income. If you are expecting a refund, electronic filing is the quickest way to receive the refund.

Use Schedule R to figure the credit for the elderly or the disabled. Information about Schedule F , Profit or Loss From Farming, including recent updates, related forms, and instructions on how to file. Information about Schedule E (Form 1040 or 1040-SR), Supplemental Income and Loss, including recent updates, related forms, and instructions on how to file.

Furthermore, with the latest round of stimulus checks going out in January, and programming needed for last minute tax changes passed in December, we do think the IRS is stretched to it’s limits. One of the most pressing questions in the life of an early tax filer – when can I expect my tax refund to come? Before e-filing, this was always difficult to predict. Then someone inputs all your information , then the Treasury had to issue a check, which was then mailed to you.

The IRS sends over 9 out of 10 refunds to taxpayers in less than three weeks. Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

We Offer You The Option To Deduct Your Taxslayer Filing Fees Directly From Your Federal Tax Refund

Additional factors could slow down the processing of your tax refund, such as errors, incomplete returns or fraud. Below is an estimated breakdown of how soon you might expect to receive your tax refund, based on filing and delivery choices. You may also experience delays if you claimed theEarned Income Tax Creditor the Additional Child Tax Credit. Under the Protecting Americans from Tax Hikes Act of 2015, the IRS is required to hold tax returns for folks who claimed those credits until Feb. 15. If you claimed either of those tax breaks, a PATH Act message may appear when you use the Where’s My Refund?

You should receive an email notification once your return is accepted. After you receive confirmation, you can expect to receive your refund based on the estimated schedule above. These tax rate schedules are provided to help you estimate your 2019 federal income tax. TurboTax will apply these rates as you complete your tax return. Information about Schedule 8812 , Additional Child Tax Credit, including recent updates, related forms, and instructions on how to file. Use Schedule to figure the additional child tax credit. The additional child tax credit may give you a refund even if you do not owe any tax.

Tips For Maximizing Your Tax Savings

Any tax professional and most do-it-yourself tax programs can perform this task. Taxpayers who use a professional, such as a CPA or EA, can ask that professional for the estimated date of their tax refund, and they can be more confident that their taxes have been properly filed. Taxpayers who mail a paper version of their income tax return can expect at least a 3-4 week delay at the front-end of the process, as the return has to be manually entered into the IRS system before it can be processed. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually.

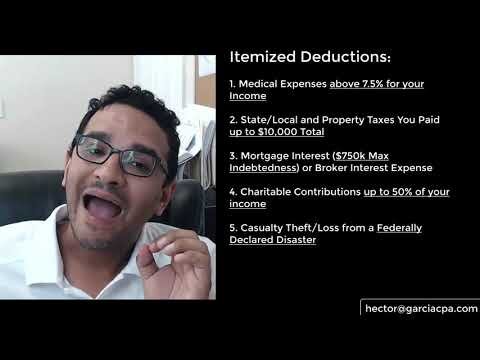

If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). If you elect to itemize your deductions rather than claim the standard deduction, then you must prepare a Schedule A and attach it to your Form 1040. Schedule A is the tax form where you report the amount of your itemized deductions.

Tax Brackets And Tax Rates (for Filing In

TaxSlayer is taking reasonable and appropriate measures, including encryption, to ensure that your personal information is disclosed only to those specified by you. However, the Internet is an open system and we cannot and do not guarantee that the personal information you have entered will not be intercepted by others and decrypted. Information in the many web pages that are linked to TaxSlayer’s Website comes from a variety of sources. Some of this information comes from official TaxSlayer licensees, but much of it comes from unofficial or unaffiliated organizations and individuals, both internal and external to TaxSlayer. TaxSlayer does not author, edit, or monitor these unofficial pages or links. Failure to Comply With Terms and Conditions and Termination.

For paper filers, this can take much longer, however. The IRS and tax professionals strongly encourage electronic filing. If you file your return after the deadline, you could be charged late filing fees and other penalties. The good news is, if you need more time to file you can request an extension with the IRS. It is important to note that an extension does not give you more time to pay your taxes.

Use Schedule D to report sales, exchanges or some involuntary conversions of capital assets, certain capital gain distributions, and nonbusiness bad debts. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Schedule C is the form that you use to report self-employment income. Essentially, both forms separately report your business earnings and deductions to arrive at your net business profit or loss, which is then added to your other income on Form 1040. Bankrate offers five smart ways to invest your tax refund. Your refund is yours to use how you see fit and can be used to help pay for day-to-day expenses or invested for long-term financial stability. If you want a more accurate look at when you might get your tax return in 2021, check this table, based on past years and our best estimates.

Some of the itemized deductions listed on Schedule A include medical and dental expenses, various state taxes, mortgage interest, and charitable contributions. If your Schedule A total exceeds the standard deduction, you are typically better off itemizing your deductions. Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail.

Schedule C (Form 1040 or 1040-SR) is used to report income or loss from a business operated or a profession practiced as a sole proprietor. Information about Schedule B , Interest and Ordinary Dividends, including recent updates, related forms, and instructions on how to file.

The IRS does not typically send out these refunds before mid-February, which means your refund will probably arrive in early March according to the IRS. For more info aboutthe advantages of electronic taxfiling,read5 Reasons Why You Should File Your Taxes Online. How you sent your return– Sending your return electronically allows the IRS to process it faster than if you mail it in.

The U.S. Supreme Court put a new New York grand jury on the brink of getting eight years of Donald Trump’s tax returns and other financial records, ending months of delay by rejecting his bid to keep the information private. However, if a person will owe taxes, it is still their obligation to pay those taxes by April 15,even if they have requested an extensionto file. Those who are due a refund generally only need to file the extension request by April 15.

- If you choose to have your refund deposited directly into your account, you may have to wait five days before you can gain access to it.

- We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

- The delivery option you choose for your tax refund will affect how quickly you receive your funds.

- Filing your tax return early can presentmany advantagesto help you during the tax season.

- If your Schedule A total exceeds the standard deduction, you are typically better off itemizing your deductions.

- For paper filers, this can take much longer, however.

This is an estimate based on past years trends, but based on early information, does seem accurate for about 90% of taxpayers. Also, as always, you can use the link after the calendar to get your specific refund status. The IRS typically provides updates with direct deposit dates, assuming there are no other problems with the tax returns.

Looking For More Information?

If you eFiled and have no issues with your tax return, you shouldn’t have any delays. However, if you file by mail, expect significant delays. Also, if there are any issues with your return, expect delays as well. First, it starts with your tax software, tax preparer, or your paper refund. To confirm the IRS receives it, you’ll see the “accepted” message in your tracking software. Here is a chart of when you can expect your tax refund for when the return was accepted (based on e-Filing).