Content

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. You need to come up with a good estimate of the income and deductions you will report on your federal tax return. North Carolina is waiving interest on certain underpayments of first and second quartered estimated taxes. The tax software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts. You retired or became disabled during the tax year for which estimated payments were required to be made or in the preceding tax year, and the underpayment was due to reasonable cause and not willful neglect. If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings.

Explore our weekly state tax maps to see how your state ranks on tax rates, collections, and more. As a 501 nonprofit, we depend on the generosity of individuals like you. In addition, various financial transactions, especially late in the year, can often have an unexpected tax impact.

To Help You Calculate Estimated Tax Payments

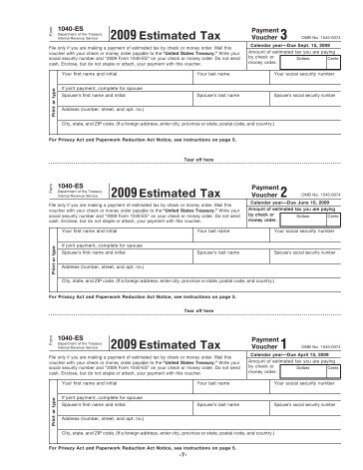

However, you may still owe an underpayment penalty for the first quarter. For taxpayers paying Washington’s Business and Occupation (B&O) tax on a quarterly basis , the first and second quarter estimated tax payment deadlines have been extended to June 30 and July 31, respectively. For estimated tax purposes, the year is divided into four payment periods. You may send estimated tax payments with Form 1040-ESby mail, or you can pay online, by phone or from your mobile device using the IRS2Go app.

If it’s easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as you’ve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments. Taxpayers who owed taxes when they last filed and who did not adjust their 2020 withholding may find that they owe taxes again, and even a penalty, when they file their 2020 return next year. Finally, unless you live in a state with no income tax, you probably owe estimated tax payments to your state, too.

There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold. Most income is taxable, so taxpayers should gather income documents such as Forms W-2 from employers, Forms 1099 from banks and other payers, and records of virtual currencies or other income. This also includes unemployment income, refund interest and income from the gig economy. As you and your tax preparer work on your business tax return, keep the above numbers in mind. If your business is a partnership, multiple-member LLC, or S corporation, your share of the profits of the business is shown on a Schedule K-1, which is included in your personal tax return. We’re an all-in-one tax prep and bookkeeping service powered by real humans. With Bench, you get a dedicated team of experts to complete your monthly books and file your taxes.

Many businesses and individuals must make estimated federal income tax payments. Your tax preparer may have told you that you need to make these payments, or maybe you have a lot of business income and realized you must pay taxes on them. If you intend to file as a sole proprietor, a partnership, S corporation shareholder, and/or a self-employed individual, you’ll generally need to make estimated quarterly tax payments if you will owe taxes of $1,000 or more. If you expect to owe over a certain amount, you must make estimated tax payments throughout the year. Please refer to IRS Form 1040-ES Instructions and IRS Publication 505, Tax Withholding and Estimated Tax, for additional information regarding federal quarterly estimated tax payments or consult your personal tax advisor. Generally, if you do not pay enough tax in a timely manner either through withholding or making estimated tax payments, you may be required to pay a penalty. If you expect your income this year to be less than last year and you don’t want to pay more taxes than you think you will owe at year end, you can choose to pay 90 percent of your estimated current year tax bill.

You want to estimate your income as accurately as you can to avoid penalties. You had no tax liability for the prior year if your total tax was zero or you didn’t have to file an income tax return. For additional information on how to figure your estimated tax, refer to Publication 505, Tax Withholding and Estimated Tax.

That includes the regular process of making estimated tax payments for people who are self-employed or don’t have taxes withheld from other sources of taxable income (such as interest, dividends, capital gains, etc.). If you’re self-employed or don’t have taxes withheld from other sources of taxable income, it’s up to you to periodically pay the IRS by making estimated tax payments. For example, if you have a seasonal business with more income in one quarter than another, you can vary the amount of estimated tax you pay for each quarter. Just remember that you must pay enough tax by each quarterly due date to avoid being charged a penalty. This requirement holds even if you think you may be due a refund at tax time.

Who Must Pay Estimated Tax

Be sure you use the form with the correct due date shown in the top margin of the form. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

If at filing time, you have not paid enough income taxes through withholding or quarterly estimated payments, you may have to pay a penalty for underpayment. The COVID-19 pandemic, and the unprecedented economic conditions surrounding it, have created immense challenges for individuals and businesses to overcome. The federal government, and most states, have sought to extend needed flexibility to taxpayers in one form or another, but in some states, more remains to be done. Tennessee does not require quarterly estimated payments for its Hall income tax on investment income. Estimated tax payment due dates shown are for Tennessee’s franchise and excise tax, which is owed by passthrough business owners who would otherwise owe individual income tax.

- However, since this would have resulted in second-quarter payments coming due a month before first-quarter payments, the IRS subsequently extended both the first- and second-quarter estimated tax payment due dates to July 15.

- Iowa is offering conditional penalty relief for certain underpayments of first and second quarter estimated tax payments.

- Due dates for state payments may or may not coincide with the federal dates, so be sure to check with the appropriate tax agency in your state.

- You have special criteria to meet, but you may end up paying less in estimated taxes.

- For corporations, payments must be filed through the Electronic Federal Tax Payment System.

If you are in business for yourself, you generally need to make estimated tax payments. Estimated tax is used to pay not only income tax, but other taxes such as self-employment tax and alternative minimum tax. Thethree-month extensionfrom the IRS on paying and filing federal income tax returns, to July 15, 2020, has passed.

To claim the refund, they will file Form 843, Claim for Refund and Request for Abatement. They should include the statement “80% waiver of estimated tax penalty” on line 7 of Form 843. Either method can help avoid a surprise tax bill at tax time and the accompanying penalties that often apply. If a taxpayer failed to make required quarterly estimated tax payments earlier in the year, making a payment to cover these missed payments, as soon as possible, will usually lessen and may even eliminate any possible penalty. You don’t have to make estimated tax payments until you have income on which you will owe tax. So, for example, if you didn’t have any taxable income until July 2020, you don’t have to make an estimated tax payment until September 15, 2020.

Which Checking Account To Use For Estimated Tax Payments

These penalties also are charged for estimated tax payments that should have been made. Income taxes and taxes for Social Security and Medicare are considered personal taxes. In any case, you can’t deduct federal income tax expenses as a business expense. Estimated tax payments are payments of income tax that are required to be paid evenly throughout the year. Most people have withholding income tax taken out of their pay and are not familiar with the estimated payment requirement.

You can also avoid the penalty if your 2020 withholding or estimated tax payments equal at least 90% of your 2020 tax liability, or 100% of the tax shown on your 2019 return (110% if your 2019 adjusted gross income was more than $150,000). If at least two-thirds of your gross income is from farming or fishing, you can make just one estimated tax payment for the 2020 tax year by January 15, 2021. If you file your 2020 tax return by March 1, 2021, and pay all the tax you owe at that time, you don’t need to make any estimated tax payments. You may need to pay estimated taxes depending on how much you owe and on your business type. Most small business owners don’t receive a paycheck, which means income taxes and taxes for Social Security and Medicare aren’t withheld from payments. The IRS requires that taxes be paid throughout the year, and estimated taxes are the way to make these payments. To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2021.

For the states that have extended their first-quarter due date, but not their second-quarter due date, to match the July 15 federal deadline, there is good reason to consider extending the second-quarter due date. Illinois has not extended its quarterly estimated tax due dates but is offering flexibility in calculating 2020 estimated tax payments for taxpayers who have not yet filed their 2019 tax return. Currently, there are some states in which first- and second-quarter estimated tax payments for tax year 2020 will come due before final tax year 2019 federal income tax forms and payments are due. There are also several states in which second-quarter estimated tax payments will come due before first-quarter payments.

Calculate Your Estimated Quarterly Taxes (for Free)

We consider you a farmer if at least two-thirds of your total federal gross income is from farming. You will likely need to make estimated payments if your income is either fully or partially exempt from Illinois withholding. Landlords and investors .People with rental income and investments might need to pay estimated quarterly taxes, too — even if their employers withhold taxes from their paychecks.

At that point, you can either pay your entire estimated tax by September 15, or you can pay it in two installments by September 15 and January 15. Examples of workers who might have to make estimated tax payments include cash earners, sole proprietors, self-employed individuals, contractors, freelance workers, temporary or seasonal workers, and per diem workers. Estimated tax payments can be complicated and each business situation is different. Get help from a tax professional for calculating and paying estimated taxes. The IRS charges penalties for underpayment and late payment of taxes.

If the total of your estimated payments and withholding add up to less than 90 percent of what you owe, you may face an underpayment penalty. So you may want to avoid cutting your payments too close to the 90 percent mark to give yourself a little safety net. Taxpayers who have already filed their 2018 federal tax return but qualify for this expanded relief may claim a refund of any estimated tax penalty amount already paid or assessed.

You could end up owing the IRS an underpayment penalty in addition to the taxes that you owe. The penalty will depend on how much you owe and how long you have owed it to the IRS. You don’t have to pay estimated tax for the current year if you meet all three of the following conditions. You may have to pay estimated tax for the current year if your tax was more than zero in the prior year.

If you’re not sure you qualify, or how this all works, TurboTax can help you figure your taxable gross income and what fishing and farming income you can include as qualified income. Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations. If you receive a paycheck, the Tax Withholding Estimator will help you make sure you have the right amount of tax withheld from your paycheck. For income received for the period September 1 through December 31, the due date is January 15 of the next year. For income received for the period June 1 through August 31, the due date is September 15.

If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. The calculations can get complicated quickly, so it’s a good idea to consult with a qualified tax preparer if you have questions. Plus, there are special rules for farmers, fishermen and certain household employers. Your consent to receive calls/texts is not a condition of purchase. Complete the form below and NerdWallet will share your information with Facet Wealth so they can contact you.

Know where unemployment compensation is taxable and where it isn’t. The answer to this question comes down to whether your stimulus check increases your “provisional income.”