Content

Your classification as one or the other makes a big difference in the number of tax breaks you get. Become a member of Real Estate Winners and learn how you can start earning institutional-quality returns with less than $1,000. The exception is completely phased out when your modified adjusted gross income reaches $150,000. If you were given the property, for example, your basis is generally the same as the basis of the generous soul who gave it to you.

The make-up for the payment, however, changes over time since a portion goes toward interest, and a different portion goes toward the principal. If you make an amortization table, you can see how much more principal and interest you have left to pay over time, which can be useful for making decisions ranging from budgeting to refinancing. This is the amount of money lent to you by the bank expressed as a percentage of your original property value. If you want to invest in real estate but don’t want to own any property, you can invest in Real Estate Investment Trusts . A REIT is a company that invests in a variety of real estate options. It can be traded privately, publicly like a stock, or be public but not traded. REITS are a great way to invest in real estate without getting fully invested in real estate.

In addition to amounts you receive as normal rent payments, there are other amounts that may be rental income and must be reported on your tax return. You generally must include in your gross income all amounts you receive as rent. Rental income is any payment you receive for the use or occupation of property. However, you cannot deduct the first line for local service coming into your home.

Property Tax

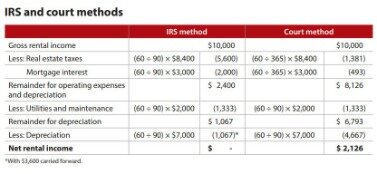

In this month’s article, we will show you the ins and outs of tax rules relating to vacation rental property to help you maximize your real estate rental income deductions. If you use credit cards or personal loans to pay for vacation rental business expenses, you can deduct the cost of interest payments on those accounts. As of 2018, personal deductions for interest on home equity loans were eliminated altogether, but you can still deduct this type of interest as a business expense for a rental property. If you have a vacation home that’s mostly reserved for personal use but rented out for up to 14 days a year, you won’t have to pay taxes on the rental income. Some expenses are deductible, though the personal use of the home limits deductions.

Property or services received, instead of money, as rent, must be included as the fair market value of the property or services in your rental income. For example, your tenant is a painter and offers to paint your rental property instead of paying rent for two months. If you accept the offer, include in your rental income the amount the tenant would have paid for two months worth of rent. Because of the rental loss and your other deductions, your effective tax rate might be running at about 15 percent. It might not make sense to put deductible money into your 401 plan to save just 15 percent, then possibly pay a higher tax rate 10 years down the road when you withdraw the money. A Roth IRA contribution would make more sense in this situation.

But the benefits of cash flow and rental propertytax deductionscan make it worthwhile. Home mortgage interest is reported onSchedule Aof the 1040 tax form. Mortgage interest paid on rental properties that is deductible is reported on Schedule E.

Advertising Costs

Your net operating income is all the money you make off your property after you’ve subtracted all the reasonable necessary operating expenses. Some examples of operating expenses include insurance, legal fees, repair costs, etc. Parking, vending machines, and laundry are other examples of ways in which your property can make you money. There’s yet another tax break for rental property owners known as the Qualified Business Income deduction, which lets you deduct upwards of 20% off your taxable rental income.

To qualify as a deductible expense, it must be expected to last for more than a year, be valuable to your rental business and lose value over time. IRS Publication 946, “How to Depreciate Property,” can help you navigate this sometimes convoluted process. Almost every state and local government collects property taxes. Depending on your rental property’s location, they can range anywhere from a few hundred dollars to hundreds of thousands. You can find the exact tax rate in your area by checking your escrow summary or inquiring with your tax professional.

Suspended Passive Activity Losses

You collect rent monthly; your investment property appreciates over time; you earn equity in your home, which you can use to get a low-interest loan; and you can sell your property. To avoid paying capital gains taxes, you can execute a 1031 exchange, which is when you use the profits from the sale of your property to buy a property of equal or greater value. You can claim a total or partial property loss when filing taxes if your property experienced a fire, natural disaster, or unexpected event. If you have insurance, your casualty loss claim has to be reduced by the amount of compensation you have received or will receive from your insurance. If your loss is 100% covered by insurance, you don’t get a deduction. If you belong to a Homeowners Association, you have to pay dues. Since they’re a necessary expense that makes them deductible against your rental income.

- Of course, if you withhold the security deposit to cover damages caused by the tenant, the cost of repairing such damage will be deductible, and offset the income from the forfeited security deposit.

- Instead, it deducts a portion of the cost each year until the entire amount has been deducted, a process known as depreciation.

- Your consent to receive calls/texts is not a condition of purchase.

- Many landlords treat one or more of their properties as a single activity, which would mean that selling just one property would not allow you to deduct those suspended losses.

- Patching a roof leak is a repair; re-shingling the entire roof is an improvement.

Learn more about the top property management and rental investment terms you should know as a real estate investor. In 2023, it will begin decreasing 20% every year until 2027, at which point it will no longer exist. Both deductions only apply to specific improvements and purchases. In rare circumstances, it might make sense to sell your rental property back to yourself by creating an S-Corporation. For instance, selling a property to your S-Corp may allow you to shield the appreciated value through capital gains protection. Claiming a workshop or home office deduction is a bit of a grey area, and for that reason, many landlords opt to steer clear of this tax deduction. But this deduction can be highly valuable, so it’s worth looking into.

This means that your losses are fully deductible against all income, passive or non-passive. Last, but certainly not least, the depreciation deduction can be one of the biggest tax benefits of owning rental property. Virtually all rental property owners maintain insurance policies on their properties. Depending on where the property is located, you may have flood or windstorm insurance policies as well.

If your rental properties are local, this isn’t likely to be a major expense, but if you own faraway vacation rentals, it could add up to a substantial deduction. It’s worth pointing out that all deductible rental property expenses must be ordinary and necessary. If you need to repair a $100 toilet and replace it with a top-of-the-line $500 model, it might not qualify as a deductible expense. Of course, if you withhold the security deposit to cover damages caused by the tenant, the cost of repairing such damage will be deductible, and offset the income from the forfeited security deposit. Yes, rental income is taxable, but that doesn’t mean everything you collect from your tenants is taxable. You’re allowed to reduce your rental income by subtracting expenses that you incur to get your property ready to rent, and then to maintain it as a rental.

TaxesThe mortgage interest deduction and other tax deductions for homeowners have fewer takers these days. Itemizing deductions allows some taxpayers to reduce their taxable income, and thus their taxes, by more than if they used the standard deduction. Your tenant might offer to trade services in exchange for rent. You must include a fair market value of the services as income. As an example, if your tenant offers to paint the rental house in exchange for one month’s rent (valued at $1,000), you must include the $1,000 as income, even though you didn’t receive the cash. However, you will be able to deduct the $1,000 as an expense.

Speaking of which, if you pay sales tax on business related items, wage and social security taxes for employees or inspection fees, be sure to deduct those as well. Only a percentage of these expenses are deductible in the year they are incurred. If you are a cash basis taxpayer, you report rental income on your return for the year you receive it, regardless of when it was earned.

As I just mentioned, it isn’t uncommon for rental properties to show a loss for tax purposes, even if they earned a profit. In other words, it’s fairly common for all of these deductions to add up to more than the property’s rental income. Hopefully, you won’t have to hire a lawyer to help deal with your investment properties.

How Is A Rental Property Defined?

In addition to money you receive as normal rent payments from tenants, there are other amounts that the IRS considers as rental income and must be reported on your tax return. This is the amount of taxes you pay on your taxable income. It is the average of all the tax brackets that your income is subjected to, combined with the deductions and credits that make your potentially taxable income less. Your effective tax rate applies only to your federal income taxes, so it excludes state and local taxes, for example. The alternative to your effective tax rate is your marginal tax rate, which is the highest bracket at which your income is taxed.

Instead the deduction only applies to payments towards interest charges. These components will be listed separately on your monthly statement, and are therefore easy to reference. Simply multiple the monthly amount by 12 to get your annual total interest. You can deduct the costs of certain materials, supplies, repairs, and maintenance that you make to your rental property to keep your property in good operating condition.