Content

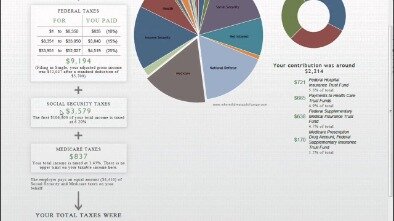

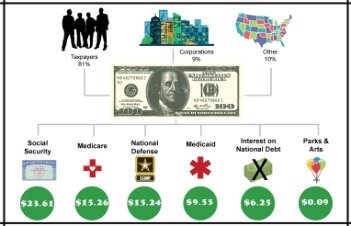

Trust funds, generated from sources such as payroll taxes, can only be used for specific programs like Social Security and Medicare. All other funds are federal funds, including revenue from your federal income taxes, and can be used for a wide variety of purposes. Some people think the federal government should give them a receipt for their income taxes to show where all that money went. While you may not get a receipt from the IRS any time soon, National Priorities Project went ahead and wrote one up. Others believe defense and corporate welfare dominate the budget. In reality, health entitlements – Medicare, Medicaid, Obamacare – and Social Security are the largest programs. These entitlements and interest on the debt are set to consume every dollar of taxes paid in just over 20 years.

These are the big programs that are funded by mandatory spending. While some of the money for these programs comes out of your check automatically, some comes from taxes on your earned income and things like capital gains. These are Social Security, Medicare, Medicaid, and Veterans Affairs benefits and services. They’re called entitlements because the government takes money out of your paycheck to fund them, so you’re entitled to these benefits once you meet certain conditions. The federal government collects taxes to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is instructive to examine what the government does with the money it collects.

Those are a portion of the taxes withheld from your paycheck, and due this year on April 15, 2019. Tax Day materials do not include corporate taxes or the individual payroll taxes that directly fund Social Security and Medicare. To read more about where federal revenues come from, visit Where the Money Comes From.

Download The Colorado State Budget White Paper

These subsidies are funded under the Affordable Care Act and usually taken as a reduction on how much someone might pay in taxes. Well, $3.5 trillion of that spending was paid for by “federal revenues,” which mostly refers to taxes. Discover 10 things taxes pay for below to understand just how the federal government is spending those trillions of dollars. Tax Day is April 15, 2019, the last day to file our tax returns for all income received in 2018. The state budget is what our state government uses to pay for all those essential state services that we depend on. Our state government collects almost $30 billion each year through three sources of revenue, with about 40% coming from state taxes (“General Funds”), 30% coming from state fees (“Cash Funds”), and 30% coming from the federal government (“Federal Funds”).

- Pro-growth tax reforms can unleash private investment, encourage job creation and fuel economic growth, increasing prosperity for all Americans.

- DHS oversees early childhood care and development programs as well as several welfare programs like the Supplemental Nutrition Assistance Program and the Temporary Assistance for Needy Families program.

- The legislature’s primary responsibility each year is to adopt a state budget which provides for these programs and stays within the bounds of the constitutional fiscal constraints which the people have placed on the use of these monies.

- To the extent that such services are worth paying for, the only way to do so is ultimately with tax revenue.

- Small amounts also go to provide single childless workers with small earned-income credits.

The categories are constructed by grouping related programs and activities into broad functions, which are further broken down into subfunctions. The details of how the categories used in this paper were constructed from those functions and subfunctions are described below. Although the data in this report is a couple years old, the trends are still consistent and the forecasted impact which Colorado’s aging population will have on our state budget is very sobering. The forced decline in residential values has disproportionately and adversely impacted the poorest communities with the lowest rates of growth in property values.

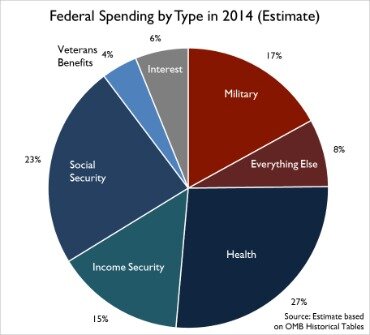

Approximately 19 percent of the federal budget goes into other categories of spending. The largest of these sub-categories, at about 7 percent of the budget, is spending on benefits for federal retirees and veterans. Interest on the national debt will total about $375 billion according to the 2019 federal budget, or about 8 percent of total expenditures. Payments for the Social Security system constituted about 23 percent of the federal budget in the 2019 fiscal year, with expenditures of about $1 trillion. The Social Security system provides retirement and survivors’ benefits along with disability payments and is categorized as a mandatory portion of the federal budget.

Not many of us can shell out $10,000 so casually that, if asked about where it went, they wouldn’t even know. However, the average American family pays the federal government at least that amount in taxes each year, and many of us only have a vague sense of where the money goes. The children are our future—but you might not know it by looking at how federal funds are spent. Education is normally a relatively small discretionary spending item (about 7% of discretionary spending in 2019), and it often includes both K-12 education as well as spending on college, training, and employment services. It’s also worth noting that only around 8% of K-12 public school spending across the country is federal.

Colorado’s increasing cost of health care for the elderly is reducing available funds for other state priorities like Higher Education. Health Care– primarily representing the state’s 50% cost-share of the federal Medicaid program – makes up the second-largest expense item in the General Fund budget, consuming 27% of the General Fund budget in FY17-18.

Various Taxing Jurisdictions

Registered users can be matched with products and services for which they are most likely to qualify. In other words, if you register and you find that your credit is less than stellar, Credit.com won’t recommend a high-end platinum credit card that requires an excellent credit score You’d likely get rejected, and that’s no good for you or Credit.com. You’d be no closer to getting a product you need, there’d be a wasted inquiry on your credit report, and Credit.com wouldn’t get paid. These are essentially what are commonly referred to as “targeted ads” in the world of the Internet. Despite all of this, however, even if you never apply for any product, the Credit Report Card will remain free, and none of this will impact how the editorial team reports on credit and credit scores. With two COVID relief acts in 2020, you should expect to see percentages in this category go up for that year.

A small portion of the Medicaid money comes from state revenue, about 25%, while the rest is covered by the federal government. Most of your tax dollars go to taking care of other Americans, followed by paying for defense. The amounts devoted to everything else, including the most controversial and hotly debated government programs, amount to a relative pittance compared to the overall amounts being spent. Historically, according to Pew, federal spending has hovered around 20% of gross domestic product . In 2016 total spending was 21.5% of GDP, and over the long term, the biggest growth in spending has been on the various human services programs . The share of GDP spent on defense has actually fallen to 3.3% in 2016 after hitting a high of 6% in 1986.

Calculate Your Own Tax Receipt

You can expand each of these areas to see more-detailed breakdowns by category. The legislature’s primary responsibility each year is to adopt a state budget which provides for these programs and stays within the bounds of the constitutional fiscal constraints which the people have placed on the use of these monies. As shown in Figure 2, the remaining 18 percent of federal spending goes to support a wide variety of other public services. A very small slice of this remaining 18 percent — about 1 percent of the total budget — goes for non-security programs that operate internationally, including programs that provide humanitarian aid. As the chart shows, the remaining fifth of federal spending supports a variety of other public services. A very small slice — less than 1 percent of the budget — goes to non-security programs that operate internationally, including programs providing humanitarian aid.

Americans have paid into Social Security and Medicare over their entire working lives. Contrary to Republican talking points, programs like welfare and food stamps make up a tiny fraction of the federal budget. Credit.com’s journalism is largely supported by an e-commerce business model.

You know where you live, but does your state collect income taxes? Defense spending accounts for about half of all discretionary spending at 48%.18 This funds the Department of Defense and all of its operations, including active military engagements in Iraq and Afghanistan.

Social Security was created in 1935 to provide income for retired workers over the age of 65 and accounts for more than a third (39%) of mandatory spending. It’s designed to supplement your income when you retire or become disabled. If you were to die before you become eligible, your dependents would receive benefits. Consequently, it will be up to Colorado voters – NOT their elected legislature – to change these constitutional funding constraints IF they desire a different outcome. Again, while Amendment 23 was well-intended to benefit K-12, it has limited the state’s ability to address other state priorities. TABOR also prohibits the state from raising tax revenues without a vote of the people.

Safety net programs typically constitute about 9 percent of the federal budget. This category includes all aid programs for low- and mid-income families that are not a part of Social Security or the major health programs.

But if you have the ability to support independent, non-profit journalism, we are so grateful. Your voluntary contribution helps keep this website paywall-free.

How Children Affect Your Taxes

The remaining 54 percent of annual spending is on the military, which is more spent on the military than the next 7 nations combined. It’s about the only really big thing the federal government does. All other government services–including Energy, Agriculture, and Commerce–account for only 1 percent of the discretionary budget.

Not including the military and other non-civilian workforces, the federal government employs more than 2 million people. That’s a lot of people to pay, which means a lot of spending on salaries, wages, and benefits. The federal government spends billions of tax dollars to cover these expenses every year. Funding the Social Security program is a big expense for federal taxpayers. Social Security spending is part of an overall government spending category known as mandatory spending. These don’t require appropriation because the spending is mandated by a previous law or appropriation. With mandatory spending, the government funds the programs based on the need—however many people are eligible for and draw from Social Security, for example, determines how much is funded.

Take those returns out of the picture, he wrote, and “you are left with 99 million Americans who recorded an average federal tax hit of $14,654.” Yes, we know taxes pay for everything from roads to defense, social programs to public television. But the specific breakdown of tax spending is something most Americans give little thought to — even though taxes are the biggest single line item for many Americans each year. Visitors to Credit.com are also able to register for a free Credit.com account, which gives them access to a tool called The Credit Report Card. This tool provides users with two free credit scores and a breakdown of the information in their Experian credit report, updated twice monthly. Again, this tool is entirely free, and we mention that frequently in our articles, because we think that it’s a good thing for users to have access to data like this. Separate from its educational value, there is also a business angle to the Credit Report Card.

That doesn’t mean, however, that our editorial decisions are informed by the products available in our marketplace. The editorial team chooses what to write about and how to write about it independently of the decisions and priorities of the business side of the company. In fact, we maintain a strict and important firewall between the editorial and business departments.

While individual Americans have no direct control over how their tax dollars are spent, it’s important to know where the money goes. It’s especially important to understand that any major increases — say in defense spending, as President Donald Trump has proposed — require cuts elsewhere. With more than two-thirds of the budget going to social insurance programs, it’s hard, if not impossible, to make major changes without impacting those programs. Income security refers to federal spending on safety net programs to increase the health and safety of the general population. Programs included under this umbrella term cover, but aren’t limited to, housing assistance, nutrition and food assistance, unemployment compensation, foster care, and certain tax credits. Our Tax Day materials show how federal funds were spent during fiscal year 2018, the time period that most closely corresponds to the calendar year for which income taxes are due. In order to do this analysis, we separate federal funds from trust funds.

The Credit.com editorial team is committed to providing our readers and viewers with sound, well-reported and understandable information designed to inform and empower. We will, however, do our best to explain the consequences of various actions, thereby arming you with the information you need to make decisions that are in your best interests. We also write about things relating to money and finance we think are interesting and want to share.

Get More With These Free Tax Calculators And Money

Our mission as journalists is to serve the reader, not the advertiser. In that sense, we are no different from any other news organization that is supported by ad revenue.

You can sign up as a subscriber with a range of benefits, including an opt-in to receive the print magazine by mail. In fact, if Trump and Republicans in Congress aren’t going to cut discretionary spending—especially on the military—the only places they can look to make way for more tax cuts for the wealthy and corporations are Social Security, Medicare, and Medicaid.