If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). TurboTax Home & Business helps you find tax-saving opportunities such as home office write-offs, deducting business mileage, retirement plans, and more. Employees are not allowed to deduct the cost of driving to and from home to work. But if you are self-employed and your home is your principal place of business, you can deduct the cost of driving from home to see a client or to go to another work location.

The final net profit figure must be transferred to Form 1040 and combined with your other earnings to calculate your taxable income. For example, the cost of sophisticated computer software is an ordinary and necessary expense for a freelance graphic designer.

- There is an exception if you spend an extra day or two away to get a cheaper airfare for a Saturday night stay over.

- You can put in up to 25 percent of your net earnings from self-employment, which is your net Schedule C profit minus the deduction for one-half of your self-employment tax.

- The number of loose tax ends you’ll have to tie up will vary depending on whether you’ve been operating alone or with a group of employees.

- However, if you sold the business to someone else, TurboTax will guide you through the disposition process and include the transaction on your income tax return.

- By accessing and using this page you agree to the Terms of Use.

- Instead, you may have an obligation to make up to four estimated tax payments to the IRS during the year.

However, you must also report the net profit or loss in the income section of your 1040 form. Hello, I’m Jill from TurboTax with some important information for self-employed taxpayers. Many sole proprietors are able to use a simpler version called Schedule C-EZ. This form omits a lot of the detail in the full Schedule C and just asks for your total business receipts and expenses. However, you still need to complete a separate section if you claim expenses for a vehicle. There is an exception if you spend an extra day or two away to get a cheaper airfare for a Saturday night stay over.

When you are self-employed, the entire burden for paying employment taxes and prepaying estimated income tax liability is left to you. The government wants you to make payments of your estimated taxes throughout the year in quarterly installments. So, you’ve started a business or decided to freelance, and freed yourself from the daily grind of that old job. In fact, you’ll owe tax that you never had to pay as an employee.

Always go back over your tax return to make sure you deducted every business expense you were entitled to. Look for differences between your estimated expenses at the time you completed Form 1040-ES and what they actually turned out to be.

Schedule C Reporting

If you have worked as an employee, you know that what you get in your paycheck is usually less than what you really made. Because your employer withheld money for Social Security, Medicare and income tax and sent that money to the government. When you’re an employee, you share that cost with your employer, with each of you paying a share of the FICA tax.

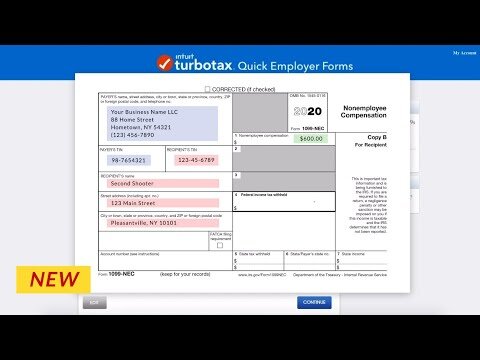

Every time I try and file it takes me to the schedule C and want me to link something. Next, you will re-enter the Form 1099-NEC as part of the Schedule C so that the income is reported directly as part of your Business Income and Expenses and within the correct form and section of your return. Check the box on Line 17 and enter the date you last paid wages.

Part I: Income

So closing down involves issuing final W-2 forms to your employees by the due date of your final tax return. You also have to file a final Form 941 for the last quarter in which you paid your workers, and use that form to tell IRS about the shutdown. When you first start your business or work as self-employed, you’ll have to make an educated guess about how much income you will earn over the tax year, because you won’t have any previous years’ income to guide you. If your estimate is wrong—either too low or too high—you can adjust the amount on your 1040-ES forms during the tax year. If you’re just starting out, it’s possible you worked at a job earlier in the tax year before making the switch to self-employment, or you’re working multiple jobs. In this case, you may have more than one source of income you’ll need to report on your income tax return.

This form, headlined “Profit or Loss From Business ,” must be completed and included with your income tax return if you had self-employment income. In most cases, people who fill out Schedule C will also have to fill out Schedule SE, “Self-Employment Tax.” You must report all your sources of income to the IRS on your tax return, even if you don’t receive a 1099 form from your customers. If you were close in estimating what you would owe when you completed Form 1040-ES and made those quarterly payments on time, you shouldn’t owe the IRS much additional tax. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. And if your net earnings from self-employment exceed $400, you will have to pay self-employment tax , which is figured on Schedule SE. You deduct one-half of that SE tax as an adjustment to income on Form 1040.

Should I File Estimated Taxes?

However, if you sold the business to someone else, TurboTax will guide you through the disposition process and include the transaction on your income tax return. Get your taxes done right and get your maximum refund, guaranteed when you use TurboTax.

(Most of the work is done on your family’s old PC and home telephone.) You get a great job offer from one of your clients, so you decide to shut down the business. If you’re planning to close a business, don’t forget to put the IRS on your to-do list, because tax rules require you to keep the tax agency in the loop. TurboTax can help with reporting the sale of assets, final employment tax reporting and more. We know your tax refund is important to you, so TurboTax shows you your refund as you go so you know where you stand. We’ll streamline the process so you won’t have to answer any unnecessary questions and file faster.

You won’t pay until you’re ready to e-file or print your return. When you work for someone else, your employer withholds money from your paycheck to cover Social Security and Medicare taxes. However, when you’re self-employed, you have to pay these taxes yourself. The IRS will require you to complete a Schedule SE in any year your sole proprietorship earns $400 or more of net profit.

If you’ve been running an unincorporated business by yourself with no employees, reporting your shutdown to the IRS couldn’t be easier. Say you’ve been a self-employed consultant for the last several years, filing Schedule C each year to report income and expenses. The number of loose tax ends you’ll have to tie up will vary depending on whether you’ve been operating alone or with a group of employees.

For tax years prior to 2018, you can deduct only 50 percent of your allowable meals and entertainment expenses. The 100% expensing is also available for certain productions, such as qualified film, television, and live staged performances, and certain fruit or nuts planted or grafted after September 27, 2017. You also use Form 4562 if you elect the Section 179 “expensing” deduction. Section 179 lets you deduct the full cost of assets in the year they are placed in service, subject to certain limits. Total up these items and subtract your cost of goods sold to arrive at gross income. One thing to remember is that you must make this evaluation each tax year—eligibility to use the Schedule C-EZ one year doesn’t mean you can use it in all future tax years.

For example, a $1,000 self-employment tax payment reduces taxable income by $500. In the 25 percent tax bracket, that saves you $125 in income taxes.

The write-off is claimed on Form 8829, and is deducted on Schedule C. Thus, it reduces your SE income and tax. Remember, with TurboTax, we’ll ask you simple questions about your income and expenses, and fill out the right tax forms for you to maximize your tax refund. Schedule C is used to calculate your business income for the portion of the year that you were self-employed—all the income your business took in, less business expenses. The resulting number is what you’ll use to calculate your self-employment tax on Schedule SE and what you’ll report on your Form 1040 as income. If your expenses were $5,000 or less, you can use Schedule C-EZ instead. You can claim 50% of what you pay in self-employment tax as an income tax deduction.

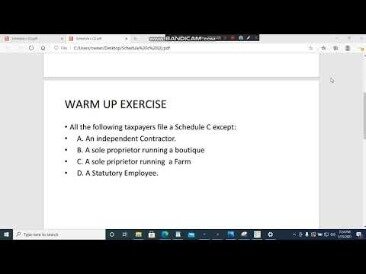

The purpose of the schedule is to calculate the self-employment tax you must pay. However, when you fill out your 1040, the IRS allows you to deduct some of these payments. In Part I, you list all the income of your business and calculate your gross profit. In Part II, you subtract all your business expenses and calculate your net profit or net loss. You only need to complete Parts III through V if your business requires you to purchase inventory, you need to claim deductions for car expenses or if you have any other expense not listed in Part II. You use Schedule C to report profits or losses from a sole proprietorship. A sole proprietorship is any business you operate and control that is not set up as a legal business entity such as a corporation or partnership.

In most circumstances, your clients are required to issue Form 1099-NECwhen they pay you $600 or more in any year. You do get to take off the 50% ER portion of the SE tax as an adjustment on 1040 Schedule 1 line 14 which flows to 1040 line 8a. For the future, you should use a program like Quicken or QuickBooks to track your income and expenses. The income can be entered directly, without using the 1099-NEC . If you already have created a Schedule C in your return, click on edit and go to the section to Add Income. On the top right corner of TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner). On the top right corner of TurboTax online screen, click onSearch(or for CD/downloaded TurboTax locate the search box in the upper right corner).

We’ve broken down the form into sections, so you can see what the IRS expects from you and what records you’ll need at tax time. You are self-employed if you operate a business as a sole proprietor, including a limited liability company you are the sole member of. You are also self-employed if you earn income as an independent contractor.

When you’re self-employed, though, you’re stuck with the full full amount yourself. That’s because they’re carrying the full burden of paying for their Social Security and Medicare. Earnings such as investment income are not subject to Social Security and Medicare taxes. You need to report all your income even if you don’t get a 1099Misc. You are considered self employed and have to fill out a schedule C for business income. You use your own name, address and ssn or business name and EIN if you have one. You should say you use the Cash Accounting Method and all income is At Risk.

In other words, the main purpose of the trip must be for business. Your other out-of-pocket expenses, such as lodging, hotel tips and 50 percent of meals, can be deducted for the business days only. You can claim 57.5 cents per mile for 2020, plus the cost of parking and any tolls you paid. Be sure to keep a record of your business driving or the IRS can deny your deduction on audit. As a freelancer, independent contractor, or consultant, you have a variety of tax issues to consider—including ways to trim your tax bill. Your deductions must be for business expenses that the IRS considers ordinary and necessary for your self-employment activities.

This deduction is an adjustment to income claimed on Form 1040, and is available whether or not you itemize deductions. When you start a small business and you do not incorporate or form a partnership, you report the results of your operations on Schedule C and file it with your Form 1040. Have you started your own business, freelance, or work as an independent contractor? Then get ready to pay the self-employment tax, which is a tax you never had to pay as an employee. These taxes are calculated on a Schedule SE, which must be attached to your tax return. The process of filing your taxes with Form 1099-NEC is a little different than if you only had income reported on a W-2.

Income reported on Form 1099-NEC must be reported on Schedule C, the program is trying to link these two forms together to be sure that it is reported correctly and on the right form. The miscellaneous expenses will be at the end of the list of business expenses where you can enter a description and amount. For a SIMPLE, despite the acronym, shutting it down is a little more involved, because it’s operated on a calendar-year basis and can’t be terminated until the end of the year in which your business shut down. If, for example, you close up shop on September 30, you still must continue funding the plan as you originally promised for the last three months of the year before you can terminate it. In addition to filing that final Schedule C, you also have to give IRS details about your asset sales.

This does not mean, however, that you can wait until you prepare your tax return to pay 100% of the income tax you owe. Instead, you may have an obligation to make up to four estimated tax payments to the IRS during the year. Because your payroll tax deposits have exceeded $1,000 annually, you’ve had to make deposits and file Form 941 each quarter.

On the other hand, the cost of hiring a limousine to travel to clients may be helpful, but is not ordinary by tax standards. As a self-employed person, you’re required to report your self-employment income if the amount you receive from all sources totals $400 or more. Self Employment tax is automatically generated if a person has $400 or more of net profit from self-employment. You pay 15.3% SE tax on 92.35% of your Net Profit greater than $400. The 15.3% self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. The Turbo Tax Free File program which is free for federal and state.