Content

Description of benefits and details at hrblock.com/guarantees. To set up an installment agreement for your business, the IRS may need to determine your business’ ability to pay.

Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only.

What should I do if the estimated tax payment amount reported in the estimated tax payments inquiry application is different than my records? Re-check your estimated tax payment records for errors. You may be reporting an estimated payment that was applied to your prior year return or was submitted for the following year’s estimated tax. Also, an adjustment to your prior year return may have changed the amount available for carryforward to the current year. My return was rejected because the amount I claimed for estimated tax payments does not match Department of Revenue records. Check the department’s estimated tax payments inquiry application and use this information to correct the amount of estimated tax payments claimed on your Wisconsin return. When should I make estimated tax payments?

In short, you’ll need to file estimated tax payments by those dates to avoid any penalties or interest. Even if you miss the deadline by a day, you’ll still be penalized. That is why it is vitally important to be organized with your taxes. Use Form 1040-ES to calculate and pay your estimated taxes.

The various payment methods are described in the instructions for Form 1040-ES. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office.

Your consent to receive calls/texts is not a condition of purchase. Complete the form below and NerdWallet will share your information with Facet Wealth so they can contact you. Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. Because of the pandemic in 2020, some tax filing deadlines were relaxed and extended.

In other words, you’ll pay a lot more the longer you wait. So, if you want to keep the penalty to a minimum, all you have to do is pay the amount as soon as possible. When you work as an employee, your employer withholds some money from your paychecks to send to the Internal Revenue Service . At the end of the year, you’ll most likely get a nice big tax return check for how much you overpaid throughout the year. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account.

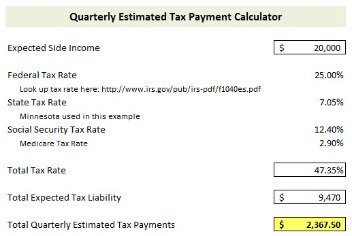

Tips For Calculating Federal Taxes In Advance

Due dates for state payments may or may not coincide with the federal dates, so be sure to check with the appropriate tax agency in your state. What a strange and difficult year it’s been!

This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

Additional fees may apply from WGU. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. he Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY.

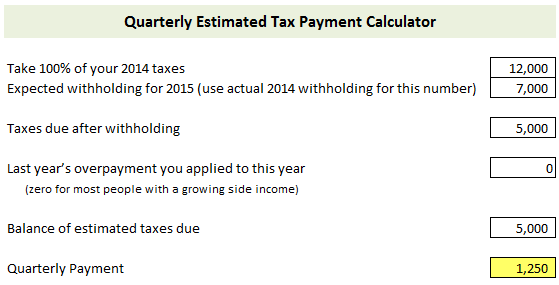

Base Your Payments On Last Year’s Earnings

This will provide you with an easy reference for your business expenses and income. Underpayment interest is computed separately for each installment due date. Therefore, you may owe underpayment interest for an earlier installment due date even if you pay enough tax later to make up the underpayment. Go to the department’s tax forms to complete and print the interactive Form 1-ES Voucher. See the Form 1-ES instructions and the “2021 Estimated Income Tax Worksheet” for a detailed computation of the required payment. Better yet, when you keep up with your bookkeeping for tax purposes, you have vital information about your business available to help you make good business decisions all year.

Timing is based on an e-filed return with direct deposit to your Card Account. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts .

Can I Get Money Back If I Overpaid One Quarter?

H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation.

- See your Cardholder Agreement for details on all ATM fees.

- This other income includes unemployment compensation and the taxable part of Social Security benefits.

- You get a little bit of a break then until January 15 of the next year.

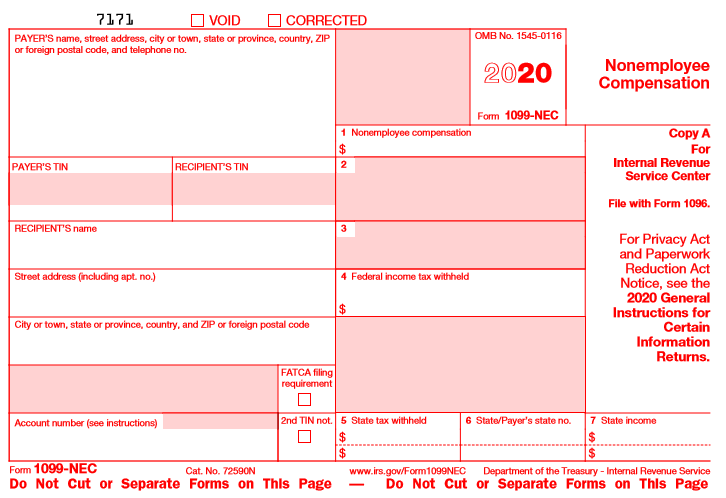

- Be sure you’ve received all of your tax documents, such as your Form W-2, Forms 1099, or other tax forms, before you complete your taxes.

- Consult your own attorney for legal advice.

- But, you don’t need to notify the IRS if you plan to adjust your payment.

Pay electronically, check your balance, and review payments in your estimated tax account by creating an Online Services account. You do not have to make estimated payments if you are 65 years or older and permanently living in a nursing home or a farmer. We consider you a farmer if at least two-thirds of your total federal gross income is from farming. You will likely need to make estimated payments if your income is either fully or partially exempt from Illinois withholding. I hope we made it easy for you to understand what happens if you miss a quarterly estimated tax payment. If you’re not sure how much you’ll owe at the end of the year, you can use our estimated tax calculator to get an estimate of how much you should be paying for your quarterly taxes. You don’t have to make the payment due January 15, 2021, if you file your 2020 tax return by February 1, 2021, and pay the entire balance due with your return.

Make ALL of your federal tax payments including federal tax deposits , installment agreement and estimated tax payments using EFTPS. If it’s easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as you’ve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account.

Along with the form, you’ll need to provide an explanation with the proof for why you weren’t able to pay estimated taxes in the specific time period that you’re requesting a waiver for. An example of proof that qualifies for approval would be documented records from the hospital, disability, insurance, police, or retirement documents. If you overpay, you will get a refund for the amount. If you are an employee, your employer withholds income taxes from each paycheck based on a completed W-4 Form. Usually, that’s enough to take care of your income tax obligations. But if you are self-employed or make money on your investments or rental property, you may need to make estimated tax payments every quarter, rather than wait until you file your annual tax return. After you start paying estimated taxes, be sure to keep a separate record of the dates you paid them and how much you sent for each period.

Ignoring the rules might save you some time during the year, but you’ll pay the piper come tax day. Another idea is to make sure you plan ahead to have the necessary cash to pay your tax bill when you file. Just be careful because not being able to pay your total tax bill can lead to penalties and interest. Unless you hire someone to do your taxes for you, you are your own accounting department. Unless you actually are an accountant, you may very well have some questions, at least during the first year of self-employment. Open separate checking and credit card accounts for your business.

However, this might limit the amount of money to use in your business until your tax return is due. If you are self-employed, you need to be very careful when calculating and paying your estimated taxes in order not to incur underpayment penalties. If you follow the tips above for calculating your quarterly estimated tax payments, you can minimize your chances of running up penalties or breaking your budget. Always consult with a tax advisor if you have questions relating to your specific tax situation. Wisconsin law requires that you pay tax on your income as it becomes available to you.

Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY.

estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit.

The first payment is typically due on April 15. This covers the income you earned from January 1 through March 31. He previously worked for the IRS and holds an enrolled agent certification. Don’t forget to check if you’ve applied your previous year’s tax refund to this year’s taxes. The IRS, however, offers safe harbor guidelines to help you avoid underpayment penalties. For example, you’re in the clear if your withholdings pay 90 percent of the tax bill you’ll owe for 2021. But if you have no idea how much you’ll earn next year, you can pay 100 percent of your 2020 tax bill to protect yourself from owing penalties and interest.

For each partial or full month that you don’t pay the tax in full on time, the percentage would increase. The penalty limit is 25% of the taxes owed. The underpayment tax penalty is worked out by looking at the sum you owed and the time it took you to before you paid.