Content

It’s possible to file both your state and federal return for free and the paid versions are priced lower than some of TaxSlayer’s main competitors. In fact, TaxSlayer offers highly affordable pricing for filers with basic and more complicated returns. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. EY TaxChat will be open for enrollment in early January 2021 and available through fall 2021.

- Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc.

- Simply fill out your form directly and securely on our website and submit your order.

- Accountants and Tax Preparers use efile4Biz to maintain and file forms for multiple clients under one account every year.

- If you know you had coverage year-round, these forms are mainly for your reference.

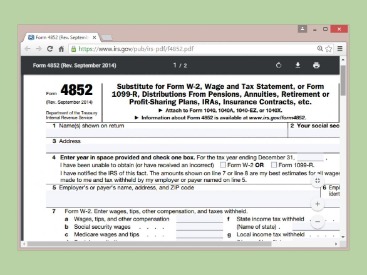

- We make switching easy — we’ll autofill your income, wages, and more when you upload a prior year return and import your W-2.

We’ll guide you through the entire filing process to help you file quickly and maximize your refund. Everyone gets free, unlimited phone and email support. And if you need more help, we have you covered from Ask a Tax Pro to Audit Defense. Maintain access to filed forms for at least four years. Our easy-to-use interface will have you filing forms in just minutes so you can spend time on what matters most to you. As your income rises, you may be surprised to see how your tax filings change. Growth is a theme we often see with our clients at EY TaxChat™.

Tax Bracket Calculator

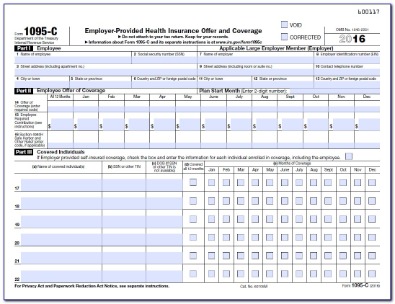

If you know you had coverage year-round, these forms are mainly for your reference. Employers have until the end of February to send them to the IRS if filing paper forms, or until the end of March if filing electronically. Employers with 250 or more forms must file them electronically. Those with fewer than 250 have the option of filing paper forms or filing electronically. The health care law defines which employers must offer health insurance to their workers. The law refers to them as “applicable large employers,” or ALEs.

If you’re a business owner, partner, contractor or gig worker, you may have to pay self-employment tax. “Trying to file without Form 1095-A could cause an issue and prevent your return from being processed until the error is remedied,” says Alison Flores, principal tax research analyst at H&R Block’s Tax Institute. The penalty, which will be subtracted from your federal tax refund or added to what you owe, is a maximum $695 per adult and $347.50 per child under age 18, up to a maximum of $2,085 per family. You’ll need a numerical code on Form 1095-C to help determine whether you’re exempt from the tax penalty for 2018 or you need to pay.

Tax Experts Can Help Or Do Your Simple Tax Return For You

A separate form, the 1095-B, provides details about an employee’s actual insurance coverage, including who in the worker’s family was covered. This form is sent out by the insurance provider rather than the employer. If an ALE does not offer its employees insurance, the 1095-C will indicate that fact.

With this subscription, you automatically get TIN Matching for all entered payers and recipients at no additional cost. Whether you’re filing one form or thousands, filing your 1099s, W-2s and ACA forms online eliminates steps, saving you precious time. Simply fill out your form directly and securely on our website and submit your order. We take care of printing and mailing the forms to your recipients, as well as e-filing your forms directly with the IRS or SSA. While this may seem like a lot to digest, our EY tax professionals remain up to date on tax developments and apply that knowledge when preparing your tax returns. If you want to avoid a surprise tax balance due when you file your returns, consider adjusting your tax withholdings or making estimated tax payments. EY TaxChat™ can help with the new tax reporting requirements on your annual tax returns.

Health

You can also enter key words to search additional articles. Jump to the front of the line with priority support via email, live chat, or phone. Please check the contact us link in your my account for the support center hours of operation. Usually, email responses can be expected within 24 to 48 hours.

Access your records and forms on efile4Biz.com from any device with internet access. The economic impact of the pandemic has been challenging, with millions receiving unemployment. These funds offer a lifeline, but they’re not tax-free income. If you recently became a US citizen, are a citizen of multiple countries or work in the US under a visa, our team will analyze your scenario to assist and file the appropriate US returns. If paying taxes makes you cringe, tax credits and deductions should make you smile.

And if you haven’t yet received either form 1095-C or 1095-B, don’t wait to prepare and file your returns. IRS Form 1095-C, “Employer-Provided Health Insurance Offer and Coverage,” is a document your employer may have sent you this tax season in addition to your W-2 wage form.

Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice. In this case, you must wait for Form 1095-A to file your taxes. The information on 1095-A can also help determine whether you’re eligible for a premium tax credit to subsidize your 2019 coverage. If you haven’t received Form 1095-A yet, contact yourstate marketplaceto ask for it. You really don’t need to do anything with the Forms 1095-B and 1095-C exceptkeep them with your recordsfor tax year 2018.

PDF editor permits you to help make changes to your Form 1095-C from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently. However, some companies are “self-insured,” meaning that they pay their workers’ medical bills themselves, rather than paying premiums to an insurance company. the IRS does NOT need any details from this form.

Turbotax Online

Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230. You acknowledge and agree that TaxSlayer and any of its website co-branding providers have no responsibility for the accuracy or availability of information provided by linked sites. Links to external web sites do not constitute an endorsement by TaxSlayer or its website co-branding providers of the sponsors of such sites or the content, products, advertising or other materials presented on such sites. Failure to Comply With Terms and Conditions and Termination. Simply Free For those with a simple tax situation.

ALEs that don’t offer coverage may be subject to financial penalties. You file the information from the form by answering the appropriate questions within the filing process. Ok, so if its not required to file it with the taxes how do we file it?

It is used by larger companies with 50 or more full-time or full-time equivalent employees. This form provides information of the coverage your employer offered and whether or not you chose to participate. This option requires you to provide a valid phone number, email address and bank account information in your return. This is a good choice for those with a checking or savings account who do not want to pay any OUT OF POCKET EXPENSES. This option is the same as a Direct Deposit, except that TaxSlayer filing fees are deducted from your federal refund. To use this option you must be filing a Federal return and receiving a refund from your federal return to cover the expenses listed above.

It details any employer-based health insurance coverage you had in 2018. Your employer also sends Form 1095-C to the IRS.