Content

I guess that defeats the purpose of backdoor Roth. 1) My taxes owed jumps from ~3000 to ~7000 (fed+state).

The next week I converted it to a Roth again for 2013. I’m told by Fidelity that I won’t receive a 1099-R for this because I made my contribution after Dec 31, 2013. If line 14 shows “0”, then in 2013 I have “0” from previous IRA basis. So this amended tax is affecting my 2013 return. Firstly, I entered contribution $10000 in total for me and my wife. When it comes to enter distribution, I remember you said I should report my distribution in 2013 (because I bought it in 3/2013). Turbo Tax should handle this properly.

I said no to “any excess contributions before. I want to report contribution in 2012 and distribution in 2013. Tried to enter “0” for 2012 distribution, this way line 14 showed $5000, but then I had problem stated in my above post. I also tried to leave distribution blank, but this way line 14 showed “0”. Rob – Sorry I don’t have time to do screenshots. The $99 remaining in the traditional IRA at the end of the year just means you will pay tax on say $98 with your $5,000 conversion and carry over $98 basis in the $99.

See how much you are taxed on line 15b. – Taxable amt not determined is checked . 1) There is no year-end value for my Traditional IRA since I converted the entire balance on 4/2014 to Roth. I would’ve submitted the return with 15a and 15b on the 1040 saying the same thing–5512.

Late Contributions To The Backdoor Roth Ira

Because if so, I’m very surprised 8606s weren’t done. If you were doing them on paper and just didn’t realize you needed to, well, you can at least do 1040Xs back to 2012.

In both cases, the penalty may be waived if the taxpayer can show reasonable cause for not complying with the requirements. Form 8606 does not have to be filed if the entire contribution or conversion is recharacterized. However, if only part of the contribution or conversion is recharacterized, the individual must complete Part l of Form 8606. Either way, the statement must be submitted along with the tax return.

What Is The Difference Between Irs Form 8606 And 8606

I made a non-deductible Traditional IRA contribution of $5,500 in February 2014 for 2013 and converted it to a Roth IRA before the end of 2014. I will be making a Traditional IRA contribution of $5,500 in March 2015 for 2014 . I just went over your tutorial and it is very helpful especially since I am new to this all. I am slightly confused over my situation and was hoping if you would be able to help/clarify.

Code R is recharacterization for the previous year , not conversion. Either your custodian issued the form wrong, or you filled out a wrong form or used the wrong verb when you made the request, or the person who processed it heard/read it wrong. If you recharacterized before you converted, maybe there’s another 1099-R form for the conversion. @kimc – TurboTax is able to figure out as much as you tell it. You can lump all contributions together as one entry.

Obviously, I didn’t know what my income was going to be and could have potentially avoided the complicated backdoor process if I had known my income would have been below the 188 or so. @Brian – I have no idea what raises their eyebrows.

- I have made 2 backdoor conversions in 2013 for 2012 and in 2012 for 2011 – but could never figured out how to do them .

- Part 1 of Tom’s Form 8606 is filled out below.

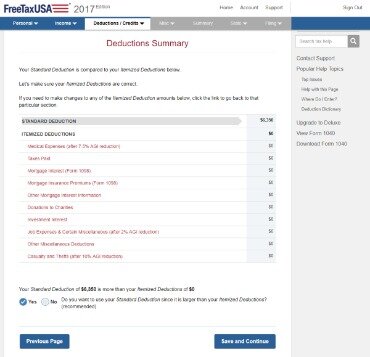

- I am trying to report a backdoor Roth In TurboTax.

- I have entered the IRA contributions first .

You can use the same traditional IRA accounts every year—they just spend most of the time with $0 in it. Most fund companies, including Vanguard, don’t close the account just because there is nothing in it. Leave it in cash (i.e. a money market fund or settlement fund) while it is in the traditional IRA to keep the math simple. You don’t want any losses or much of a gain between the contribution and conversion step. Last year was the first time I did a backdoor Roth for both me and my wife and I was doing turbo tax yesterday, entering 1099R for spouses backdoor Roth. When I put it in Turbo tax my tax owed increased by a lot.

Therefore, on Dec 31, 2011, I still had $6000 in my Trad IRA. Then, the taxes were reduced to zero. TT must have changed the screens to ask for the cost basis prior to conversion vs. after . Thank you so much for your site and your reader’s comments to help me through this. TFB, Thanks for this helpful article. And sorry if somebody has asked the same question to you above. I contributed $5k to a new Trad IRA account in 2011.

Answer “No.” You converted the IRA, not recharacterized or switched. Here it’s asking about the prior year carryover. When you’re doing a clean “planned” backdoor Roth as in our example — contribute for year X in year X and convert before the end of year X — you can answer No here. If you contributed for the previous year between January 1 and April 15, answer Yes here.

I thought 1099R was wrong until I looked at mine and they were the same. I deleted my 1099 (it was imported from an institution while I entered my wife’s manual) and tax didn’t change. I imported it again and tax didn’t change. But when I deleted my wife’s 1099R tax owed went down.

The earnings are attributed to the traditional IRA. I would probably not bother with a late statement either. My confusion comes from my 1099-R statements.

Line 1 is your non-deductible contribution. On Line 2, your basis is zero because you had no money in a traditional IRA on December 31 of last year (if you’ve been carrying a non-deductible IRA for years this may not be zero). Note that Turbotax may fill this out a little differently (may leave lines 6-12 blank) but you end up with the same thing. Line 13 is the same as line 3, so tax due is zero. IRS Form 8606 is a tax form for documenting nondeductible contributions and any associated distributions from traditional, SEP, and SIMPLE IRAs. The most common reason to file Form 8606 is making nondeductible (after-tax) contributions to a traditional IRA.

Hence the amount on line 14 is wrong. You’re discovering why I recommend you do the contribution and conversion in the same year.

Because these contributions do not reduce your taxable income as regular IRA contributions do, they must be reported and taxed accordingly. This would typically happen if you have maxed out your regular tax-deductible contributions for the year but still want to make additional contributions to your retirement fund. This distinction is necessary for determining whether any portion of a Roth IRA distribution is subject to income tax and/or penalty. To properly account for these conversion amounts, the individual must complete Part ll on Form 8606. Basically, you must file Form 8606 for every year you contribute after-tax amounts (non-deductible contributions) to your traditional IRA.

When To File Form 8606: Nondeductible Iras

Remember that you need one form for each spouse. INDIVIDUAL Retirement Arrangements. You need to double-check this to make sure it is done right, even if you hire a pro. Advisors have told me that they have had to help clients fix dozens of these that tax preparers have done improperly. If you don’t do it right, you’ll pay taxes twice on your Backdoor Roth IRA contribution. Married physicians should be using a personal and spousal Roth IRA, and will usually need to fund both indirectly (i.e. through the back door). That allows you to determine your own tax rate as a retiree by deciding how much to take from tax-deferred accounts and how much from Roth accounts.

After entering the form, TurboTax never asks me what I did with the money, so I have no chance to say I converted it to a Roth. If I enter the amount as a Roth IRA contribution in the Retirement section under Deductions and Credits, TurboTax tells me I make too much and have to pay a penalty . @Z – Your conversion triggers the 1099, not the other way around. You just won’t have to report the conversion until you file the 2014 tax return in 2015. You can contribute in 2014 and convert in 2014. If you choose to do so, you report them in 2015.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return. You do not entered it directly on then 8606 form. then you’ll have todownload and print Form 8606, manually fill it out , and print and file your return, as you won’t be able to e-file. Note that you can still contribute money to an IRA in these situations, and your earnings will still grow tax-free. All that’s affected is how much you can deduct in the current year. A SIMPLE IRA is a traditional IRA set up by an employer, with both the employer and employee contributing money. A Simplified Employee Pension, or SEP-IRA, is a traditional IRA set up for an employee by an employer.

It is an IRA owner’s responsibility to maintain accurate records allowing proper and timely completion of Form 8606 when he/she files his/her federal tax return. If an individual is not filing a federal tax return, Form 8606 is filed at the time and place a tax return would otherwise have been filed. It is not an IRA custodian/trustees’ responsibility to inform an IRA owner of the need to file Form 8606 or provide the form to an IRA owner. With this said, an IRA owner may not be aware he/she must file Form 8606. Thus, an IRA custodian/trustee may inform the IRA owner of the requirement and how it relates to the IRA and recommend the IRA owner see a tax professional for assistance. I think some of the conversion is taxable, even though all of the prior existing IRAs were nondeductible traditional IRA’s. Several years ago when I first met this physician he brought in his tax information with a current year nondeductible traditional IRA contribution, and had prior year nondeductible IRA’s as well.

But run through that worksheet just to be sure. Hi, I have been following your website since last year. It has been a great learning experience for me. Unfortunately, I have never contributed to Roth before (never got to know about this website while in training!).

I actually had it mixed up because I made two contributions last year. I initiated it all in early April 2014, hence falling within the deadline contributing for 2013 and converting it, and then made second transaction in May for 2014 itself with the same custodian. However, I am disappointed because in efforts of trying to secure future well-being, I made more than one error. I know for the already existing amount in the Rollover IRA, I’ll have to report that taxable amount for 2014. My 1099-r with Vanguard is trying to get me to report the entire amount as taxable for 2014.

Now you should have a good understanding of the importance of filing Form 8606. As we have demonstrated, filing this form could mean tax savings, while failure to file could result in paying the IRS tax and penalties on amounts that are actually tax- and penalty-free. Generally, a transfer of IRA assets from one spouse to another is not taxable to either spouse if the transfer is in accordance with the divorce or legal separation agreement. If such a transfer results in a change in the ownership of the after-tax amounts, both spouses must file Form 8606 to show the after-tax amount owned by each.

Turbotax

Can I pay to get an hour of your time to consult me on my tira to rira contributions, which I recharacterized. I only started this a few years ago, but it’s so complicated due to my recharacterization. I’ve had a lot of wrong advice and really need to get my historical part correct and what to do ever year. Did you do the contribution part first? Follow the instructions as a complete set from start to finish. Otherwise you scare yourself unnecessarily.