Content

However, if you receive advance payments of the credit, you will need to reconcile the payment with the actual premium tax credit amount (which is calculated by eFile.com on your tax return). With an annual income of $24,280 for 2020, John is eligible for a premium tax credit of $3,412 for the year. In February 2021, when John files his 2020 tax return, John’s federal tax is $1,500. He will receive the full premium tax credit amount of $3,412 even though the amount of the credit is larger than his federal income tax liability. For any tax year, if you have APTC in any amount or you do not have APTC but you plan to claim the premium tax credit, you must file a Form 8962, and attach it to your federal income tax return for that year. If you have any APTC, you will use Form 8962 to reconcile the difference between the APTC made on your behalf and the actual amount of the credit that you may claim on your return.

One state program can be downloaded at no additional cost from within the program. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns. State e-file available within the program. An additional fee applies for online.

Check cashing not available in NJ, NY, RI, VT and WY. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. Emerald Card Retail Reload Providers may charge a convenience fee.

Credits & Deductions

Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

H&R Block Emerald Advance® line of credit, H&R Block Emerald Savings® and H&R Block Emerald Prepaid Mastercard® are offered by MetaBank®, N.A., Member FDIC. Cards issued pursuant to license by Mastercard International Incorporated. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. OBTP# B13696 ©2020 HRB Tax Group, Inc.

Based upon that estimate, you can decide if you want to have all, some, or none of your estimated credit paid in advance directly to your insurance company to lower your monthly premiums. Premium credits are based on a household’s income in the tax year premiums are paid. Yet the credits are calculated the following year, when households file their income tax returns. However, the Treasury usually sends advance payment of premium credits directly to the insurance company, and the household pays a reduced premium. The advance payment of credits is based on estimated income, generally from the last tax return filed before enrollment in health insurance.

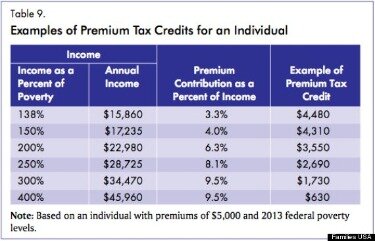

Pay the share of premiums not covered by advance credit payments. If you need help filing your tax return, the Internal Revenue Service lists programs offering free tax preparation assistance here. Please be aware that these changes may allow you to apply for insurance through the Marketplace during its special enrollment period that permits health care plan changes after the original enrollment deadline. Generally, the special enrollment period is open for 60 days from the date of the life event. The Affordable Care Act bases your credit amount on an income scale. Households and individuals with lower incomes get a larger credit, while those with higher incomes receive a smaller credit. Generally, you cannot use the Married Filing Separately filing status and claim the Premium Tax Credit on your tax return.

Tax Tools & Resources

7500 Security Boulevard, Baltimore, MD 21244. Health Insurance Marketplace® is a registered trademark of the Department of Health and Human Services. A federal government website managed and paid for by the U.S. A taxpayer is a victim of spousal abandonment for a taxable year if, taking into account all facts and circumstances, the taxpayer is unable to locate his or her spouse after reasonable diligence. You certify on your return that you are a victim of domestic abuse or spousal abandonment. Debt forgiveness or cancellation, such as the cancellation of credit card debt.

Your life may get a little easier when you apply for TSA PreCheck enrollment. Find out what TSA PreCheck and taxes have in common at H&R Block. To find out if you can claim the credit, you’ll need to look at your household income. If you do qualify, your household income will also determine the amount of credit you can claim.

Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority.

How To Save On Your Monthly Insurance Bill With A Premium Tax Credit

Have household income that falls within a certain range . Are not able to get affordable coverage through an eligible employer-sponsored plan that provides minimum value. The federal poverty guidelines are sometimes referred to as the “federal poverty line” or FPL. The Department of Health & Human Services determines the federal poverty guideline amounts annually. 1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4/1/19 through 4/17/19. 93% of TaxSlayer Pro respondents reported that they continue to use TaxSlayer Pro software after switching.

For example, consider a family of four with income equal to 200 percent of FPL in 2020 who are purchasing an insurance plan costing $15,000. Multiplying family income (here, $51,500) by the applicable 6.49 percent maximum premium results in a family contribution of $3,342 and thus a premium credit of $11,658 ($15,000–$3,342). For the purposes of qualifying for the Premium Tax Credit, it is your Modified Adjusted Gross Income plus the AGI of every other individual in your family who is required to file a tax return. Modified AGI is your AGI plus any excluded foreign, nontaxable Social Security benefits and tax-exempt interest received or accrued during the Tax Year. However, it does not include Supplemental Security income . Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund.

If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. Satisfaction Guaranteed — or you don’t pay.

Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage.

- Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000.

- Higher premiums for smokers are not counted in determining the amount of the second lowest cost silver plan that applies to your family.

- With TaxSlayer Pro, customers wait less than 60 seconds for in season support and enjoy the experience of using software built by tax preparers, for tax preparers.

- HHS.gov A federal government website managed and paid for by the U.S.

- As a result, individuals earning between 100 and 138 percent of poverty can qualify for a premium tax credit in states that do not expand Medicaid, if states don’t already cover those individuals.

- Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. If your estimated income falls between 100% and 400% of the federal poverty level for your household size, you qualify for a premium tax credit. John is 64 years old and has an annual income of $25,520, or 200 percent of the poverty line, which qualifies him for a premium tax credit. His expected contribution is 6.52 percent of his income, or $1,656 a year. Because he is 64 years old, John’s premium could be as much as three times the cost of the premium for someone who is 24 years old.

Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. Fees apply if you have us file a corrected or amended return. If you receive the advance premium tax credit, you’ll need to file a return for the year, even if you don’t meet the threshold to file otherwise. The premium tax credit took effect beginning in the 2014 tax year, and provides tax savings to offset the cost of health insurance, for those who qualify.

For example, someone who received advance payments of the credit for the 2020 calendar year will need to file a tax return and reconcile their APTC for 2020 before the April 2021 deadline. John is eligible for a premium tax credit of $3,344 a year. During the open enrollment period, he chose to purchase the second-lowest cost silver plan , which has an annual cost of $5,000. He decided to take the premium tax credit in advance, which means that the IRS sends a monthly payment of $279 ($3,344 divided by 12) directly to his health insurer. This brings down John’s portion of the health insurance premium from $417 to $138 per month, which he pays the insurer.

How To Claim The Premium Tax Credit

If APTC is made on behalf of you or an individual in your family, and you do not file a tax return, you will not be eligible for APTC to help pay for your Marketplace health insurance coverage in future years. This means that you will be responsible for the full cost of your monthly premiums. For purposes of the premium tax credit, your household income is your modified adjusted gross income plus that of every other member of your family who is required to file a federal income tax return. Modified adjusted gross income is the adjusted gross income on your federal income tax return plus any excluded foreign income, nontaxable Social Security benefits , and tax-exempt interest received or accrued during the taxable year. It does not include Supplemental Security Income .