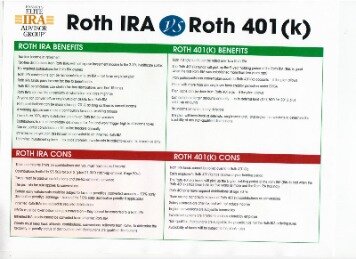

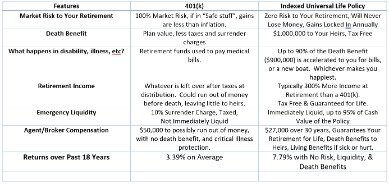

What this means is that taxes are paid upfront, and during retirement, qualified withdrawals are tax-free. The same annual contribution limits of $19,500, or $26,000 for individuals who are 50 or older still apply. These are funded on a post-tax basis, so that contributing to one won’t reduce your taxable income. But the growth is tax-free – as opposed to tax deferred – so that when you make withdrawals once you reach age 59.5, you will owe no taxes on your contributions or earnings.

- When you contribute to a 401 plan at work, you do it on a pretax basis — the money comes out before income taxes and other levies are applied to your pay.

- Changes from year to year in contribution limits, tax advantages, and your financial needs make it prudent to regularly review your plan’s performance and any alternatives that may suit you better.

- Company matches are also a good perk for attracting and retaining talent.

- But over time, you should be re-assessing your asset allocation (e.g., what percent is in equity and what is in fixed income) and rebalancing your assets accordingly.

- 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

- These vary between mutual funds, index funds or exchange-traded funds, all of which have an assorted mixture of stocks, bonds, international market equities, treasuries, and much more.

Previously, the RMD was 70½, but following the passage of the Setting Every Community Up For Retirement Enhancement Act in December 2019, the RMD age is now 72. Unlike a tax-deferred 401, contributions to a Roth 401 have no effect on your taxable income when they are subtracted from your paycheck.

Strategies For Your Roth 401(k)

Another common matching scheme is a dollar-for-dollar employer match, up to a certain percentage of salary. Waiting periods–Some employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law. “They’re not necessarily taking away the benefit but reducing it for higher income savers,” said Jamie Hopkins, director of retirement research at Carson Group.

If you’re wondering about the employerandemployee contribution limits, it increased $1,000 in 2019 to $56,000. However, if you’re considered a highly compensated employee your minimum compensation increased to $125,000 this year. The majority of businesses match half of the employee’s contribution. In other words, for every dollar invested by the employee, the company matches 50 cents.

Some employers require a vesting period for their 401 plans in order to incentivize employees to stay long term. Vesting refers to how much of a 401’s employer contributions are owned by an employee. An employee that is fully-vested has full ownership of the funds in their retirement plan.

Currently, contributions you make to your traditional 401 plan at work are made with pretax dollars. They reduce your taxable income and trim your tax liability. You might prefer making contributions to a Roth 401 if you anticipate being in a higher tax bracket when you retire, or if you prefer the idea of tax-free growth of earnings. That can help make maximizing your contributions to a retirement account a better investment strategy than directing money to a regular brokerage account.

K) Distributions In Retirement

This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions. Meanwhile, higher-income earners who currently enjoy greater tax savings from contributing to a 401 might be more inclined to save in Roth accounts, experts said.

On the other hand, contributions to a 401, both from employees and employers, are always tax deductible because they reduce taxable income, lowering total taxes owed. With this option, you can take withdrawals as needed and not pay the 10% penalty tax that typically applies to people younger than age 59½. You will still pay regular income tax on any amount withdrawn. (If your spouse was over their RMD age, you will be required to continue the required minimum distributions.) The beneficiary designations set up by your spouse would continue to apply at your death.

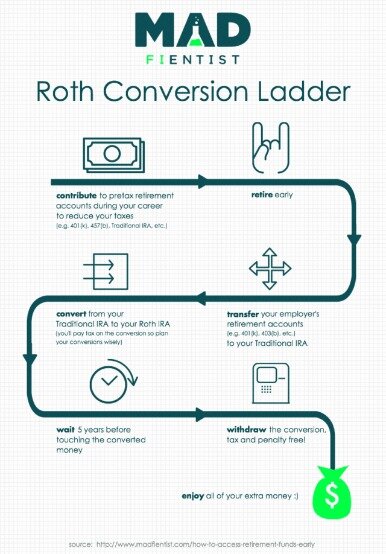

Based on your income and filing status, your contributions to a qualified 401 may lower your tax bill more through the Saver’s Credit, formally called the Retirement Savings Contributions Credit. The IRS lets you begin to withdraw without a penalty at age 59 1/2, and requires you to begin withdrawing by April 1 the year after you turn 72 or after age 70 1/2 if you attained this age prior January 1, 2020. However, required minimum distributions from 401s and IRAs have been suspended for 2020. As a retiree, your income often drops, putting you into a lower tax bracket than you had as an employee. Money you take from a tax-deferred 401 during retirement years therefore, gets taxed at a rate lower than what you pay while fully employed. The 401 plan may require you to take all of the money out of the plan no later than December 31 of the fifth year following the year of the person’s death. You should have the option to do this by leaving the money in the plan or by rolling it over to an account titled as an Inherited IRA.

Some employers offer to match the amount you contribute to your 401 plan. And some even add a profit-sharing feature that contributes a portion of the company’s profits to the pot as well. If your company offers one or both of these features, sign up for them—they essentially represent free money. Among other things, the tax savings you get with a Roth 401 depends on the difference between your tax rate while employed and your future tax rate during retirement. When your retirement tax rate is higher than your tax rate throughout your working years, you benefit tax-wise with a Roth 401 plan. The income tax on $32,900 is $525 less than the tax on your full salary. So, not only do you get savings for retirement, you save on taxes today.

K) Fiduciary Benefits

These contributions are pre-tax, which means they are deducted from your income before your income tax is calculated. Participation in 401s has risen as pensions have become less common.

The ability to withdraw contributions at any time, penalty and tax-free, as well as not having an RMD are two significant advantages of a Roth IRA that are missing in Roth 401s. Stowing savings in a 401 plan is a great way to prepare for your golden years. For one thing, because taxes are deferred until you retire, your earnings will compound – and grow faster than if you had to deduct taxes from the earnings.

For Simple Tax Returns Only

That’s because skipping paying tax on your account contributions allows you to have more capital working on your behalf during the years leading up to retirement. However, chances are you’ll pay less to withdraw funds from the plan in retirement than you did when you made the contributions.

This individual’s paycheck is only reduced by $308.34, even though they contributes $375.00, because they’re paying tax on less income. Actual pre-tax savings might be greater if subject to state or local income taxes. You’ll often discover that the contributions cost you less than you would have expected when you determine the amount you’re able to save in income taxes. Your take-home pay won’t be reduced by the full amount of your contributions. They’re made before withholding is calculated based on what remains after you’ve made them. These pre-tax contributions reduce your taxable income and you pay less tax overall.

You can continue to contribute to these for as long you’re still working. Even better, while you’re working, you’re spared from taking mandatory distributions from the plan provided you own less than 5% of the business that employs you. Some employers even go one better and match your contributions dollar-for-dollar for up to the first 6%, which would add another $2,700 in this scenario, thus doubling your annual contributions to the plan.

From an employers perspective, offering a 401k can give you that extra edge to stand out amongst your competitors. The main benefit of a solo 401 is that, for the most part, they can legally be used to invest in almost anything, which can include real estate, tax liens, precious metals, foreign currency, or even money lending. Keep in mind that there may be limits on types of investments as set by individual plans. The ability to expand investment horizons is one of a SD 401’s main features. The federal penalty for not taking the RMD is a 50% tax on any amount not withdrawn in time. The amount of the required distribution is based on the prior year’s December 31st account balance and an IRS life expectancy chart. Distributions can be received in the form of either a lump sum or in installments.

An individual retirement account is a tax-advantaged account that individuals use to save and invest for retirement. Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals. Roth 410s are also an ideal avenue for high earners who want to invest in a Roth but may have their contributions to a Roth IRA limited by their income. The advantages of contributing pre-tax income to a regular 401 when your earnings are at their peak may diminish as your career is winding down. Indeed, your income and tax rate may actually rise as you get older, as Social Security payments, dividends, and RMDs kick in—especially if you keep working. Many companies offer to match 50% of up to the first 6% you contribute to a 401. If you contribute 6% of your annual earnings ($2,700) to your 401, your employer would contribute an additional 50% of that amount.

Some of those bosses — traditionally the higher-income earners — may lack the incentive to offer those retirement accounts if their tax benefit is slashed, Graff said. Biden has vowed to convert the current deductibility of traditional retirement contributions into matching refundable credits for 401s, IRAs and others. Company match programs and vesting options make them a no-brainer for staff. But did you know that an employer-sponsored 401k does also benefit the employer? If you’ve been thinking about offering retirement benefits to your staff, here are some benefits to consider. SD 401s allow plan participants to borrow from their funds as personal loans for any reason, such as for credit card debt, mortgage payments, investments, or even a vacation.

How Does A 401k Benefit An Employer?

In addition, as part of a 401 plan, employers can choose to match employee contributions, usually up to a certain percentage of the employee’s paycheck. The IRS contribution limit increases along with general cost-of-living due to inflation. The 2019 deferral limit for 401 plans was $19,000, the 2020 and 2021 limit is $19,500.