Content

Comments that include profanity or abusive language will not be posted. The details of the income tax system have changed greatly since 1913. The top rates of tax have varied enormously and were particularly high during the First and Second World Wars and the Great Depression. Individuals and families with very low levels of income do not have to pay income tax and may receive some subsidy via the tax system. Lincoln enacted a three percent federal income tax to any household making over $800 a year, according to the History Channel.

Some were increased, while others were repealed—only to be added again. Let’s explore the origins of some of the more common taxes we face today. The Tax Foundation argues that the Tax Freedom Day calculation does not include capital gains as income because it uses income and tax data directly from the Bureau of Economic Analysis . BEA has never counted capital gains as income since they don’t represent current production available to pay taxes, and so the Tax Foundation excludes them as well.

In America, while Tax Freedom Day presents an “average American” tax burden, it is not a tax burden typical for an American. That is, the tax burdens of most Americans are substantially overstated by Tax Freedom Day.

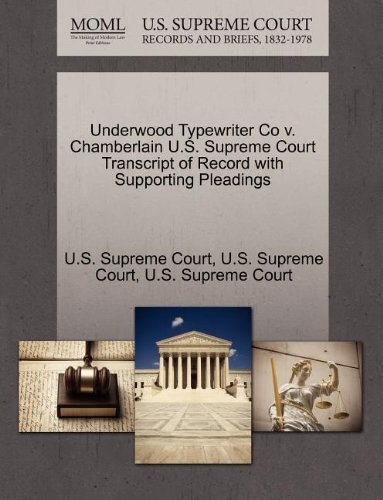

In 1900, Tax Freedom Day arrived January 22, for an effective average total tax rate of 5.9 percent of the nation’s income. Constitution gave Congress the authority to tax all income without regard to the apportionment requirement with a filing deadline of March 1. This was changed to March 15 in 1918 and then to April 14 in 1955. In America, the Federal Income Tax was first instituted as part of the Revenue Act of 1861 to help fund the Civil War. But it was later repealed, re-adopted, and ultimately found unconstitutional in 1895 because it violated the rule that direct taxes be apportioned among the states. However, it differed from today’s Income Tax in that back then, it was based on assessments, not voluntary tax returns.

In 1971, Hostetler retired and transferred the trademark to the Tax Foundation. The Tax Foundation has calculated Tax Freedom Day for the United States ever since, using it as a tool for illustrating the proportion of national income diverted to fund the annual cost of government programs. In 1990, the Tax Foundation began calculating the specific Tax Freedom Day for each individual state. Though the amount raised was important in the short run, it was the expansion in the number of people paying that fundamentally altered U.S. tax structure.

States With No Income Tax

You know the saying—nothing is certain except death and taxes. While that may be true, taxes tend to be more complicated and very inconsistent. In fact, America’s first citizens enjoyed very few taxes. But as time went on, more levies were added—federal income tax, the alternative minimum tax, corporate tax, estate tax, the Federal Insurance Contributions Act , and so on.

If April 15 falls on a Saturday, Sunday or a civil holiday, such as Patriot’s Day, the deadline is extended to the next working day. An extension due to a holiday may only affect certain states. In 2007, the residents of some states were granted an extension due to the disruption to public life in many areas caused by a huge Nor’easter storm. In some years in Washington DC, Emancipation Day may be the reason to extend the deadline for filing an income tax return .

This Amendment gave the United States Congress the legal authority to tax all incomes without regard to the apportionment requirement. The Income Tax remains the primary way that the US Government finances itself. To ensure that all monies due for the prior year are paid, a Tax Day was created. All US taxpayers are required to file taxes based on prior years earnings by this date. Traditionally, this date has been on April 15 of each year. If this day falls on a weekend, the due date is extended to the following Monday.

The filing deadline to submit 2015 tax returns is Monday, April 18, 2016, rather than the traditional April 15 date. Washington, D.C., will celebrate Emancipation Day on that Friday, which pushes the deadline to the following Monday for most of the nation. on the weekday nearest April 16, and under a federal statute enacted decades ago, holidays observed in the District of Columbia have an impact nationwide. If April 15 falls on a Friday then Emancipation Day is celebrated on the same day and tax returns are instead due the following Monday, April 18. When April 15 falls on a Saturday or Sunday then Emancipation Day is celebrated on the following Monday and tax returns are instead due on Tuesday. If the government taxes behavior it wants to discourage, why does it tax gasoline? After all, gas taxes were implemented long before the environmental movement kicked in.

How The Irs Works: Functions & Audits

The Ides of March were no longer financially deadly but April, TIME noted with no hint of irony, is the cruelest month. The president made the decision to tax Americans because of the Civil War— he was having trouble funding the Union’s efforts from the government’s pockets.

- The modern estate tax as we know it was implemented in 1916.

- The date doesn’t fall on Monday, because it is the District of Columbia Emancipation Day, which is regarded as federal holidays when it comes to federal income taxes.

- Some were increased, while others were repealed—only to be added again.

- The case of Pollock v. Farmers’ Loan & Trust Co. challenged the constitutionality of the Wilson–Gorman Tariff Act of 1894, which taxed incomes over $4,000 at the rate of two percent.

- The 16th Amendment was ratified a few years later, on February 3, 1913.

The higher the tax, the more likely Americans are to be discouraged from consuming tobacco and alcohol. But because tobacco and alcohol taxes are flat taxes, they fall disproportionately on the poor. In other words, it is mostly the poor who are discouraged from using tobacco and alcohol, because other income groups can afford to pay the higher taxes. The federal income tax as we know it was officially enacted in 1913, while corporate income taxes were enacted slightly earlier in 1909.

However, this bias is equal to roughly 1/366, which is about 0.27%. In 1954, President Eisenhower asked Congress to reform the Tax Code. Congress added deductions and credits, which made it more complicated. The IRS said the deadline moved to spread out the peak workload.

Other Taxes

The middle class had pitched in before—paying a tax on a purchase was seen as totally normal—but most people had never written a check to Uncle Sam. ax Day–which is April 18 this year, not April 15–is one occasion in which history offers little consolation. As you tally up your withholding and deductions, it may not help to know that you’re also paying into a system created to fund World War II.

TIME’s coverage of that looming date was headlined The Ides of March, 1943. “This week the U.S. citizen faces a hard and stubborn fact of wartime living…” the article began, “the U.S. The filing deadline for individuals was March 1 in 1913 , and was changed to March 15 in 1918 and again to April 15 in 1955. The date of Wednesday April 15, 2020 represents the filing deadline to submit 2019 tax returns. The date doesn’t fall on Monday, because it is the District of Columbia Emancipation Day, which is regarded as federal holidays when it comes to federal income taxes. Congress passed the 16th Amendment creating the income tax on February 3, 1913.

While the Civil War led to the creation of the first income tax in the U.S., the federal income tax as we know it was officially enacted in 1913. No matter what day taxes are due, be sure to drive carefully on the way to the post office. A recently released study shows that, perhaps due to increased stress, there are on average 6% more auto accidents on tax day. This year the saddest of all unofficial holidays is April 17, 2012. The IRS can’t force people to file taxes on a holiday or the weekend. That’s why Tax Day became Monday, April 18 in 2011, because Friday the 15th was technically Emancipation Day.

One, it gave the IRS a month longer to go through the tax returns (imagine the piles of paper before e-filing), and two, it let Uncle Sam hang onto the money a little longer before issuing refunds. Of course, the later date also meant the government had to wait longer to get a check should it be owed money. Interestingly, the previous deadline of March 15 symbolically corresponded with the Ides of March—a date on the Roman calendar that served as a deadline for settling debts.

A survey by the British Chambers of Commerce warned last month that half of UK exporters faced difficulty trading with EU businesses after the end of the Brexit transition period. It found that a quarter of UK exports either planned to reduce their EU exports or would not enter its market in the next 12 months.

The Civil War led to the creation of the country’s first income tax and the first version of the Office of the Commissioner of Internal Revenue—the earlier version of what we now call the Internal Revenue Service . This office took over the responsibility of collecting taxes from individual states. Excise taxes were also added to almost every commodity possible—alcohol, tobacco, gunpowder, tea.

In the United States, income tax returns may be filed on paper or electronically. Now, people are encouraged to file a return via Internet as this is efficient and reduces the risk of mistakes being made or documents being lost in the post. 2020 dateJuly dateApril dateApril dateApril 18 In the United States, Tax Day is a colloquial term for the day on which individual income tax returns are due to be submitted to the federal government. The term may also refer to the same day for individual states, even where the tax return due date is a different day. Tax Day marks the last day to file income taxes in the United States. The history of US Income Tax dates back to the Civil War and the Revenue Act of 1861.

In the United States, it is annually calculated by the Tax Foundation, a Washington, D.C.-based tax research organization. In the U.S., Tax Freedom Day in 2019 is April 16, for a total average effective tax rate of 29% of the nation’s income. The latest that Tax Freedom Day has occurred was May 1 in 2000.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

Many think it is because as the middle class grew, the IRS had to issue more refunds. When April 15th falls on a weekend, Tax Day gets moved to the first business day after the 15th. This year, Emancipation Day falls on Monday the 16th, so Tax Day for 2018 is Tuesday, April 17th. Emancipation Day is celebrated in the District of Columbia on April 16th each year to remember the signing of the Compensated Emancipation Act. Even major tax reforms that followed, like the Reagan-era cuts in the 1980s, didn’t overhaul the foundation.