Content

If you already have a MFT SecureTransport service account, you can use the same account to transmit the 1095 files provided the filename starts with NJHIM. New Jersey will accept returns submitted in bulk filing by users of MFT . Files must be under 12 MB in size and may be split into multiple files.

Ace sends Tim a Form 1095-B on January 31, 2021, reporting coverage for every month in 2020. On February 1, 2021, Ace cancels Tim’s coverage effective November 1, 2020. Ace must send Tim a corrected Form 1095-B reporting that Tim was covered only for January through October 2020. If Ace filed the Form 1095-B with the IRS, it must file a corrected Form 1095-B with the IRS reporting coverage only for January through October 2020.

No penalty will be imposed for reporting incorrect or incomplete information on the return or statement if you can show that you made good-faith efforts to comply with the information reporting requirements. Special rules apply that increase the per-return and per-statement and total penalties with no maximum limitations if there is intentional disregard of the requirement to file the returns and furnish recipient statements. You must file a corrected return to report retroactive changes in coverage.

However, the tax reform bill passes in December of 2017 removes the penalty for not having insurance beginning in 2019. Understand that an employer will share liability if its multi-employer plan does not file the required 1095 forms on time. Employers must send 1095 forms to New Jersey if insurers do not meet their requirements.

Additional state programs extra. Emerald Cash Rewards™ are credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Get your taxes done by a tax pro in an office, via video chat or by phone. Or do your own with expert, on-demand help.

If you are an out-of-State employer who provides health coverage, transmit to us any required 1095 document for each New Jersey resident you employ. Insurers, government agencies, exchanges, multiemployer plans, and all others responsible for reporting Minimum Essential Coverage on behalf of New Jersey residents also must file the required information with the State. For returns required to be made and statements required to be furnished for 2020 tax year returns, the following apply. The “responsible individual” is the person who, based on a relationship to the covered individuals, the primary name on the coverage, or some other circumstances, should receive the statement.

See section 6724 and Regulations section 301. and Proposed Regulations section 1.6055-1.

ACA 1095 State Reporting – Many states are beginning to require state reporting, in addition to federal IRS reporting, of the ACA 1095 tax forms. eFileMyForms has you covered!

When people get health coverage through a job, the employer is the sponsor. Market Preservation Act is a continuation of the ACA provision, requiring every New Jersey resident to obtain health insurance or make a Shared Responsibility Payment. If you are required to submit a correction file to the IRS, New Jersey will also require you to submit the correction file. Size limits for MFT filings are at 12 MB for both initial filings and corrections.

In April 2021, Sharon is approved for Medicaid coverage beginning on November 1, 2020. The Medicaid agency must file a corrected Form 1095-B with the IRS and furnish Sharon a corrected statement reporting coverage for January through September and November through December 2020. You will meet the requirement to file if the form is properly addressed and mailed on or before the due date.

Not Sure How You Want To Get Started With A Tax Pro? No Problem, We’ll Help

Providers of these and later designated programs will file Form 1095-B. The sponsor for the Basic Health Program is the state government agency administering the program. Coverage of pregnancy-related services that consists of full Medicaid benefits.

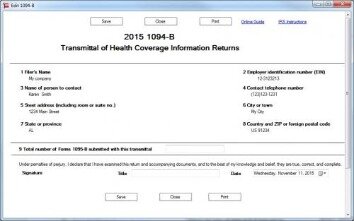

Form 1094-B is the transmittal form that accompanies Form 1095-B when filing with the IRS each year. Small employers who sponsor self-insured group health plans and other providers of health insurance coverage must use Forms 1094-B and Form 1095-B to report information about covered employees and individuals. Single-Company, Not an Applicable Large Employer (Non-ALE). Non-ALEs generally are companies that employed an average of fewer than 50 full-time equivalent employees on business days during the preceding calendar year. Health coverage provider files a 1095-B or NJ-1095 for each covered member of the plan. If the insurer does not meet its obligation to file, the employer must send 1095 forms. The 1094-B and 1095-B is also for self-insured plans but for small groups not subject to the employer shared responsibility provisions.

Additional fees may apply from WGU. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Fees apply when making cash payments through MoneyGram® or 7-11®. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings® account. The Rapid Reload logo is a trademark owned by Wal-Mart Stores.

Irs Form 1094

For information about filing corrections for electronically filed forms, see section 7.1 of Pub. A corrected return should be filed as soon as possible after an error is discovered. File corrected returns as follows. 5223, General Rules and Specifications for Affordable Care Act Substitute Forms 1095-A, 1094-B, 1095-B, 1094-C, and 1095-C, for specifications for private printing of substitute information returns. You may not request special consideration. Only forms that conform to the official form and the specifications in Pub. 5223 are acceptable for filing with the IRS.

- An additional fee applies for online.

- If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied.

- The student will be required to return all course materials, which may be non-refundable.

- A sponsor is whoever arranges the health coverage.

- These types of coverage are reported by the government sponsors of those programs.

- Approval review usually takes 3 to 5 minutes but can take up to one hour.

Power of Attorney required. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Terms and conditions apply.

Get More From Healthcare Exchange

Coverage providers and employers who file more than forms can send files containing data pertaining only to part-year and full-year residents of New Jersey. However, the Division of Taxation also will accept files that include data about individuals who are not residents of New Jersey. Filers who provide information on non-residents of New Jersey should consult privacy and other laws pertaining to residents of other States before sending any sensitive or personal data about non-residents to New Jersey. New Jersey will accept the NJ-1095 form from any filer. The State also will accept filings of federal 1095-C forms, Employer-Provided Health Insurance Offer and Coverage, if Parts I and III are completed or the form is fully completed. Filers of fully completed Form 1095-B. Health Coverage, also can use that form for New Jersey filings.

May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period.

Do not count the continuation sheet as additional Forms 1095-B in the count of forms submitted with the accompanying Form 1094-B. Enter your name, EIN, and complete mailing address. The provider of the coverage is the issuer or carrier of insured coverage, sponsor of a self-insured employer plan, government agency providing government-sponsored coverage, or other coverage sponsor. Enter on line 18 the telephone number that an individual seeking additional information may call to speak to a person. The formatting directions in these instructions are for the preparation of paper returns. When filing forms electronically, the formatting set forth in the XML Schemas and Business Rules published on IRS.gov must be followed rather than the formatting directions in these instructions.

Guide To Prepare Form 1094

Filers will use Form 1094-B to submit Forms 1095-B . Since it’s the IRS’s responsibility to enforce this part of the health law, the tax agency needed a way of telling who does and doesn’t have coverage. That’s where forms 1094-B and 1095-B come in.

As noted earlier, minimum essential coverage doesn’t include coverage consisting solely of excepted benefits. Excepted benefits include vision and dental coverage not part of a comprehensive health insurance plan, workers’ compensation coverage, and coverage limited to a specified disease or illness. Every person that provides minimum essential coverage to an individual during a calendar year must file an information return reporting the coverage.

File With A Tax Pro We Do The Work.

Take advantage of expert tax services in an office or virtually. Start one way, finish another. You’ll always get your max refund. It is recommended that employers advise employees to provide a copy of any Form 1095 containing coverage information to their children residing in New Jersey. Contact their insurer or multi-employer plan to discuss New Jersey’s 1095 filing requirements well in advance of filing deadlines. A 1095 form also must be sent to each primary enrollee.

E-file your Forms before the deadline to avoid late filing penalties. New Jersey will also accept with a pipe delimited flat text format through Axway. You must follow the pipe delimited flat text format schema or your submission will be rejected. Subscribe today to stay up-to-date on the latest healthcare reform news, tools and resources. Just register on the admission portal and during registration you will get an option for the entrance based course. There is no separate form for DU CIC. How do I fill out the form of DU CIC?

Each participating employer for a plan or arrangement maintained by a Multiple Employer Welfare Arrangement. For additional information relating to reporting by Providers of Minimum Essential Coverage, go to IRS.gov/Affordable-Care-Act/Employers/Information-Reporting-by-Providers-of-Minimum-Essential-Coverage. A new code G must be entered on Form 1095-B, line 8 to identify an individual coverage HRA. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Western Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit.

If you’re filing on paper, send the forms to the IRS in a flat mailing and don’t staple or paperclip the forms together. If you’re sending many forms, you may send them in conveniently sized packages. On each package, write your name, and number the packages consecutively. Place Form 1094-B in package number one and a copy of Form 1094-B in each additional package. Postal regulations require forms and packages to be sent by first-class mail. Returns filed with the IRS must be printed in landscape format. Generally, the return and transmittal form must be filed with the IRS on or before February 28 if filing on paper of the year following the calendar year of coverage.

See – ACA 1095 State Reporting Service. Usually, when a company provides health insurance to its employees, it does so through a group insurance policy. The employer and employees pay premiums to the insurance company, and the insurer pays the workers’ medical bills (minus deductibles, co-pays and other out-of-pocket expenses). Providers that fail to comply with the filing requirements may be subject to penalties. The penalty for failure to file information returns is $250 for each missing return, with a maximum penalty of $3 million. Special rules apply that increase the total penalties if there is an intentional disregard of filing requirements.