Content

Those who are 50 years old and above can add $6,000 to their basic workplace retirement plan. Even those who don’t have a retirement plan at work can get a tax shelter if they contribute up to $6,000 ($7,000 for those who are 50 years old and above) to a traditional individual retirement account . Similar to a 401 plan, a tax sheltered annuity plan is a retirement plan offered by public schools and charities. Also referred to as the 403 plan, a tax sheltered annuity plan allows employees to defer a portion of their salaries into individual accounts. Apart from your primary job as a physician, side hustles offer a lot of advantageous tax shelter strategies. There are many business expenses which can be deducted from your income tax bill, such as health insurance premiums. As per IRS guidelines, a business owner can deduct a portion of their home expenses with the home office deduction.

Take note that your high W-2 income is also a financial strength which makes you eligible to be an accredited investor. Every dollar you save from liabilities like expenses and taxes is another dollar added to your investment capital. This will put you in the right path for wealth generation and financial freedom. A tax shelter is a vehicle used by individuals or organizations to minimize or decrease their taxable incomes and, therefore, tax liabilities.

Tax Haven Vs Tax Shelters: Is There A Difference?

The Tax Shelter is a full-service accounting firm dedicated to providing our clients with professional, personalized services and guidance in a wide range of financial and business needs. Ownership structures should be examined carefully to determine if an entity would be considered a tax shelter under Sec. 448 and if measures can be taken to avoid being tainted by that status. test if its average annual gross receipts for the previous three tax years does not exceed $25 million. For example, the federal tax law prohibits you from assigning income you earn to another taxpayer who is subject to lower tax rates. If you earn $200,000 during the year as an independent contractor, you are responsible for paying all of the income tax on it. This doctrine looks for transactions where the economic activities giving rise to the tax benefits do not occur. A clear example of this doctrine is seen in Knetsch v. United States, 364 U.S. 361.

Interest earned from these government certificates of debt is usually free from federal income tax. Earnings from the sale of municipal bonds are subject to capital gains taxes. In most common situations, income from real estate rental is an example of passive income. There is a special break, however, allowing a passive loss from rental real estate to be deducted from non-passive income, such as wages. This passive loss deduction is limited to $25,000, but is reduced by 50% of the amount of the taxpayer’s adjusted gross income that exceeds $100,000.

However, there is value in knowing when a business is changing from the cash to the accrual method and having a year in which to plan for the change. A business would be able to decide which tax year the Sec. 481 adjustment is included in taxable income, choosing to recognize the adjustment in the tax year most advantageous to the business. This definition of tax shelter can pose certain problems, as the rule does not allow or account for large deductions or losses during a tax year. For example, large Sec. 481 adjustments (a common adjustment related to implementing the recent qualified improvement property technical correction change) might create a loss causing the entity to be a tax shelter for the year. The taxpayer is also then locked into the accrual method and cannot change back to the cash method for five years, which is generally unfavorable, unless requested using an advance consent accounting method change. We handle income taxes of all levels – individual, federal, state and business.

Individual Retirement Accounts (iras)

You are eligible for this tax exemption for as long as your investment is able to produce or refine less than 50,000 oil barrels per day. Investments which include more than 1,000 oil barrels per day, or 6 million cubic feet of gas per day, are excluded.

- As per IRS guidelines, a business owner can deduct a portion of their home expenses with the home office deduction.

- For example, the IRS permits charitable donations to be tax deductible for up to 50% of an individual’s adjusted gross income .

- For example, the federal tax law prohibits you from assigning income you earn to another taxpayer who is subject to lower tax rates.

- To understand the key differences between long-term and short-term capital gains is crucial to developing the most favorable tax shelter outcome.

- Tax shelters are generally beneficial if considered from the individual or firm perspective.

- In addition, in 1986, use of the LLC entity was rare, as most states did not even have LLC laws.

The Tax Shelter offers full service accounting and bookkeeping for businesses of any size. Let us handle your finances, so that you can focus on growing your business. That’s why the accountants at The Tax Shelter take an individualized approach with each client.

That is because the erosion of the tax base may be an acceptable loss for largely beneficial tax shelters . Of course, some tax shelters have little to no social benefits or are even harmful. Tax avoidance is the use of legal methods to reduce the amount of income tax that an individual or business owes. An abusive tax shelter is an illegal investment scheme that claims to reduce income tax without changing the value of the user’s income or assets.

For extra wealthy, seasoned investors, oil and gas investments tax deductions stand out as a vehicle that is great at growing wealth. Increased interest on domestic energy production here in the US has paved the way for numerous tax shelters and investment opportunities, and oil is definitely part of the lucky roster.

You can then read their profiles to learn more about them, interview them on the phone or in person and choose who to work with in the future. This allows you to find a good fit while the program does much of the hard work for you. A 401 and traditional IRA aren’t the only retirement accounts that offer shelter from tax liability.

While tax shelters provide a way to legally avoid taxes, they can also be used to evade taxes. Tax minimization is a perfectly legal way to minimize taxable income and lower taxes payable. Do not confuse this with tax evasion, the illegal avoidance of taxes through misrepresentation or similar means.

The Advantage Of Tax Credits

Similar to the substance doctrine, the step transaction doctrine treats a series of formally separate steps as a single transaction to determine what really was going on with the transaction. By paying unreasonably high interest rates to a related party, one may severely reduce the income of an investment , but create a massive capital gain when one withdraws the investment. The tax benefit derives from the fact that capital gains are taxed at a lower rate than the normal investment income such as interest or dividend. Repurchasing the same security within 30 days of its sale is called a wash sale and eliminates any tax deductions from the security’s capital loss. Another strategy investors use to shelter themselves from taxes is tax swapping.

However, under the accrual method, all or most of the expenses may be deductible under the rules of Sec. 461. To change from cash to accrual, the tax shelter uses the automatic change procedures of Rev. Proc. For this purpose, gains or losses from the sale of capital assets or Sec. 1221 assets are not taken into account. The popular 529 college savings plan is both a tax shelter and a way to save for your children’s education. States and educational institutions sponsor 529 plans, allowing parents to save for future higher education costs. Earnings from those savings are not subject to federal income taxes if they are eventually used for qualified educational expenses.

Client Services

Some tax shelters that are provided in the form of tax deductions include deduction of charitable contributions, student loan interest deduction, mortgage interest deduction, deduction for certain medical expenses, etc. Qualified retirement accounts, certain insurance products, partnerships, municipal bonds, and real estate investments are all examples of potential tax shelters. Actual tax shelter investments sometimes require a large investment with a degree of risk. The goal of many shelters is to create offsetting losses to other taxable income. Any excess intangible drilling costs incurred are also part of oil and gas investment tax deductions. This is considered a “preference item” on the Alternative Minimum Tax Return. This was established to ensure that tax payers would pay a minimum amount of taxes by recalculating the income tax they owe, adding back the “preferred item” or tax deduction.

Second, the investor buys a similar security, which the investor believes to be a better investment, to replace it. By swapping securities, the investor offsets his or her portfolio gains with a loss while leaving the portfolio essentially unchanged. A portion of the premium payments is invested by the insurance company and builds the policy’s cash value tax-deferred. This cash value can later be converted into a taxable withdrawal or borrowed, without tax consequence. By legally reducing your tax liability, you have more capital available for spending or investing.

As of 2019, a low-income tax payer may be able to receive up to $529 in credits. Taxpayers with three or more children may be eligible for up to $6,557 in credits. Over time, it becomes increasingly hard and costly to extract oil from an area because pressure from within the well decreases. Even though production declines, there is almost always oil to be extracted and this is why the government encourages different methods of extraction.

To learn more about the different oil and gas investment methods, you can refer here. In any case most of your time is devoted to clinical services, you may have your spouse (non-working or part-time working) declare themselves as the real estate professional.

What Are Tax Shelters?

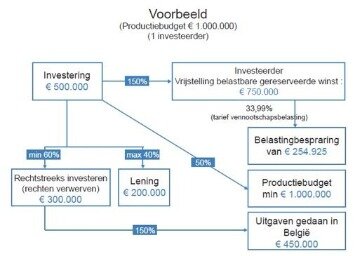

The proposed regulations allow for a permanent election to determine any year’s tax shelter status based on allocations of the prior year, which provides some limited relief. However, this election to use last year’s information only delays the impact by a year. That is, the next year an affected entity would no longer be allowed to use any of the simplified methods for small businesses. Treasury regulations require that certain tax shelters and transactions be registered and that lists of investors be maintained by parties who organize or sell interests in the shelter.