Content

There is no limit on itemized deductions since the Tax Cuts and Jobs Act. According to the IRS, a charitable contribution is a voluntary gift made to a qualified organization, without anything of value expected in return.

TaxSlayer Classic supportrs all major forms and can import your W-2. Information in the many web pages that are linked to TaxSlayer’s Website comes from a variety of sources. Some of this information comes from official TaxSlayer licensees, but much of it comes from unofficial or unaffiliated organizations and individuals, both internal and external to TaxSlayer. TaxSlayer does not author, edit, or monitor these unofficial pages or links. TaxSlayer will not intentionally monitor or disclose any private electronic-mail message unless required by law. TaxSlayer reserves the right to refuse to post or to remove any information or materials, in whole or in part, that, in its sole discretion, are unacceptable, undesirable, inappropriate or in violation of these Terms of Service. You may not download and/or save a copy of any of the screens except as otherwise provided in these Terms of Service, for any purpose.

- Available to all U.S. residents and resident aliens with an AGI $69,000 or less and age 51 or younger.

- TaxSlayer does not author, edit, or monitor these unofficial pages or links.

- Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

- By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

- David Kindness is an accounting, tax and finance expert.

To qualify for the guarantee, the larger refund or smaller tax due cannot be attributed to variations in data you provided TaxSlayer.com for tax preparation, or for positions taken by you or your preparer that are contrary to the law. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.com. Click here to learn how to notify TaxSlayer if you feel like you are entitled to a refund. All prices here, and on all outward facing TaxSlayer.com sites, are subject to change at any time without notice. Price is determined at the time of print and/or e-file.

TurboTax ItsDeductible is easy to navigate, with intuitive links and drop-down selection lists. The service does not support uploading digital images as evidence of non-cash donations, however. Therefore, you may want to save photos like these on your own to prove the condition of the goods.

Over 10 Million Federal And State Returns Filed This Year

You can save up to $100 when you file with TaxSlayer! You get all forms, all credits, and all deductions for less than The Other Guys. Plus, you can deduct the cost of your TaxSlayer products and services from your federal tax refund and pay nothing out of pocket. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic.

When you have items cluttering up your home that you no longer want or need, it only makes sense to give them to charity. Someone out there can surely use them and the Internal Revenue Service is willing to give you a tax break for your generosity. Most of us are familiar with the idea of donating something to a charity and “writing it off.” But there is often some confusion about exactly what this means. Some believe that you can deduct contributions to any organization you want. Others insist that you can deduct the value of time spent volunteering.

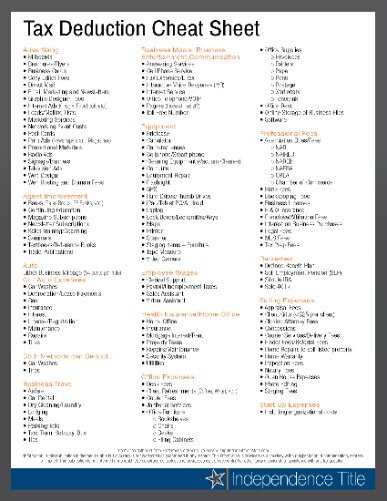

How To Maximize Your Itemized Tax Deductions

Qualified appraisals are required or suggested for other non-cash contributions as well. Donated artwork valued at $20,000 or more, for instance, requires that a signed appraisal be attached to your tax return. When it comes to making charitable contributions – and getting the deductions you are entitled to – documentation is everything.

So, after adding up your itemized deductions, make sure your itemized deductions total is greater than the standard deduction amount for your filing status. If it’s not, then you’ll most likely pay more in tax if you itemize. For years prior to 2018, itemized deductions also include miscellaneous deductions such as work-related travel and union dues. Beginning in 2018, these types of expenses are no longer deductible for federal tax, however some states still allow these deductions.

When You File With Us, You Get:

Finally, a copy of completed Form/s 8283 should be forwarded to the Merchandise Analyst. Properly documenting the taxes you’ve already paid can keep you from overpaying. For example, if you have been delaying certain medical treatments, you’ll get more mileage out of your deductions if you spend that money in a year when you’re already over the medical deduction threshold. If you have medical expenses every year that equal 7% of your AGI, you’ll never get to itemize those deductions. You can deduct up to $300 of charitable donations as an adjustment to income on the 2020 Form 1040 Line 10b. Save tax deduction-related digital images and receipts on a drive and store it with your yearly tax documents along with reports printed from ItsDeductible.

They cover the terms and conditions that apply to your use of this website (the “Website,” or “Site”). (“TaxSlayer”) may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service. Enter your income and we’ll guide you through the rest of your return to maximize your refund.

A member of the management staff must verify that the donation receipts match the completed form and fill in the date of donation/s in this section. In addition, Goodwill’s name (Goodwill Retail Services, Inc.), store address and identification number ( ) must be completed. Management staff must also provide their signature, title, and the signature date.

Free Fed & State, Plus Free Expert Review

You’re able to itemize your deductions if your itemized deductions, such as deductions for home mortgage interest and property taxes, are more than the standard deduction. Any contribution of $250 or more requires that you get a “contemporaneous written acknowledgement” – in other words, a receipt – from the charity you donated to.

And if you need more help, we have you covered from Ask a Tax Pro to Audit Defense. We make switching easy — we’ll autofill your income, wages, and more when you upload a prior year return and import your W-2. You can file confidently with our always up-to-date calculations and 100% accuracy guarantee.

However, it requires you to complete and file a Schedule A with your tax return and to maintain records of all your expenses. Many of your everyday expenses can be itemized as deductions on your income tax return, saving you lots of money at tax time. However, unless you have a large amount of qualifying expenses, you might be better off taking the standard deduction, as most taxpayers do. Since you can decide every year whether you want to take the standard deduction or not, careful tax planning can help you maximize your deductions in years you itemize.

People who need advanced tax software, which can run $100 or more elsewhere, can especially benefit from the price difference, particularly when adding a state return. We’ll guide you through the entire filing process to help you file quickly and maximize your refund. Everyone gets free, unlimited phone and email support.

At tax time, you may be looking for help deducting your charitable contributions on your tax return in order to lower your taxable income and reduce your tax bill. TurboTax, a brand of tax preparation software, offers a tool called ItsDeductible that estimates the value of your noncash donations for you. You agree not to hold TaxSlayer liable for any loss or damage of any sort incurred as a result of any such dealings with any merchant or information or service provider through the Site. You agree that all information you provide any merchant or information or service provider through the Site for purposes of making purchases will be accurate, complete and current.

The merchants and information and service providers offering merchandise, information and services through the Site set their own prices and may change prices or institute new prices at any time. You agree to pay all charges incurred by users of your account and credit card or other payment mechanism at the prices in effect when such charges are incurred. You also will be responsible for paying any applicable taxes relating to purchases through the Site. If you’re looking for a cost-friendly online tax filing software, TaxSlayer doesn’t disappoint. It’s possible to file both your state and federal return for free and the paid versions are priced lower than some of TaxSlayer’s main competitors. In fact, TaxSlayer offers highly affordable pricing for filers with basic and more complicated returns. Keep in mind that you must itemize your deductions to claim your charitable gifts and contributions.

A professional support agent will assist you in finding a solution to your question. We will automatically transfer information from your federal tax return to your state tax return. Double-check your entries to be sure you entered all of your information correctly. This ensures your return is processed by the IRS and state without delay. We stand behind our always up-to-date calculations and guarantee 100% accuracy, or we will reimburse you any federal or state penalties and interest charges.

Published prices are meant only as a guide and are not a guarantee. are available in Spanish and English, year round and can even review, sign, and file your tax return. For tax year 2020, the standard deduction increased to $12,400 for single filers and $24,800 for married filing jointly. If you file as head of household, your standard deduction is increased to $18,650. If your itemized deductions are more than the standard deduction, you will benefit from claiming itemized deductions and will be able to deduct cash and non-cash contributions.

You’ll most likely need the help of a tax professional if you’re going to be this generous. As a general rule, you can multiply these numbers by 3.5 or 4 to get a rough idea of the best deduction you might claim if an item is practically brand new or at least looks like it.