Content

However, in general, most states follow the deadline to file a Federal Tax Return Extension. Find out how to file a State Tax Extension for a particular state. Even if you do not have the money to pay the taxes you owe, you should e-file a Tax Extension or Tax Return. The potential IRS fees and penaltiesfor not e-filing anything are going to be larger than on the taxes owed.

- This question calls attention to a key distinction about what a tax extension is — and what it is not.

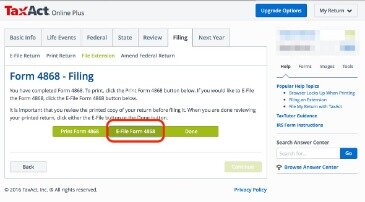

- You can file Form 4868 quickly and easily online.

- Students will need to contact WGU to request matriculation of credit.

- We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you.

- Filing for a tax extension can be done either electronically or by using a paper form.

Additional state programs are extra. Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. Learn more about tax extension deadlines for 2020 because of the Coronavirus, with help from experts at H&R Block.

Do You Owe On Taxes?

Converting a traditional IRA to a Roth IRA could yield tax benefits that you’d like to apply to your taxes, but you may need more time to accomplish the conversion. You might think you need a really, really good reason to convince the IRS to let you postpone filing your tax return for six months. You may apply for anInstallment Payment Planif you cannot afford to pay any remaining balance in one lump sum. A short-term payment plan is free to set-up; long-term plans carry a $31 set-up fee.

How do I update or delete my online account? If you pay less than 90% of the tax you owe, you’ll end up owing a penalty of 0.5% of the underpayment every month until you pay the remaining balance. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties. If you don’t think you’ll be able to get your taxes together in time, talk with one of our tax ELPs. We’ve vetted some of the top tax pros in the country and can recommend the best ones near you. They have years of experience and, believe it or not, they love this stuff. They can help you get your taxes together after you file an extension.

If You Don’t Want To File Online

See the penalties of Not Filing Versus Not Paying Taxes with the IRS Penalty Estimator. You do have to pay any taxes that are owed to the IRS by the federal due date, or you will owe interest on any tax that is unpaid. An extension does not provide more time to pay your tax bill just file your return.

Therefore, pay as much or as little as you can, but do e-file a Tax Extension or Return. The IRS will most likely add penalties and/or interest to the late payments. Learn about your tax payment options. If you do not have enough tax information, or all your tax records, to start and efile a Tax Return by Tax Day – in 2021, it is April 15, you should efile an IRS extension by that date. You can estimate your Tax Liability with the Free Tax Calculator. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund.

Company Information

Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable.

Plus, when you are ready to file your tax return, we already have the information from your extension which should make filing your return as seamless as possible. Your state may have different rules and due dates for extended state income tax returns. So, be sure to check with your state’s tax agency to see how return filing and payment extensions work where you live. IRS Form 4868 is an official request to the Internal Revenue Service for an extension of time to file your tax return. You don’t need to file Form 4868 if you make a payment using one of the electronic payment options. The IRS will automatically process an extension of time to file when you pay part or all of your estimated income tax (1040-ES) electronically. For your 2020 return, that means you may have until June 15, 2021, to file your tax return.

To estimate the tax you must pay, you might want to use an estimated tax calculation. Tax season is the time period between Jan. 1 and April 15 of each year when taxpayers usually prepare financial reports for the previous year. There are also some tax-software companies that offer free filing under certain conditions. Of course, there’s also a deadline for that, but the good news is that getting an extension is easier than you might think. Even though you don’t have to justify yourself to the IRS, there are still good reasons for filing for an extension and not-so-good ones.

You still need to pay what you owe by April 15, even if you file for an extension. If you underestimate what you owe, you may end up paying interest on what you don’t pay by the deadline. If you pay less than 90 percent of the tax you owe, you’ll be charged a penalty of 0.5 percent of the underpayment every month until you pay the balance. But if you’re missing key documents, dealing with an unexpected life event or simply running out of time to get your taxes done by the deadline, you can file for a six-month extension.

Then once you’ve created your account, send your tax pro a secure message to request the extension. Simply connect with them to determine if an extension is necessary.

You can also download the completed form and save a copy. Some victims of natural disasters and certain military members serving in combat zones also qualify for automatic extensions, but these are based on more complicated rules.

If you need more time to file your 2020 Tax Return beyond June 15 , you can prepare and e-file extension Form 4868 on eFile.com by April 15, 2021. After April 15, you will need to prepare and file the form on paper . Make sure that you sign the form and check off the box indicating that you were out of the country on Tax Day before you mail it to the IRS. Be aware that any owed taxes, penalties, and interest will apply after April 15. Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify.

Find out how to file an extension when you’re living abroad from our Expat Tax Services team. If you don’t pay the full amount you owe, the IRS will charge you interest on the unpaid balance until you pay the full amount. Small Business Small business tax prep File yourself or with a small business certified tax professional. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Taxpayers affected by natural disasters may have extra time. For more details, check thedisaster relief pageon the IRS website.

Individual tax filers may also request an extension via theIRS’ E-File service. If you e-filed a 2020 Tax Extension on eFile.com, but the IRS rejected it, we recommend that you just get started on your 2020 Tax Return. There is no penalty for filing late if you are getting a Tax Refund. If you owe taxes, you should eFile your Tax Return now to avoid the worst penalties even if you can’t pay your taxes right now. The requirements for filing a State Tax Extension vary from state to state. They mostly relate to Tax Extension filing deadlines, tax payment rules, or certain Tax Extension forms to fill out (or not, in some states’ cases).

To get an extension without the form, you can pay all of your estimated income taxes online. You’ll get an automatic extension just by paying, but you do have to fill out your return eventually. Failure to file your income tax return when it is due can be a costly mistake. It includes a fine of up to 5% of your liability, per month.

Because your extension was rejected, the tax payment you set up did not go through. As soon as possible, you should make a payment to avoid IRS penalties.You can mail a payment with your Tax Extension. Are there penalties if I expect a Tax Refund but do not file on time? No, there is no tax penalty for failure to eFile a Tax Return or Tax Extension if you expect a Federal or State Tax Refund. However, by waiting too long to eFile you can lose your refund. Please be aware that your return must be filed/e-filed within three years of the original due date. We recommend that you file your Tax Return as soon as possible and pay as much as you can to avoid further late filing and/or payment penalties.

You should file your Tax Return by the time it is due, regardless of whether or not a full payment can be made with the return. Depending on your circumstances, you may qualify for an IRS payment plan. “Filing a Tax Extension postpones my tax deadline and my tax payments without IRS penalties.”

Any overage you pay will be refunded to you once you file your tax return. Keep in mind that late-filing penalties are typically more than the late-payment penalty. Now that you know how to file a tax extension, you can avoid the penalty for filing late. Learn about filing state taxes for freePaid with your extension?