Content

Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Due to tax law changes, we know it can be difficult to estimate your refund or balance due.

Since then, families in most states have been able to set aside savings for higher education and withdraw the proceeds tax-free, when the time comes, as long as they’re spent on qualified expenses. Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment.

Financial Recovery Guide And Resources

Fortunately, states allowing 529 plans have the latitude to tailor the rules governing the use of their funds—and have done so in the past. In states where income tax rules automatically conform to federal changes, lawmakers can “decouple” from the new federal provision by disallowing deductions for income withdrawn from 529 plans to pay for private K-12 education. Lawmakers in almost every state already are working up a to-do list of provisions in the new tax bill that add fresh uncertainty to their budgetary process for 2018—and those allowing 529 plans should add this one to the list. Taxpayers are still learning about the intended and unintended consequences of the major tax overhaul that Republican leaders ramrodded through late last year. One little-noted provision subverts state laws that prohibit the use of public dollars for private schools by allowing taxpayers to use 529 plans to pay for K-12 tuition.

- But if you’re scratching your head because you’re sure that you saw something about private school tuition in the tax reform bill, you’re not wrong.

- This isn’t exactly a tax break for paying tuition, but it’s a tax break all the same.

- “If you are eligible to contribute to a Roth IRA when a child is born and you invest $5,000 for 15 years, you would be able to take out $75,000 tax and penalty free when they enter high school,” she added.

- Grade school and high school tuition and expenses don’t usually count.

- Fortunately, there are many ways to manage the cost of private school tuition.

If your children are young, you could consider opening an educational savings account . ESAs grow tax-free, and you can use them to pay for elementary and secondary education expenses. If you are an employee and can itemize your deductions, you may be able to claim a deduction for the expenses you pay for your work-related education. Your deduction will be the amount by which your qualifying work-related education expenses plus other job and certain miscellaneous expenses is greater than 2% of your adjusted gross income.

How To Pay For An Unexpected Tax Bill

Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations.

H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit.

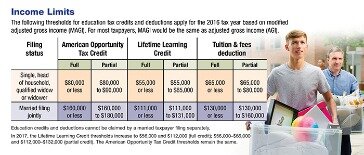

This is a great savings for parents with more than one child in college. The credit is 100 percent of the first $2,000 of qualified education expenses paid for each eligible student, and 25 percent of the next $2,000 of qualified education expenses paid for each student.

Both private and public post-secondary educations come with some generous tax breaks for your family to help make education more affordable. The law provides that only “kindergarten” is eligible for the subtraction.

A couple who decides to withdraw $10,000 annually from their 529 plan to cover K-12 tuition expenses will begin to drain the money needed for college costs. And taking large amounts out of the account each year will also limit the parents’ ability to benefit from tax-free growth inside the 529 plan. Recent tax reform has opened up a whole new way for millions of American families to pay their child’s tuition from kindergarten through 12th grade at private schools, including religious schools. Now, more than 20 years after Congress authorized these top-heavy tax breaks, lawmakers have added a new twist that will use the tax code to subsidize private K-12 education for children in the best-off families.

Tax Deductions And Tax Breaks For Private Schools

This deduction can reduce the amount of your income subject to tax by up to $2,500. If you’re eligible to claim the lifetime learning credit and are also eligible to claim the American opportunity credit for the same student in the same year, you can choose to claim either credit, but not both.

Consult an attorney for legal advice. Description of benefits and details at hrblock.com/guarantees.

New Irs Rule: Tax Deduction For Special Education Tuition

He previously worked for the IRS and holds an enrolled agent certification. • Many states also offer in-state taxpayers incentives, in the form of credits or deductions, for contributing to a 529 account.

Additional personal state programs extra. One state program can be downloaded at no additional cost from within the program. State e-file available within the program.

This page includes all the information available on this and other new benefits of 529 plans as of August 1, 2020, and will be updated regularly as additional details become available. The issue isn’t what schools children must attend. It is whether government should provide a 100-percent subsidy to the individuals and businesses that choose to make contributions to private schools. And by that standard, Trump’s plan gets a failing grade for both tax and education policy. Even if taxpayers are not contributing to their own child’s K-12 schooling, the bill would create an extraordinarily generous subsidy for individuals or businesses that donate to private schools, including religious schools. In effect, this credit allows taxpayers to direct federal funds to the private or religious schools they prefer.

Just like that, Taxgirl® was born. You can deduct private K-12 tuition for children with special needs if such schooling is medically or therapeutically required. This would include community colleges, universities, trade or vocational schools, and pretty much any other accredited post-secondary education program. However, educational expenses are tax-deductible at the federal level for post-secondary and other types of costs. William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income.

H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due.

Individuals could give up to 10 percent of their Adjusted Gross Income annually. And the Cruz bill also allows taxpayers to stretch out the credits for five years, so that if they exceed the limits in one year, they could simply carry the credits forward to future years. The information contained in this article is not tax or legal advice and is not a substitute for such advice. State and federal laws change frequently, and the information in this article may not reflect your own state’s laws or the most recent changes to the law. For current tax or legal advice, please consult with anaccountantor anattorney. As a parent, you want the best education possible for your child.

Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. US Mastercard Zero Liability does not apply to commercial accounts .

“The danger is that kids will have finished K–12 schooling and the parents will still have the debt,” LaMarche said. You want your home paid off before retirement to keep your options open, she said.

People in higher tax brackets will see greater savings than those in lower tax brackets. • A 529 plan allows you to invest money tax-free as long as you use the withdrawals only for qualified expenses. In this way, it’s similar to a 401 or IRA, but it’s specifically for education. Paying no taxes on the interest you earn means the money can grow more quickly. Like other medical expenses, the cost of tuition or tutoring for a special needs child is only deductible if it exceeds 7.5 percent of the parents’ adjusted gross income.