Content

If you made self-employment income but also worked for someone else, you should use Long Schedule SE to make sure you don’t pay more self-employment tax than you need to. Andrew Martins has written more than 300 articles for business.com and Business News Daily focused on the tools and services that small businesses and entrepreneurs need to succeed.

The sole proprietor losses offset your day job’s income to provide a possible tax refund. This being said, in order to file your general income taxes for your sole proprietorship, you must complete the required forms on the same schedule as your personal tax returns. Therefore, you must file by April 15 unless you file an extension, which will give you until October 15 to file. tax liability belongs to the owner of the business, “passing through” to the business owner’s personal tax return. As we’ll discuss in greater detail shortly, this means that you’ll complete a separate form for your sole proprietorship taxes, Schedule C, which you file with your personal income tax form, Form 1040. Every business has operating expenses, and a sole proprietorship is no different.

You’ll need to keep accurate records for your business that are clearly separate from your personal expenses. One good approach is to keep separate checkbooks for your business and personal expenses — and pay for all of your business expenses out of the business checking account. For information about allowable expenses and deductions, see Small Business Tax Deductions, Top Tax Deductions for Your Small Business, and Nolo’s book, Tax Savvy for Small Business. You’ll be taxed on all profits of the business — that’s total income minus expenses — regardless of how much money you actually withdraw from the business.

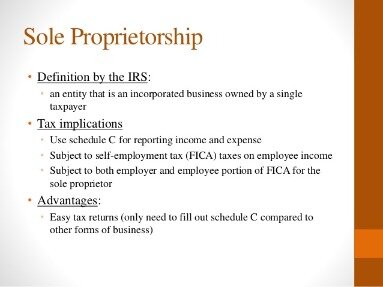

Like most W-2 employees, you’ll have to file your sole proprietorship taxes annually . In its most basic form, a sole proprietor runs and operates their own business. It is not established as a legal entity, therefore all the financial and legal obligations fall upon the owner. First off, we’ll walk through the basics of an IRS sole proprietorship and how it is taxed. Then, we’ll be going in-depth on several tax deductions you need to know about and how to take advantage of them. One of the most common tax deductions self-employed taxpayers can claim is automobile expenses.

Deductions To Keep In Mind As A Sole Proprietorship

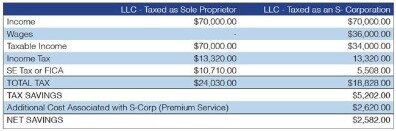

If you operate as a sole proprietor, those “retained” profits would be taxed at your marginal individual tax rate, which is probably over 27%. But if you incorporate, that $50,000 would be taxed at the lower 15% corporate rate. Because you don’t have an employer to withhold income taxes from your paycheck, it’s your job to set aside enough money to pay taxes on any business income you bring in over the year. To do this, you must estimate how much tax you’ll owe at the end of each year and make quarterly estimated income tax payments to the IRS and, if required, to your state tax agency. You’ll be taxed on all profits of the business — that’s total sales minus expenses — regardless of how much money you actually withdraw from the business. In other words, even if you leave money in the company’s bank account at the end of the year — for instance, to cover future expenses or expand the business — you must pay taxes on that money.

So don’t fret over the steadily depreciating value of that new van you purchased to make deliveries for your catering business. Several tax options can help you recoup some of the money you spend maintaining and using your car for business-related purposes. These professionals can answer any questions you have, ensure that you receive the maximum deductions, and even complete the returns on behalf of your business. for your tax return—by doing so, you’re ensuring that you’re only paying taxes on the income you’ve actually received. deduction isn’t limited to sole proprietorships, sole proprietors often tend to overlook this deduction, thinking it’s insignificant. However, if you use your car for business purposes, at 57.5 cents per mile , this deduction can make a sizable impact on your tax liability. In order to receive this deduction, though, you’ll need to keep thorough mileage records, but luckily, there are a number of available business apps that can help facilitate this process.

Services like freelance writing, photography, or design work could fall into this category. Others may sell handmade goods through online marketplaces like Etsy or Uncommon Goods. Many state governments have altered their tax deadlines, so check with your Department of Revenue for more info. They’re making exceptions to help during this difficult time, including payment plans and giving those who owe delinquent bills a break. Due to the ongoing pandemic and economic crisis, the IRS has delayed the 2019 tax deadline until July 15, 2020. going out to lunch for yourself on the business account is not going to be a deductible expense). Hopefully, this doesn’t happen often, but you may have a client who cannot pay a debt they owe you.

This schedule takes the total revenue and subtracts the amounts you spent to earn that total. As a result, after subtracting the cost of materials, labor, employee benefits and other business expenses, you obtain the net profit from your business. This is the number that you enter in your Form 1040 and that is taxed as income. If you have a loss, you may be able to deduct it from other income. A sole proprietorship business structure acts as the same entity as the owner of the business. Income from a business operating as a sole proprietorship is personal income. Despite this financial characteristic, there are fundamental differences for the treatment of income when it comes from a business, as opposed to income from employment.

You should be aware that your contributions to Medicare and Social Security will be significantly higher. Since you are your own employer, you’ll be paying both the employee and the employers’ portions of those contributions. According to the IRS, the self-employment tax rate is 15.3%, with 12.4% going to Social Security and 2.9% going to Medicare.

The IRS announced on Feb. 25, 2021 that this relief will extend to taxpayers in Oklahoma as well.

Instead, you’ll only pay sole proprietorship taxes on the profit of your business. Essentially, this means you’ll be taxed on all profits—total income minus expenses—regardless of how much money you withdraw from the business.

Do Sole Proprietors Charge Sales Tax?

The business profit is calculated and presented on Schedule C, Profit or Loss from Small Business. To complete Schedule C, the income of the business is calculated including all income and expenses, along with cost of goods sold for products sold and costs for a home-based business. Sole proprietors file need to file two forms to pay federal income tax for the year. Firstly, there’s Form 1040, which is the individual tax return. Secondly, there’s Schedule C, which reports business profit and loss.

Similarly, you’re solely responsible for any debts and tax obligations the business accumulates. Income is reported on Schedule C, which is part of the individual tax return Form 1040. Regardless of your sole proprietorship’s function and how you intend on earning profits, it’s imperative that you nail down your tax burdens as soon as possible. Failing to do so can result in dire circumstances, while keeping up with your federal and state taxes will ensure you can keep operating for years to come.

- If you incur any expenses on your trip that are not related to the business (i.e. going to a sporting event or visiting a museum) then you cannot deduct those as part of your trip.

- When you’re not marketing for new customers, you’re counting inventory or cleaning the shop floor.

- You can either keep track of the miles you drove on business and use a standard mileage rate given in the Schedule C instructions, or you can claim the actual expenses.

- In most situations, you’ll be able to claim a deduction on any health, dental, and qualified long term care insurance you’ve purchased.

These costs vary but include advertising, travel, and fees associated with professional services or consultants. If you’re unable to meet your tax obligation, you can set up a payment plan. By using your bank account, you can schedule payments in advance. Those paying with debit or credit card also have the option to call and make a payment.

Form 1040 reports your personal income, while Schedule C is where you’ll record business income. Unlike a sole proprietorship, a regular corporation (also called a “C” corporation) is considered a separate entity from its owners for income tax purposes. Owners of C corporations don’t pay tax on the corporation’s earnings unless they actually receive the money as compensation for services or as dividends.

Get Started On Your Sole Proprietorship Taxes

The Tax Cuts and Jobs Act dramatically changed the corporate tax rate to a single flat tax of 21%. This replaced tax rates ranging from 15% to 35% that corporations paid under prior law. The 21% rate is lower than individual rates at certain income levels. The top 37% individual rate applies to income over $600,000 for marrieds and $500,000 for singles. However, corporations do not benefit from the up to 20% pass-through tax deduction established by the Tax Cuts and Jobs Act, which can cut the effective tax rate for sole proprietors by 20%. Because you don’t have an employer to withhold income taxes from your paycheck, it’s your job to set aside enough money to pay taxes on any business income you bring in during the year. To do this, you must estimate how much tax you’ll owe at the end of each year and make quarterly estimated income tax payments to the IRS and, if required, your state tax agency.

During the year, sole proprietors are required to report estimated taxes to the IRS each quarter. Estimated taxes are due on any income that is not subject to withholding.

You are allowed to expense much of the money you spend in pursuit of profit, including operating expenses, product and advertising costs, travel expenses, and some of the cost of business-related meals. You can also write off certain start-up costs and the cost of business equipment and other assets you purchase for your business. Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer.

When it is time to file annual taxes, you will either owe more or get a refund. If you do not pay estimated taxes quarterly, the IRS may fine you and charge interest. LLCs with one member are called single-member LLCs and are treated as disregarded entities because the LLC does not file its own tax return. Once your business reaches a certain size, it should be converted to an S corporation or C corporation. These business entity types allow for shares to be sold to outside owners and can reduce business taxes as the corporate tax rate is likely lower than what your personal marginal rate would be at that point.

You can typically qualify for a 50% deduction of the costs associated with meals and entertainment. Traveling to these meetings is a separate expense and not subject to the 50% rule. This relates to trips outside of your normal commute or within the general area of your business and residence.

But, like any business, you will invest some money to get your idea off the ground. Many of these expenses can be deducted from your sole proprietor taxes. But, to save you some time , we’ve put together a list of important deductions you need to know about. Using this will help you reduce the burden of your sole proprietor taxes.

As a sole proprietor, the IRS will not even know you exist until after you file your first personal income tax return. This return will include a Schedule C which communicates all of the sales and expenses you recorded in LessAccounting on your business. These sales and expenses do not have to be in a separate bank account as mandated by the LLC or Incorporation format.

A sole proprietorship business must also pay self-employment taxes, which are Social Security and Medicare. Other tax deductions that exist for sole proprietorships include health insurance deductions for yourself, your spouse and any dependents in your home. Even if you don’t itemize deductions on your tax return, this deduction can still happen as an “above-the-line” item, according to Intuit. Keep in mind, however, that this deduction is limited by your taxable income. Most startups lose money for the first several years, so keep your day job to pay your living expenses. There are tax implications for anyone who works in these fields. Whether gig work is your full-time business or just a side hustle, you’ll need to pay taxes on this income.