It’s also important to separate your business expenses from your personal expenses. And you should have a separate business bank account for your consulting work. For example, assume that a client sues your consulting firm for failing to implement an employee-training course fully. The client believes that a high rate of worker errors is due to the incomplete training course. The PLI insurance policy can help cover the legal costs incurred to defend your firm and the cost of any legal damages awarded. qualified business income deduction allows eligible self-employed and small-business owners to deduct a portion of their business income on their taxes.

Using the standard mileage rate is easiest because it requires minimal record-keeping and calculation. Just write down the business miles you drive and the dates you drive them. Then, multiply your total annual business miles by the standard mileage rate. When you use your car for business, your expenses for those drives are tax-deductible. Make sure to keep excellent records of the date, mileage, and purpose for each trip, and don’t try to claim personal car trips as business car trips. Your travel expenses for business are 100% deductible, except for meals, which are limited to 50%. Keep complete and accurate records and receipts for your business travel expenses and activities, as this deduction often draws scrutiny from the IRS.

The federal Tax Court ruled in favor of deducting the cost of childcare while you work or volunteer to work for no pay for a recognized charity. Just don’t get greedy and try to claim the cost of hiring a babysitter for any personal use like date nights.

Examples of tax-deductible startup costs include market research and travel-related costs for starting your business, scoping out potential business locations, advertising, attorney fees, and accountant fees. Some people don’t like paying insurance premiums because they perceive them as a waste of money if they never have to file a claim.

The simplified option is a clear choice if you’re pressed for time or can’t pull together good records of your deductible home office expenses. However, because the simplified option is calculated as $5 per square foot, with a maximum of 300 square feet, the most you’ll be able to deduct is $1,500. In short, the cost of any workspace you use regularly and exclusively for your business, regardless of whether you rent or own it, can be deducted as a home officeexpense.

General Tax Write

According to the IRS website, “You can’t deduct the cost of basic local telephone service for the first telephone line you have in your home, even if you have an office in your home.” It is important to note that the self-employment tax refers to Social Security and Medicare taxes, similar to FICA paid by an employer. When a taxpayer takes a deduction of one-half of the self-employment tax, it is only a deduction for the calculation of that taxpayer’s income tax.

Deduct all commissions paid to non-employees for sales and marketing purposes. This can include payments to individual sales reps, or marketing channels and platforms like Amazon or eBay. You can use the links to jump directly to each write-off to learn if it’s relevant to you. We’ve compiled the most common 1099 and freelance tax breaks below. Read it through, and check it twice to make sure you don’t miss out on any tax savings.

- It is important to note, however, that the same plan must be available to all of the business’s employees.

- Improvements that you make to leased business property are also depreciable.

- In nearly every case, withdrawals made before the age of 59 1/2 are subject to an IRS penalty in addition to ordinary income tax.

- As long as you have some kind of dedicated workspace, like a desk and chair, you can write off the following expenses.

If consultants need to travel in order to meet with clients, do research, attend classes related to their area of expertise or for other work-related reasons, they can deduct their travel expenses. If they are traveling by air, the cost of the plane ticket is deductible.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. Examples are business credit cards, lines of credit, or interest on equipment loans.

Top Tax Deductions For Consultants

Most people have occasion to drive a car while conducting business. Business-related automobile mileage is tax deductible, with the exception of commuting to and from work. Any other mileage from the place of business to another location can be considered a business expense as long as the travel was made for business purposes. The IRS allows the mileage deduction to be calculated using two different approaches. The straight-mileage approach multiplies the cents-per-mile allowed by the IRS (40.5 cents in 2006) by the number of miles attributable to business use of the automobile. For example, a small business owner who drove 1,000 miles at .405 per mile would gain a deduction of $405. The everyday things you use to run your business could score you some self-employment tax deductions.

This income is then reported on your personal Form 1040 tax return. For self-employed meal deductions, you can deduct 50% of all meals with clients that are specifically about business. For business meals while traveling, you can either choose to deduct the actual cost of your meals (again, 50% deduction), or use the standard meal allowance specified by the General Services Administration. Some examples include the cost of printing flyers and business cards, running Google Adwords and Facebook ads, and trade show promotions. You can also deduct any “middleman” costs, such as fees paid to PR agencies or freelance copywriters. Overall, the 2017 tax reform lowered the Individual Tax Rates .

If 10 percent of your home is used exclusively for business, 10 percent of the cost of these bills can be deducted from your taxes. Of course, a dedicated phone line can be fully deducted from your taxes, since it’s exclusively used for business purposes. The same can be said for the entirety of your bills if you rent office space outside of your home. Consultants can deduct the costs of operating a home office or rented office space. If they have a room that strictly serves as an office, they can deduct a proportionate amount of household expenses such as utilities, insurance, mortgage interest and repairs.

The Home Office Expense

Conferences and classes that help you keep up with the industry are tax deductible. In 5 minutes, you’ll have your account set up with Benji actively working to find tax write-offs for you.

If you want to keep things simple, stick with the standard mileage rate since you aren’t required to keep receipts every time you stop for gas or get an oil change. If you prefer, you can try calculating your deduction both ways and use the method that gives you the higher deduction. Taxpayers have the option to deduct state and local income taxes or state and local general sales taxes from federal income taxes. Additionally, the cost of registering your vehicle may be eligible as a deduction. One of the biggest perks of being a home-owner is the ability to write off your home mortgage interest. You can deduct interest on any load used to buy, build, or make real estate improvements.

If you belong to a professional organization, you may be able to deduct the membership fee. U.S. General Service Administration sets the standard meal allowance rate. If you form an LLC or a C Corp, you’ll have a different tax situation. Contributions to a solo or one-participant 401 plan of up to $57,000 in 2020 and $58,000 in 2021 (add an extra $6,500 if you’re 50 or older) or 100% of earned income, whichever is less. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Based in Minneapolis, Minn., Dana Severson has been writing marketing materials for small-to-mid-sized businesses since 2005.

You can usually have your employer withhold additional taxes from your paychecks to cover your consulting income if you work for someone and consult on the side. Your spouse could also request additional withholding from their pay if they’re employed, you’re married, and you’re going to file a joint return. You’re a “sole proprietor” tax filer as an independent consultant, unless you’ve taken steps to establish yourself as another type of business entity. Sole proprietors are required to report and file their business taxes with their personal income taxes. This category includes incidental repairs and maintenance made to machines and other property. For example, you can deduct costs for re-carpeting your office or fixing your broken photocopier.

Should you suffer a loss caused by theft, vandalism, natural disaster, car accident, etc. Should you be unfortunate enough to suffer more than one loss in a tax year, you can deduct $100 from the dollar amount of each loss less any funds received from your insurance policy. Once you have that dollar amount subtract the amount of what is 10% of your AGI. Also, when you track your 1099 expenses and it comes to claiming hardware, it’s wise to use a percentage to calculate the business deduction. While you may have purchased that laptop solely for work purposes, a 100% deduction might be a flag for the IRS and you want to make sure you can back up your claim.

Health Insurance

Keeping strong records or just keeping a separate card for business expenses is wise. Did you pay for any Facebook ads, Google ads, a website, a billboard, a TV commercial, or print materials (business cards, flyers, postcards, mailers, etc.)?

Track your actual car expenses, including gas, maintenance, insurance and depreciation and deduct a percentage based on the number of business miles you drive. You can deduct up to $5,000 of all the costs related to starting a new business if your business was started this tax year. This can include things like market research, advertising for your business launch, and even the cost of hiring a business coach or consultant.

Many independent contractors and freelancers don’t have employees. But if you do, and you provide health insurance and other benefits for those employees, the cost of providing those benefits is fully deductible. It’s a good idea to talk to your accountant before you claim these tax deductions. They’ll be able to catch any missing ones, and tell you which ones don’t apply to you. Keeper makes it easy to identify and track qualified business expenses, as well as organizes and creates easy reporting for tax filing.

For traditional solo 401s, your contributions are pretax, and distributions after age 59½ are taxed. You can contribute as both an employee and as the employer, with salary deferrals of up to $19,500 in 2020 and 2021, plus a $6,500 catch-up contribution if you’re 50 or older. And you can add approximately 25% of net self-employment income, not exceeding $57,000 in 2020 and $58,000 in 2021. The cost of launching and running a website can also be deducted from your taxes. If you paid someone to design the site, the total cost can be deducted from your taxes. The cost incurred from a hosting provider can also be deducted.

In his free time, he loves to go jogging, playing chess, and helping people find tax write offs. If you are combining business with pleasure, be sure to only claim actual business-related expenses. You can use our handy self-employment tax calculator to see how much you owe. Planes, trains and automobiles are all work travel costs that can be written off. Whether rental or homeowner insurance, you can write off a portion as part of home office. A desk, chairs, lamps, and other home office necessities are all tax write offs. Oil changes, repairs, and regular checkups are all tax deductible if you drive for work.

The $5,000 deduction is reduced by the amount your total start-up or organizational costs exceed $50,000. The costs of “qualifying work-related education,” including things such as tuition, books, supplies, lab fees, transportation to and from classes and related expenses. So if your AGI is $100,000, your first $7,500 of medical expenses isn’t deductible. Career-related memberships sometimes come into question, but they’re a legitimate deduction for any consultant or freelancer. The Society of Professional Consultants, for example, is related to business.

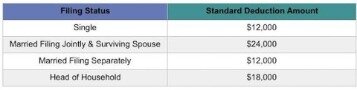

Meals at a restaurant with a client can be deducted from taxes, as long as the consultant discussed business with the client over the meal. Even a golf outing can be considered a tax deduction if that’s where the consultant and client get together to do business. It’s always important to keep solid records of such meetings, noting with which client you met with and why, in case of an audit. 25 write offs you may be missing to help you out during tax time. Check out this list of other potential write-offs for small business owners and see if you qualify to capitalize on them. If you do pay state taxes, taking the sales tax break on your federal taxes might be beneficial if you make a larger purchase like an engagement ring or a car. But because the standard deduction for 2018 has increased, it might be worth calculating both scenarios to see which will give you the better deduction.

Prior to this, Severson worked as a manager of business development for a marketing company, developing targeted marketing campaigns for Big G, Betty Crocker and Pillsbury, among others. You can combine any of these methods as long as the IRS receives regular payments.