Content

Got $1,000 in tax credit and owe the government $2,000? A tax deduction reduces the amount of your income that is subject to being taxed. Although you may have been awarded Federal Work-Study to help pay for college, the money you earn at your work-study job must be reported as income just like any other employment earnings. Include these earnings with your wages and salary.

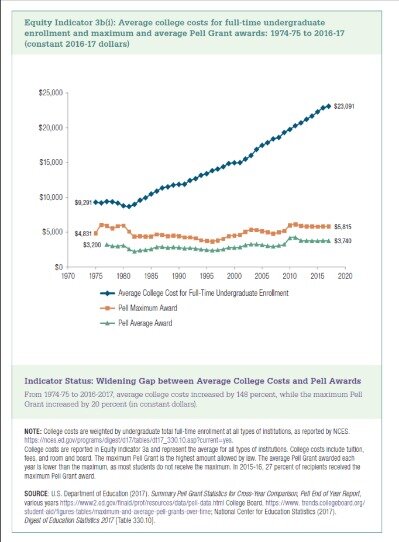

For tax purposes, all of your financial aid is lumped together. You will not have to file separately for each scholarship, grant and student loan. Simply add up the financial aid you received and subtract your qualified education expenses. The amount leftover is what you have to report on your taxes. As you can see, there are many different ways to pay for school. To start, fill out the FAFSA to see if you qualify for a Pell Grant.

Are Pell Grants Always Tax

They help to pay for college expenses when a student displays financial need. However, in some rare instances, Pell Grants may be considered taxable income. This guide will explain when Pell Grants are and are not taxable so you can properly file your taxes. Qualifying for a Pell Grant helps you minimize the amount you have to contribute to help your children attend college.

You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. How do I update or delete my online account? What if I receive another tax form after I’ve filed my return? You also need to weight your net benefit of using this strategy. Because raising your income intentionally to claim more of the American Opportunity Tax Credit means you have to report more income for other things, where the effect will be reduced benefits. Raising your AGI may decrease other tax deductions or credits, raise your state tax income, or make you eligible for less or no public benefits like state aid or other government programs. Oftentimes, the increased refund from this strategy is large enough for the net benefit to be worth it, but you need to consider everything.

- Filing taxes is simple for most college students, since they only have a couple forms to fill out.

- All tax situations are different and not everyone gets a refund.

- H&R Block Audit Representation constitutes tax advice only.

- Some factors won’t automatically make your scholarship taxable, at least not by themselves and if you meet the other rules.

- You’ll need to report the $500 in the above example on the “wages and salary” line and enter “SCH” to the left of the amount.

I’m going to explain how you can categorize your federal pell grants in such a way to leverage the heck out of the American Opportunity Tax Credit. In fact, I used this strategy to file my tax return and amend two previous years’ tax returnsto get over $1,000 extra dollars back from the IRS than what I got originally.

When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees.

Eligibility criteria for the Pell Grant are governed by Free Application for Federal Student Aid -FAFSA. One big non-qualifying expense is room and board. If you use your FAFSA® grant money for room and board, then you have to report it on your tax return.

College Scholarships For Women, National History Month

For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits.

The flip side is that your entire scholarship would be tax-free if you receive $10,000 that’s tagged solely for tuition and fees, but your tuition and fees are going to run you $11,500 a year. Every dime of the scholarship would therefore go to qualified expenses, and you’ll have to come up with $1,500 out of pocket for the balance besides. Grants, sometimes called fellowship grants, are intended to pay for a specific area of research or study.

You cannot take this deduction if you are taking one of the education credits we discussed above. lifetime learning credit, which can be claimed by the student, the student’s spouse or the student’s parent. It can be claimed for a deduction of up to $2,000 per household, but not by the same student if he or she has claimed a different tax credit within the past year of their claiming the Lifetime Learning Credit. If the taxpayer’s income exceeds $47,000, this credit won’t apply. Another bonus is that 40% of the credit is refundable — that means that if you end up not owing anything on your taxes, you can still get up to $1,000 back. The credit will phase out for taxpayers making more than $90,000 a year on their own, or $180,000 a year for married couples. Any felony drug convictions by the end of the tax year disqualify the student from receiving this credit.

On average, community college students incur an estimated $16,833 in education-related expenses annually, but only $3,435 of that amount comes from the direct costs of tuition and fees. Indirect costs are included in student budgets as determined by the college and in the federal definition of the cost of attendance used to determine the total Pell Grant. In essence, taxing Pell funds used for indirect costs is awarding low-income students financial aid through one arm of the federal government and taking it away with another. Before you seek any outside help, your school’s financial aid office is a resource for information about your college money. A qualified accountant can also help you sort out your grant and loan information if you’re confused. How you use grants and scholarships is essential in whether or not that money is tax-free.

See examples of non-qualified expenses below. You might also get a 1098-E for any student loan interest you paid. Students worried about owing taxes should collect any related information throughout the year and reference that information when filing.

Qualified Education Expenses

Beverly Bird—a paralegal with over two decades of experience—has been the tax expert for The Balance since 2015, crafting digestible personal finance, legal, and tax content for readers. Bird served as a paralegal on areas of tax law, bankruptcy, and family law. She has over 30 years of writing and editing experience, including eight years of financial reporting, and is also a published author of over 30 books. room and board, travel, equipment and other expenses not required for enrollment. Amounts received that exceed qualified expenses.

However, the last $1,000 that isn’t used for qualified expenses counts as taxable income. Qualified educational expenses include tuition and fees required to attend school as well as course-specific materials that are required for everyone in the class.

However, the amount you used for housing and meals is taxable. Student loans aren’t taxable because they aren’t representative of income—you have to pay that money back. What if a community organization gives you a $10,000 scholarship, but the qualified expenses at the school you want to attend only total $8,500? That $1,500 balance becomes taxable income to you. Tuition money spent on required equipment, books, and supplies is tax-free.

Amounts that the scholarship or grant requires to be used for expenses other than qualified expenses. The IRS has a Q&A tool that will determine if the money you received counts as taxable income. Read below to see what you need to know about how financial aid can affect you during tax time and how you can be prepared. You use a balance of $1,000 for hostel and transportation.

The Pell Grant “trick”

We’re proud of our content and guidance, and the information we provide is objective, independent, and free. Edmit may receive compensation from SoFi on a per-funded loan basis. SoFi does not guarantee the accuracy of information provided by Edmit, its affiliates or subsidiaries. Enrollment in Edmit does not guarantee eligibility for a SoFi loan product.

However, not all scholarships and grants are tax-free. Knowing the rules for how you must report grants on your taxes – and the tax returns your children file – allows you to avoid making mistakes on your tax return.

Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation.

A covered educational institution’s name or logo on the Edmit platform is not an endorsement by the covered educational institution of SoFi’s student loan products. Student loan products offered by “SoFi” are made by SoFi Lending Corp. (CFL# , NMLS# ) and not by any covered educational institution displayed on the Edmit platform. I understand that my consent is not required to make a purchase or obtain services and that I may opt-out at any time. By clicking Submit, I clarify that I am a US resident over 18, and I agree to the Privacy Policy and Terms & Conditions. I agree to receive emails from The Monk Media Inc and their marketing partners.