Content

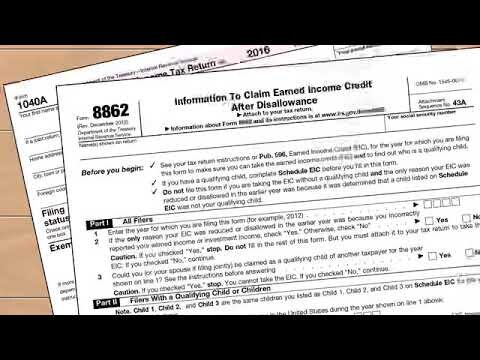

For any year when you received advanced premium tax credits, you are required to file a federal income tax return, including Form 8962. If you fail to do this — it is called “failure to reconcile” — you may be unable to apply for premium tax credits for the following year. If you file a federal income tax return but don’t include Form 8962, that is also considered a failure to reconcile and you may be prevented from applying for premium tax credits at the next Open Enrollment. Again, you need Form 1095-A to complete each section of the form, as well as your Form 1040 showing your modified adjusted gross income.

Not everyone can file Form 8962 and claim the Premium Tax Credit. Only those who have health insurance through the Affordable Care Act health insurance Marketplace are eligible to use Form 8962, and not everyone who has Marketplace coverage can qualify. If you used healthcare.gov or your state’s health insurance exchange to get coverage, you may qualify. Though I wasn’t able to follow your instructions perfectly to solve this issue , your guidance was the most helpful in getting there. I did click add a state, but I didn’t have the magnifying glass/search available.

On Line 26, you’ll find out if you used more or less premium tax credit than you qualify for based on your final 2020 income. This will affect the amount of your refund or tax due. You would only need to complete IRS Form 8962 if you purchased health insurance through the Affordable Care Act’s Health Insurance Marketplace. If you’re covered by a health insurance plan at work or you purchased health insurance directly from an insurance company outside of the exchange, you don’t need this form to complete your tax filing. Or, if you got divorced in the tax year and are now filing separately but at one point during the year you both were covered by the same health care policy, this section is also for you. If no APTC was paid for a policy shared between two tax families, consult the Form 8962 instructions. You and the other tax family will have to decide how you will split the burden of reconciling any APTC repayments if applicable.

Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. It’s a secure PDF Editor and File Storage site just like DropBox. Your selected PDF file will load into the DocuClix PDF-Editor. Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. APTC was paid for someone for whom you told the Marketplace you would claim a personal exemption and neither you nor anyone else claims a personal exemption for that person. If either your income or personal exemptions changed during the year, you should have reported those changes to the Marketplace.

Otherwise, use one or more of the lines for the 12 months of the year to enter your monthly contributions. When you buy health insurance from the Marketplace, you provide information about your income, and the government uses that information to calculate how much it will pay your insurer. Changes in income during the year can affect your eligibility for the credit—and that’s why you might end up either having credit “left over” or having to repay some of your credit. For Paperwork Reduction Act Notice, see your tax return instructions. While Form 1095-A is not filed with your tax return, the information is needed to complete Form 8962,Premium Tax Credit. Form 8962 should be filed as part of your tax return for 2019.

When you enter the 1095-A form, TurboTax will automatically generate form 8962. I need to know if I can reenter my income tax file which I have already filed to add a 1095A on 8962 which I didn’t receive until a few days ago.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. “If you earn more than expected, you may need to adjust your subsidies midyear or else repay all or part of your subsidies,” she says. You can use the credit to reduce your monthly insurance payments. If you choose this option, the government pays money to your insurer over the course of the year, and you pay less for health insurance each month.

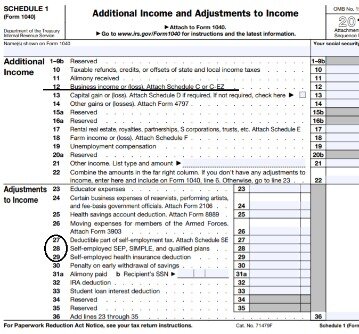

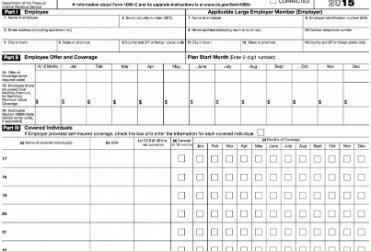

TaxFormFinder has an additional 774 Federal income tax forms that you may need, plus all federal income tax forms. If you confirm that you filed your 2019 tax return, you won’t need to do anything else. Include your completed Form 8962 with your 2020 federal tax return. You’ll receive Form 1099-H if you get help paying your health insurance premiums as a TAA, ATAA, RTAA, or PBGC recipient. Form 1095-C is a tax form reporting information about an employee’s health coverage offered by an Applicable Large Employer. Reading your Form 2441, Child and Dependent Care Expenses, doesn’t have to be difficult.

I noticed on the left were the options under 2019 Taxes. I clicked onFederal,which allowed me to look at the Healthcare forms such as 1095-A. Though I didn’t see 8962 right away after I completed the 1095-A information, the information was automatically filled out for 8962 and was able to print Form 8962 along with the rest of the federal return papers. Hopefully this helps some people who were struggling like me. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic.

You will not pay a penalty on your 2020 return if you did not have health insurance in 2020. If your APTC is greater than your PTC, you’ll need to enter this information in Part III. On line 27, subtract line 24 from line 25 if line 25 is greater. Follow the form instructions to enter the repayment limitation on line 28. Enter your excess advance premium tax credit repayment on line 29. Write the smaller of either line 27 or line 28 on line 29, and on your Form 1040 or 1040NR.

Tax Bracket Calculator

If you’re filling out a paper tax return and mailing your forms to the IRS, you include Form 8962 with your Form 1040. You then mail your forms to the IRS regional office that covers your state of residence.

- Only those who have health insurance through the Affordable Care Act health insurance Marketplace are eligible to use Form 8962, and not everyone who has Marketplace coverage can qualify.

- Sign up to get the latest tax tips sent straight to your email for free.

- You’ll receive Form 1099-H if you get help paying your health insurance premiums as a TAA, ATAA, RTAA, or PBGC recipient.

- To get your refund as soon as possible, follow the directions in the letter.

- I don’t want to start all over again with a new software/website if 1095-A is not supported.

Sign up to get the latest tax tips sent straight to your email for free. To determine your household income for this purpose, start with your adjusted gross income. I can guarantee you that Form 8962 is supported by TurboTax Freedom version, for free. You need to have income under $34K to qualify for that. Sign in to your existing TurboTax account and select Take me to my return. Instead, if your income is under $34K, go to /freefile and start from there.

Turbotax Free Edition Does Not Support 1095

You will have to amend the 2019 tax return that was filed to add the Form 1095-A and Form 8962 as requested by the IRS. If you have not filed the 2019 tax return it will be included in the tax return sent to the IRS when you file.

On the other hand, if the amount of advanced premium tax credit received exceeds the amount of the premium tax credit you’re eligible to claim, you owe money back to the IRS. The sum you owe could either reduce the size of your overall tax refund or mean that you have to pay money to the IRS. For the purposes of qualifying for the Premium Tax Credit, it is your Modified Adjusted Gross Income plus the AGI of every other individual in your family who is required to file a tax return. Modified AGI is your AGI plus any excluded foreign, nontaxable Social Security benefits and tax-exempt interest received or accrued during the Tax Year. However, it does not include Supplemental Security income . Now on to Part II, Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit.

Please Complete The Security Check To Access Igotmyrefund Com

If you don’t owe any taxes, you can get the full amount of the credit as a refund. However, if you receive advance payments of the credit, you will need to reconcile the payment with the actual premium tax credit amount (which is calculated by eFile.com on your tax return). If this happens to you, be sure to remedy this failure as soon as you can. You can still sign up for health insurance coverage for the coming year, but you won’t be able to get advance premium tax credits until you have filed your prior-year tax return with Form 8962.

File Form 8965 with your tax return to report your number. Form 1095-B is a statement from your health insurance company verifying that you and other members of your household have insurance coverage that meets the requirements of the ACA. This is for people whose insurance comes from a source other than the Marketplaces. Form 1095-A is the Health Insurance Marketplace Statement. You’ll get this version if you bought health coverage through the “Marketplace”—the web-based insurance markets that the federal government and states set up under the ACA. The Internal Revenue Service usually releases income tax forms for the current tax year between October and January, although changes to some forms can come even later. We last updated Federal Form 8962 from the Internal Revenue Service in January 2021.

What Is Form 8962: Premium Tax Credit Used For?

This is where you’ll figure out your PTC and compare it against any advance payments . If you had Marketplace coverage for the whole year you’ll use Line 11 to enter your annual totals.

If you didn’t, you might have been receiving too much or too little in APTC. After the Form 1095-A has been entered the TurboTax program will create and populate the Form 8962 automatically. Some are available only by applying to the Marketplace. These include exemptions for membership in religious groups that object to insurance and for certain financial hardships.

Completing Form 8962 can tell you how much credit you’re eligible to receive or if you owe the Internal Revenue Service because you received too much in advanced premium tax credit . This page specifically covers Form 8962, which is used for the Premium Tax Credit . Of course, using tax preparation software like TaxAct or H&R Block—or a tax accountant will simplify filling out Form 8962.

That’s the amount you owe in repayment for getting more than your fair share in advance payment of the PTC. Receiving too much in advanced premium tax credits could result in you owing money to the IRS when you file your tax return. Form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace. Claiming the premium tax credit could reduce your tax liability for the year.

Where To Mail Form 8962

The result could be additional credit owed to you, or you may have to repay any amount already received in advance. Because of either of these results, it is important for taxpayers to include the information from Form 1095-A on their return.

If you elected the alternative calculation for marriage, enter zero. At the end of Part II you’ll have three very important numbers to enter. On Line 25 you’ll write the advance payment of PTC amount. Before you dive in to Part I, write your name and Social Security number at the top of the form.