Content

TaxSlayer is taking reasonable and appropriate measures, including encryption, to ensure that your personal information is disclosed only to those specified by you. However, the Internet is an open system and we cannot and do not guarantee that the personal information you have entered will not be intercepted by others and decrypted. Information in the many web pages that are linked to TaxSlayer’s Website comes from a variety of sources. Some of this information comes from official TaxSlayer licensees, but much of it comes from unofficial or unaffiliated organizations and individuals, both internal and external to TaxSlayer. TaxSlayer does not author, edit, or monitor these unofficial pages or links.

can be accessed online, and because you can use the calculator anonymously, you can rest assured that your personal information is protected. The TurboTax TaxCaster is an all-in-one online tax tool that helps you work out a range of tax-related figures.

TaxSlayer does not grant any license or other authorization to any user of its trademarks, registered trademarks, service marks, or other copyrightable material or other intellectual property, by placing them on this Website. Simply Free For those with a simple tax situation.

Growth is a theme we often see with our clients at EY TaxChat™. When it comes to taxes, even a small error can lead to big problems. Learn which details to look out for when preparing your returns. There’s no doubt that taxes can be quite complex, especially with the frequency of recent tax law changes and personal circumstances during these times. Self-employed individuals are required to pay income taxes throughout the year.

Weve Been Helping People Slay Taxes For Over 50 Years

your tax return to the IRS or state since the deadline for e-filing self-prepared past year tax returns has ended. You want all your tax documents on hand, in one place. Import your W-2s and PDFs from another online tax service or tax preparer.

- Enter your income and we’ll guide you through the rest of your return to maximize your refund.

- Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.com.

- Everyone gets free, unlimited phone and email support.

- Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.

- TaxSlayer reserves the right to change any information on this Website including but not limited to revising and/or deleting features or other information without prior notice.

People who need advanced tax software, which can run $100 or more elsewhere, can especially benefit from the price difference, particularly when adding a state return. Cost-effective — the service is competitively priced and is powered by Ernst & Young LLP , an organization with more than 100 years of experience in tax preparation. The economic impact of the pandemic has been challenging, with millions receiving unemployment.

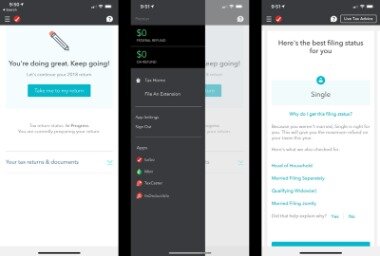

The first step in preparing your federal tax return is determining your filing status. Generally, you will have to select between single, head of household, married filing jointly and separately, or as a qualified widower. Your filing status determines your standard deduction, tax rates, and brackets. When getting ready to file your taxes, it’s a good thing to pay attention to your adjusted gross income . It can directly impact the how eligible you are for certain deductions and credits, which could reduce the amount of taxable income you report. Quickly estimate your 2020 tax refund amount with TaxCaster, the convenient tax return calculator that’s always up-to-date on the latest tax laws. This interactive, free tax calculator provides accurate insight into how much you may get back this year or what you may owe before you file.

Get More With These Free Tax Calculators And Money

TaxSlayer.com’s “Free” products are excluded from this guarantee. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.com. Click here to learn how to notify TaxSlayer if you feel like you are entitled to a refund.

You acknowledge and agree that TaxSlayer and any of its website co-branding providers have no responsibility for the accuracy or availability of information provided by linked sites. Links to external web sites do not constitute an endorsement by TaxSlayer or its website co-branding providers of the sponsors of such sites or the content, products, advertising or other materials presented on such sites. Failure to Comply With Terms and Conditions and Termination. TaxSlayer reserves the right to change any information on this Website including but not limited to revising and/or deleting features or other information without prior notice. Clicking on certain links within this Website might take you to other web sites for which TaxSlayer assumes no responsibility of any kind for the content, availability or otherwise. (See “Links from and to this Website” below.) The content presented at this Site may vary depending upon your browser limitations.

Recent Tax Developments

Based on your income and your filing status you might have to file a return for 2016 and/or 2017. If you need to prepare a return for 2016 and 2017 you can purchase and download desktop software to prepare it, then print, sign, and mail the return. If you need a copy of your past year tax return, W-2 or 1099-R transcript, we can assist. We have the expertise to retrieve important aged tax documents online for all your needs.

I owe or if I’m getting a refund back, I can then focus on what I have to do and, how frugal I have to be with the funds I have, if I owe. Video ads are not only irritating, they actually waste your time. Free ad blocker for Windows that can block all kinds of ads. to see how big of a refund you can get, when you claim the Earned Income Tax Credit. to see how big of a refund you can get, when you claim the Child Tax Credit. Frank Ellis is a Traverse City Tax Preparation Planner and published author. He has written tax and finance related articles for twelve years and has published over 1000 articles on leading financial websites.

Click here to learn how to notify TaxSlayer if you believe you are entitled to a refund. For those who do not qualify the price to file a federal tax return is $17 and the state is $32. While this may seem like a lot to digest, our EY tax professionals remain up to date on tax developments and apply that knowledge when preparing your tax returns.

and situation, helping to reduce the amount of income tax you owe to the federal and state governments. In most cases, tax credits cover expenses you paid thought the year and come with requirements you must satisfy before you can claim them. You probably noticed your tax refund changing based on the life events you selected from the tax calculator.

By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service. Enter your income and we’ll guide you through the rest of your return to maximize your refund.

If you’re looking for a cost-friendly online tax filing software, TaxSlayer doesn’t disappoint. It’s possible to file both your state and federal return for free and the paid versions are priced lower than some of TaxSlayer’s main competitors. In fact, TaxSlayer offers highly affordable pricing for filers with basic and more complicated returns.