Content

Their excess amount is $275,000 less $250,000, or $25,000. Barney and Betty’s Additional Medicare Tax is 0.9% of $25,000, or $225. If you have self-employment income, you file form 8959 if the sum of your self-employment earnings and wages or the RRTA compensation you receive is more than the threshold amount for your filing status. Employers who fail to withhold the Additional Medicare Tax will be liable for both the tax and any penalties and interest.

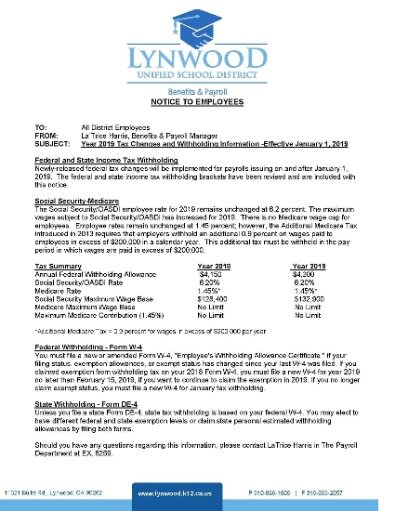

The 0.9% rate is the same, and the threshold amounts are the same as for wage earners and for self-employment income as well. Calculations are made in the same way the surtax is calculated on wage income. The number employees arrive at might or might not match up with what was withheld from their earnings when they calculate the AMT on their tax returns. An employee is liable for the Additional Medicare Tax even if the employer doesn’t withhold it. Employees are accustomed to having Medicare taxes withheld from their wages by their employers, and having the right amount of Medicare tax withheld.

You earn $150,000 and are married filing jointly. Your spouse also earns $150,000. You and your spouse’s combined income ($300,000) is more than $250,000. So, you’ll be liable for the additional 0.9% Medicare tax. However, neither of your employers will withhold the tax since each of your wages is less than $200,000. So, you should make estimated tax payments and / or request additional withholding on Form W-4.

Additional Medicare Tax: What Must I Know?

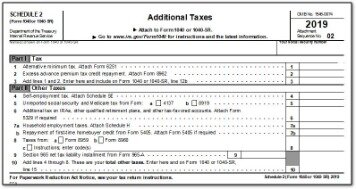

The threshold amounts apply separately to each category of income. Compensation subject to the Additional Medicare Tax will not also be subject to the Net Investment Income Tax, since that additional Medicare tax applies only to investment income. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. No cash value and void if transferred or where prohibited. Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied.

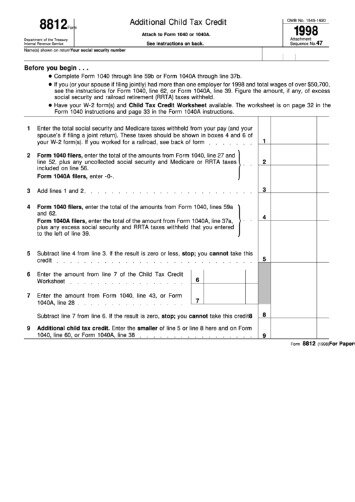

The types of income include your Medicare wages, self-employment income, and Railroad Retirement Tax Act compensation. If you’re not sure if you have income subject to these rules, please call our office. Every employer must calculate withholding for Medicare taxes as part of FICA taxes , for each employee for each pay period. All employee income, including tip income, is subject to Social Security and Medicare taxes. Before you calculate Medicare taxes and Social Security taxes, deduct any payments to employees that are not included in Social Security wages, so you’re not adding additional tax to income that shouldn’t be taxed.

- Most people don’t pay for Medicare Part A because its funded by taxpayer contributions to the Social Security Administration.

- Offer period March 1 – 25, 2018 at participating offices only.

- Adding to the confusion, are the instructions from the IRS to employers to calculate the amount to withhold from their employees’ pay using the threshold of $200,000.

- Additional feed may apply from SNHU.

Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021.

Price varies based on complexity. Starting price for state returns will vary by state filed and complexity. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. State e-file not available in NH. E-file fees do not apply to NY state returns. State e-file available for $19.95.

Information Menu

The AMT is imposed on employees only, unlike the regular Medicare tax which employers are required to match. Medicare wages are reported on Form W-2 in box 5. As of 2020, the threshold amounts aren’t indexed for inflation. An employer is responsible for withholding the Additional Medicare Tax from wages or compensation it pays to an employee in excess of $200,000 in a calendar year. Withholding and estimated tax.

If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Limited time offer at participating locations. ©2020 HRB Tax Group, Inc. Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return .

What Is The Income Threshold For Additional Medicare Tax?

For more on this, please call. Underpayment of Estimated Tax.If you had too little tax withheld, or did not pay enough estimated tax, you may owe an estimated tax penalty. CS Professional Suite Integrated software and services for tax and accounting professionals. The Check-to-Card service is provided by Sunrise Banks, N.A.

Your employer will begin withholding the additional Medicare tax once your wages reach a certain amount. Your filing status isn’t important for this. Withholding starts when your wages and other compensation are more than $200,000 for the year.

When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. Available at participating offices and if your employer participate in the W-2 Early AccessSM program.

Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund.

Consult your attorney for legal advice. Power of Attorney required. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Terms and conditions apply.

Federal Form 8960 Net Investment Income Taxwas also introduced in 2013. If this form is applicable to your return it will also print with the return. This form calculates the additional tax on net investment income . If an employee works for several subsidiaries of a corporate group, then the wages paid by each subsidiary are only combined if they are paid by a common paymaster; wages from different payers are not combined. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment.

H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit. Additional fees may apply from WGU. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year.

Withholding Requirement For Employers

But the rules for AMT withholding are different from the rules for calculating the regular Medicare tax. This can result in an employer withholding an amount that’s different from the correct amount of tax that will ultimately be owed.