Content

Support – Must not have provided more than half of their own support during the year. Age – Must be under age 19 or under 24 and a full-time student for at least 5 months. They can be any age if they are totally and permanently disabled. Relationship – Must be your child, adopted child, foster-child, brother or sister, or a descendant of one of these.

If you file a separate return, you can claim an exemption for your spouse only if your spouse had no gross income, is not filing a return, and was not the dependent of another taxpayer. This is true even if the other taxpayer does not actually claim your spouse as a dependent. This is also true if your spouse is a nonresident alien; in that case, your spouse must have no gross income for U.S. tax purposes. Since your girlfriend is not related to you, she would need to have lived with you for 12 months in 2011 in order to be claimed as your dependent. If she lives with you all 12 months of this year and otherwise meets all of the dependency rules, you will be able to claim her as a dependent on your 2012 tax return.

My boyfriend has own house but has been unemployed for the last year so has been living with me to save on utilities, etc. I have provided most of the support at my house for the last year . I have been told I can claim him as a dependent because he is living with me even though he still pays the bills for his house. The question is, how would I ever prove he lived with me for the last year if his mail is still delivered in his town and he’s never changed his address? I’m wondering what the IRS would require as proof? She can claim you as a “qualifying relative” as long as she provided over half of your support, you meet the citizenship rules, and no one else claimed you as a dependent.

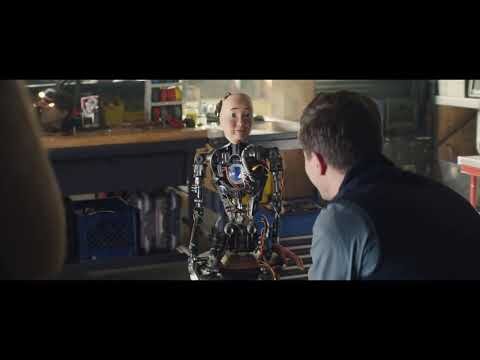

Intuit knows this and in its new ad says that if you could do all that, you can do your own taxes too. New TurboTax ad celebrates all you did over the last year… and now wants you to do your own taxes. Stay tuned to JustJared.com the rest of the game for the latest Super Bowl commercials. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc.

My wife just started up a cuppycake business. Don’t think she’ll make that much in a year, or just over half a year, but how much is she allowed to make before having to claim it on taxes? My husband is an American citizen and files his taxes there , even though we live in Canada. This ad, narrated by John C. Reilly, shows a messy baby trying to eat, and let’s you know that since you can answer simple questions, you can file your own taxes. For some TurboTax is a godsend around this time of the year, but from April until January, most tax-calculating programs stay off most consumers’ radars. Luckily, John C. Reilly, of ‘Step Brothers’ and ‘Wreck-It-Ralph’ fame, has been doing most of TurboTax’s commercials lately (mostly in the form of voice-overs), such as their ‘The Year of the You’ commercial. The actor known for playing Dr. Steve Brule can be heard narrating and describing the importance of efficiently filing and calculating one’s taxes for numerous TurboTax ads for this past year.

Whos That Hot Girl In The Turbo Tax Love Hurts Commercial?

During 2011, I put $1800 in my employer dependent care FSA and claimed it because my daughter was going to daycare/after-school when my wife went to my native country ( i.e outside of USA) for 5 months. I have receipt of all daycare and my W2 has entry of $1800 in line 10. I was going thru different IRS publication but did not find good answer that whether or not I am eligible to take benefit of dependent care credit. I guess I’m out of luck on claiming him then since he never changed his address on anything. It’s tough to claim him as a dependent if I can’t physically prove he lived here since I don’t have any of those items. The number of exemptions that you can claim on Form W-4 is separate from how you will file your personal tax return.

- I am a struggling 40 year old woman, single and supporting two helpless senior citizens whom I can’t claim on my taxes for lack of information.

- My husband provides rent, pay all bills, and provides all food and nessecities for our Niece also.

- The program will ask you a series of questions, including your child’s age and if they are disabled.

- Since your girlfriend is not related to you, she would need to have lived with you for 12 months in 2011 in order to be claimed as your dependent.

- Reilly’s hulking, silly voice helps the over-the-top effects of the prom setting really pop.

- This is where Reilly turns the commercial back to the viewers and explains that using TurboTax will make you feel like you’re that centerpiece.

The 2nd twist is that she has been separated from her current husband for 2 years, but is still legally married, and won’t be divorced until later this year. Can my parents claim me as a dependent if I was a full-time student, my tuition was paid by scholarships, I did not live at home, and I earned nearly $8000 last year? I am a struggling 40 year old woman, single and supporting two helpless senior citizens whom I can’t claim on my taxes for lack of information. 2) I am also supporting my 66 year old aunt (my mom’s sister) for five years now but could not claim her as a dependent because she has no immigration papers.

The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. Intuit may, but has no obligation to, monitor comments.

Super Bowl Commercials That Moved Me

TurboTax will walk you through all of the necessary questions to determine if you are eligible to claim your daughter. TurboTax will guide you through this by asking you a few questions and then will let you know if they qualify based on your specific tax situation and why. If your boyfriend meets all of the requirements to be considered your dependent then you would need to file Single with a dependent .

However, they would not be considered a dependent on their tax return, they would be considered the primary tax payer and get a personal exemption of 3,700 as long as the parent or guardian doesn’t claim them. From what you’ve said, you’ll be able to claim both of your children as dependents on your return, which will amount to a $3,700 reduction in your taxable income for each child. If you go through the Turbotax product, in the “Personal Information” section, it will ask the following question “Do you have children or financially support someone?

For Virginia, you’ll just take the amount of Adjusted Gross Income from your Federal return – which will include any profit after expenses from your wife’s business – and put it on your Form 760, line 1. If she makes more than $400 after deducting business expenses then she will also need to pay Self Employment Tax. TurboTax will ask you simple questions and give you the tax deductions and credits you’re eligible for based on your answers. And so we have one of many commercials elbowing their way to the top of the heap for best of the big game. Only time will tell if Sean’s moves will prove memorable outside your respective living rooms and well into the subsequent week. Of course, it was hard to guess what the commercial was actually selling until the final 15 seconds.

On a joint return, you can claim one exemption for yourself and one for your spouse. As you will see I have answered over a hundred questions just on this blog post alone. We are very busy so I apologize for the wait. I am the blog editor, but I try to engage with all comments even though we have free tax experts available to answer questions. I definitely have to file extension as HOH but was wondering if the IRS would allow me to change my filing status to something else such as Married joint when I file the actual return.

Intuit TurboTax, it’s amazing what you’re capable of. A little, tiny person that’s really bad at eating? Wieden & Kennedy and TurboTax returned to the Super Bowl in 2015 (“Boston Tea Party”) and 2016. It’s funny, and it’s relevant to football in general and the Super Bowl in particular. It even attempts to make the ad relevant to tax preparation. It says the Super Bowl might not be holiday for you, the hater of that year’s teams, the Seattle Seahawks and the Denver Broncos.

Turbotax: Turbotax Says If You Can Catch Spiders Or Have A Baby, You Can Do Your Taxes

The bottom line is a dependent must be your “qualifying child” or “qualifying relative” and meet specific tests in order for you to claim them. if you still have questions, you can connect live via one-way video to a TurboTax Live tax expert with an average 12 years experience to get your tax questions answered. other tax benefits like the Child Tax Credit (up to $2,000) or the new $500 tax credit for dependents who aren’t your children. Did you turn a four-year degree into a paycheck every two weeks and completely unlimited access to a water cooler? You know the answers to questions like that, so you’re the best person to do your taxes.

This is where Reilly turns the commercial back to the viewers and explains that using TurboTax will make you feel like you’re that centerpiece. Reilly’s hulking, silly voice helps the over-the-top effects of the prom setting really pop. In ‘Love Hurts’, TurboTax’s Super Bowl commercial, John C. Reilly tries to appeal to the masses as commercial starts out with an everyday Joe watching the big game by himself. Reilly says that, despite what we think, the Super Bowl isn’t really a holiday except for the towns whose teams are playing. He rationalizes watching a team that isn’t your favorite play the Super Bowl is like going to prom and watching the girl you love dance with some other guy throughout the entirety of the event.

My ex-husband wants to claim our 7 year old son as a dependant on his taxes for the year 2013. I have been claiming our son since our divorce in 2009. I carry all of my son’s health insurance through my company plan. If my ex wants to claim our son, does he have to carry the medical insurance? I realize I will not be able to sign up for the dependant care account since my ex will be claiming him.

If he filed his own tax return and claimed himself as an exemption, you will not be able to claim him. In addition, unless he was a full-time student for 5 months he would qualify under the “qualifying relative” rules so he could not have earned over $3,700. Keep in mind that in order to claim a child as a dependent, they must live with you for more than half the year. On your personal tax return, if your parents will claim you as a dependent then you’ll need to check a box to indicate that fact and you will not receive a personal exemption for yourself on your return. Claiming the exemptions on the W-4 will not have an impact on your mom claiming them as dependents on her taxes.

Tax Tips From Turbotax

Don’t feel bad, you would be surprised how many people scratch their heads about dependency tax laws. The question “Who can I claim as my dependent? ” has remained a top question for many taxpayers and an area where tax deductions and credits are often missed or misstated on tax returns. You can claim a dependent in TurboTax by clicking on the Personal Info Tab, under the You & Your Family sub-tab. You will see an area in the summary table on Dependents, click on Edit next to that topic.

Someone told me this year that she can apply for a W-7 and I can claim her. I am afraid that claiming her would create a red flag to the INS and get her deported and I get in trouble for giving her a home. Unfortunately because you don’t meet the age requirement for being a “qualified child” and you made too much to be claimed as a “qualifying relative (over $3,700)”, she cannot claim you. If social security income is the only income you receive then it is most likely not taxable income so claiming your son may not be beneficial. Yes you can claim them as an exemption on W-4, but if you increase your exemptions on your W-4, you’ll have more money each paycheck which means you may pay more taxes when you file your taxes. Claiming more exemptions could be a good choice if you usually get a large refund each year and would rather receive that money in your paycheck each pay period.

The Child Tax Credit applies only for children who are under age 17 at the end of 2011, so since both of your children were 17 or over, you no longer qualify for that credit. As far as the education, this deduction is located in the Federal Taxes Tab, Deductions and Credits sub tab, under the Education Topic. If you follow along the interview, the product will ask you if anyone on the return, including your dependents, when to school. I and my daughter use TurboTax to prepare our taxes. Regarding your wife’s brother, you may be able to claim him as a “qualifying relative” as long as he doesn’t make over $3,800 for 2012, $3,700 for 2011 and he meets the other qualifications per the blog post. TurboTax will ask you the appropriate questions if you qualify for the deduction.

Except, unlike the prom, the Super Bowl features professional commentary, statistical breakdowns and slow-motion replays. Sure, tax software doesn’t seem like the most impressive thing to make a Super Bowl ad about, but John C. Reilly’s narrations atop a failed love story make it quite funny. All we know is that while football season is nearly over, this Sean character looks like he is having the time of his life.

Submissions should come only from actors, their parent/legal guardian or casting agency. Submit ONCE per commercial, and allow 48 to 72 hours for your request to be processed.

New Turbotax Ad Celebrates All You Did Over The Last Year And Now Wants You To Do Your Own Taxes

If you thought the game starting with a safety was a shock, then came the reveal that our poor protagonist and his plight was all to get you thinking about the looming tax season. TurboTax speaks directly to you — yes you, sitting on the couch eating buffalo chicken dip — in its Super Bowl commercial. Created via Wieden & Kennedy, the spot reminds you that watching the Broncos play the Seahawks is just like going to prom and watching some other guy get lucky. Somehow, the whole thing comes back to tax season — and the fact that the software can help you get your holiday, and your money, back. Last year was probably a pretty busy one for you, right? Between work, family, friends and maintaining that carefully crafted social media persona, you got a lot of stuff done.

She goes to Community College full time and the only income she recieves is from her student grant which is about $4800 for the year. My husband provides rent, pay all bills, and provides all food and nessecities for our Niece also. we just found out her mother claimed her without our knowledge which I think is totally unfair. We dont get no cash aid or food stamps for her just medi-cal. Did you know you may be able to claim your couch potato friend as a dependent? Did you realize that the support of your struggling aunt who didn’t live with you may qualify your aunt as your dependent?