Content

Similarly, if you know you’re near the threshold for the medical-expenses deduction, moving that root canal up might make the pain more bearable if the cost suddenly becomes deductible, too. Depending on your income, marital status and how many children you have, you might qualify for a tax credit of up to almost $7,000 in 2020 and 2021. Should you fill out paper forms, use tax software or hire a tax pro?

If you own a home, for example, your itemized deductions for mortgage interest and property taxes may easily add up to more than the standard deduction. You get to subtract tax deductions to determine your taxable income (that’s why your taxable income usually isn’t the same as your salary or total income). If you itemize, you may be able to subtract the value of your charitable gifts — whether they’re in cash or property, such as clothes or a car — from your taxable income. And for the 2020 tax year, you may be able to deduct $300 on your tax return without having to itemize. Tax deductions and tax credits can be huge money-savers — if you know what they are, how they work and how to pursue them. tax software packagesincludes preparation and filing for only one state. Filing multiple state income tax returns often means paying extra.

For 2020 and 2021, you can funnel up to $19,500 per year into an account. If you got a huge refund, do the opposite and reduce your withholding — otherwise, you could be needlessly living on less of your paycheck all year. Answer questions to get a quote and get matched with a tax pro.

More Tax Stories

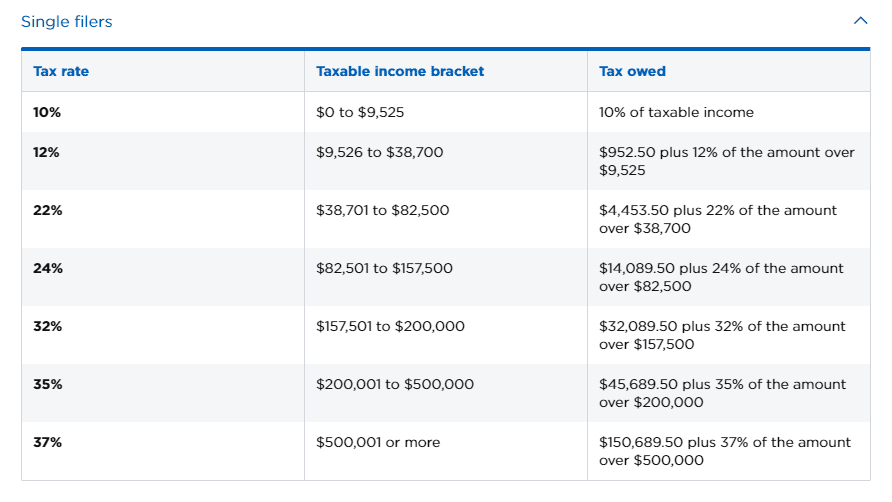

State income tax rates tend to be lower than federal tax rates. Some states tax as little as 0% on the first few thousand dollars of income.

A tax deduction lowers your taxable income and thus reduces your tax liability. You subtract the amount of the tax deduction from your income, making your taxable income lower. The lower your taxable income, the lower your tax bill. A deduction cuts the income you’re taxed on, which can mean a lower bill.

Contribute To Your Health Savings Account

You have until the April tax deadline to fund your IRA for the previous tax year, which gives you extra time to do some tax planning and take advantage of this strategy. If your employer matches some or all of your contribution, you’ll get free money to boot. IRS website, fill it out and give it to your human resources or payroll team at work. Know your bracket, how key tax ideas work, what records to keep and basic steps to shrink your tax bill.

You don’t have to do anything to qualify for the standard deduction or provide any documentation. That means that if you don’t owe a lot in taxes to begin with, you don’t get the full value if the credits take your tax bill below zero. In other words, a $600 tax bill combined with a $1,000 nonrefundable credit doesn’t get you a $400 tax refund check.

You can use Form W-4 to reduce your withholding easily right now so you don’t have to wait for the government to give you your money back later. The standard deduction is a flat reduction in your adjusted gross income, the amount determined by Congress and meant to keep up with inflation.

Tax Credits Vs Tax Deductions

a good tax advisorcan help you figure out which deductions you’re eligible for and whether they add up to more than the standard deduction. You might be able to itemize on your state tax return even if you take the standard deduction on your federal return. Instead of taking the standard deduction, you can itemize your tax return, which means taking all the individual tax deductions that you qualify for, one by one. Tax rules can be complicated, but taking some time to know and use them for your benefit can change how much you end up paying in April. Here are some key tax planning and tax strategy concepts to understand before you make your next money move. There are many valuable tax deductions for freelancers, contractors and other self-employed people.

- How much you can deduct depends on whether you or your spouse is covered by a retirement plan at work and how much you make.

- Your employer might offer a 401 savings and investing plan that gives you a tax break on money you set aside for retirement.

- Generally, the income limit to qualify for free tax help is $57,000.

- requires more forms and you’ll need to have proof that you’re entitled to the deductions.

- Learn more about what’s different for taxpayers as part of the federal government’s response to the coronavirus.

Here’s how some of the most influential tax rules have changed and how they might affect you. Think of this as your salary, or the sum of your wages and tips, plus any income from interest, dividends, alimony, retirement distributions, unemployment compensation and Social Security benefits.

Paid Tax Software Packages At A Glance

Two common ways of reducing your tax bill are credits and deductions. For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket.

Depending on the provider, these pros might be able to give you tax advice or review your whole tax return before you file. Most Americans claim the standard deduction, which we’ve pre-filled here. If you’re not one of them, change that number to the sum of your itemized deductions. (But exclude the 401 and Traditional IRA contributions you entered on the previous screen.) Also, enter any taxes you’ve already paid or had withheld. Dependents can make you eligible for a variety of tax breaks, such as the Child Tax Credit, Head of Household filing status and other deductions or credits. If you can’t pay your taxes all at once, an option might be an IRS payment plan, which is an agreement you make directly with the agency to pay your federal tax bill over a certain amount of time.

High-tax states top out around 13%-14%, and that’s often on top of property taxes, sales taxes, utility taxes, fuel taxes and whatever the taxpayer must send to the federal government. You are being referred to Facet Wealth, INC.’s website (“Facet Wealth”) by NerdWallet, Inc., a solicitor of Facet Wealth (“Solicitor”). The Solicitor that is directing you to this webpage will receive compensation from Facet Wealth if you enter into an advisory relationship or into a paying subscription for advisory services. You will not be charged any fee or incur any additional costs for being referred to Facet Wealth by the Solicitor. The Solicitor may promote and/or may advertise Facet Wealth’s investment adviser services and may offer independent analysis and reviews of Facet Wealth’s services. Facet Wealth and the Solicitor are not under common ownership or otherwise related entities.Additional information about Facet Wealth is contained in its Form ADV Part 2A available here.

Both your earned income and your adjusted gross income each have to be below the levels in the table. The standard deduction is $1,300 higher for those who are over 65 or blind; it’s $1,650 higher if also unmarried and not a surviving spouse. If you’re facing financial anxiety, NerdWallet can find ways to save. The IRS temporarily allowed people with installment agreements to skip payments, but that expired on July 15, 2020. The U.S. Treasury will disburse up to $600 per adult and $600 per child. Not everyone qualifies, and when you’ll get money depends on a few factors. Tax changes related to annual adjustments in tax rules and thresholds that could affect what you can claim and how you file.

Less taxable income means less tax, and 401s are a popular way to reduce tax bills. The IRS doesn’t tax what you divert directly from your paycheck into a 401. TaxAct is less well-known among tax software providers, but it offers quality online software that generally costs far less than TurboTax or H&R Block. It may not be as fancy in some ways, but you can get on-demand, on-screen access to a tax pro like the other guys offer, and the data-entry process is similar to most of the competition. Most tax software offers a searchable FAQ section or knowledge base, and some offer video tutorials or user forums to help answer questions. One recent differentiator has been one-on-one help from a human tax pro, live on your screen.