Content

And if you are employed, it’s likely you will see these taxes withheld from your salary in the same way federal taxes are. You can deduct all state income tax payments you make during the year (for tax years before 2018. Beginning in 2018, the deduction limit is $10,000) —which includes the withholding amounts reported on your W-2s and 1099s. Once you calculate the deduction, you must report it in the “taxes you paid” section of Schedule A.

- The IRS allows you to factor in common fees and services if they are not fully covered by your insurance plan, such as therapy and nursing services.

- The Virginia deduction for long-term health care insurance premiums is completely disallowed if you claimed a federal income tax deduction of any amount for long-term health care insurance premiums paid during the taxable year.

- You need to claim all the write-offs you’re entitled to if you really want to cut your tax bill to the bone.

- Check out our list of 20 frequently overlooked tax breaks and deductions.

The state income tax deduction can help with year-end tax planning because taxpayers can elect to increase their state tax payments at the eleventh hour to cover any expected state liability that will occur for the year. For federal purposes, you can no longer claim an itemized deduction for a casualty or theft loss unless it is the result of a federally declared disaster. For New York purposes (Form IT-196, line 20), you can claim casualty and theft losses. However, for a casualty loss that is the result of certain federally declared disasters (Form IT-196, line 37), see Other miscellaneous deductions, below. For federal purposes, the itemized deduction rules for home mortgage and home equity interest you paid in 2020 have changed from what was allowed as a deduction for tax year 2017.

If you filed a joint federal income tax return, but your Virginia filing status is married, filing separately, you’ll need to divide your deductions between both spouses. If you can’t separately account for the deductions, you can allocate them based on the percentage of income for each spouse.

Get More With These Free Tax Calculators And Money

In the years following the year of disposition, the taxpayer would be required to add back the amount that would have been reported under the installment method. Each disposition must be tracked separately for purposes of this adjustment. Enter the amount of total contributions to the Virginia Public School Construction Grants Program and Fund, provided that you have not claimed a deduction for this amount on your federal income tax return. The Tax Cuts and Jobs Act of 2017 capped the deduction for state and local taxes, including property taxes, at a total of $10,000 ($5,000 if married filing separately), starting in 2018.

Refer to Publication 17, Your Federal Income Tax for Individuals for the states that have such funds. Lea D. Uradu, JD is an American Entrepreneur and Tax Law Professional. Professionally, Lea has occupied both the tax law analyst and tax law adviser role.

The Virginia deduction for long-term health care insurance premiums is completely disallowed if you claimed a federal income tax deduction of any amount for long-term health care insurance premiums paid during the taxable year. If you itemize your deductions on your federal income tax return, you must also itemize them on your Virginia return. You can claim most of the same deductions on your Virginia return that you did on your federal Schedule A. As noted below, the Tax Cuts and Jobs Act capped the property tax deduction, along with other state and local taxes, starting with 2018 taxes.

Hold onto receipts for services and keep a file throughout the year, so you have a record of even the smallest expenses you incur for business, charity, and your health. Individuals can elect to deduct donations of up to 100% of their 2020 AGI (up from 60% typically). Corporations may deduct up to 25% of taxable income, up from the previous limit of 10%. The same goes for an RV or boat—check the registration paperwork to see if you are paying property taxes on those, too, and keep in mind the $10,000 cap on total SALT taxes.

The law capped the deduction for state and local taxes, including property taxes, at $10,000 ($5,000 if married filing separately). The higher your income, the more you care about tax deductions, regardless of where you live, because—you guessed it—you’re taxed at a higher rate. So if you make a lot of money, don’t rule out the SALT deduction, even if your state has low income taxes. Although most high-income taxpayers claimed a SALT deduction, the federal individual alternative minimum tax limited or eliminated the benefit for many of them.

Here’s How To Choose Diy Tax Software According To Tax Expert Kathleen Delaney Thomas

Virtually all who itemized claimed a deduction for state and local taxes paid. High-income households were more likely than low- or moderate-income households to benefit from the SALT deduction. The amount of state and local taxes paid, the probability that taxpayers itemize deductions, and the reduction in federal income taxes for each dollar of state and local taxes deducted all increase with income. The owner of a property must pay taxes, assessed annually by a state and/or local government, on the value of the property. A property owner can claim a tax deduction on some or all of the property taxes paid if they use the property for personal use and itemize deductions on their federal tax return. If itemizing proves to be the better course of action, taxpayers then must choose between taking the state and local income tax deduction or the sales tax deduction.

But if you’re self-employed and have to pay the full 15.3% tax yourself (instead of splitting it with an employer), you do get to write off half of what you pay. Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it’s collected more than once a year or less than once a year.

Nonbusiness taxes may only be claimed as an itemized deduction on Schedule A , Itemized Deductions. This might not change your federal tax liability because the sales tax deduction is also eliminated for purposes of calculating the AMT if you’re subject to the AMT.

Tax Policy Center Briefing Book

So, missing one is even more painful than missing a deduction that simply reduces the amount of income that’s subject to tax. In the 24% bracket, each dollar of deductions is worth 24 cents; each dollar of credits is worth a greenback. Don’t miss these frequently overlooked tax deductions, credits and exemptions. If a portion of your monthly mortgage payment goes into an escrow account, and periodically the lender pays your real estate taxes out of the account to the local government, don’t deduct the amount paid into the escrow account. Only deduct the amount actually paid out of the escrow account during the year to the taxing authority. Many states and counties also impose local benefit taxes for improvements to property, such as assessments for streets, sidewalks, and sewer lines. However, you can increase the cost basis of your property by the amount of the assessment.

![]()

If your contribution totals more than $250, you’ll also need an acknowledgement from the charity documenting the support you provided. If you drove your car for charity during the year, remember to deduct 14 cents per mile, plus parking and tolls paid, for your philanthropic journeys. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Bank statements with copies of canceled checks or debits can prove estimated payments and after-the-fact payments of state tax. “How the CARES Act changes deducting charitable contributions.” Accessed Dec. 28, 2020.

Some of these items include payments for improvements made to a local residential area, such as sidewalks, and fees for a service delivery, such as trash collection. To understand what portion of a tax bill qualifies for deduction, refer to Form 1098, which is reported by the bank or lender to the IRS and sent to the property owner. If you tally up your itemized deductions and they don’t exceed the standard deduction amount, you’re better off not itemizing at all.

When you file with TurboTax, we’ll ask you simple questions and determine which state tax payments may be deductible. We’ll walk you through, step by step, to help you get your biggest refund, guaranteed. For more information on this and other tax topics visit TurboTax.com. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Just like the federal government, states impose additional income taxes on your earnings if you have a sufficient connection to the state.

The primary purpose of the trip must be for charity, with no substantial element of a vacation. According to the IRS, to qualify, you must be “on duty in a genuine and substantial sense throughout the trip.” Capital gains property donations, such as appreciated stock, are limited to 30% of AGI, and you may no longer claim a deduction for contributions that entitle you to college athletic seating rights. For 2020 filers, due to the coronavirus pandemic and resulting CARES Act, taxpayers who do not itemize are also allowed up to a $300 deduction for charitable contributions made in 2020. Additionally, the 60% AGI limitation is suspended for itemizing taxpayers who donate to charity in 2020. Work-related expenses, home ownership, and charitable giving are all easy ways to rack up deductions.

As stated earlier, property tax can only be deducted if the owner chooses to itemize deductions. It makes sense for a taxpayer to itemize deductions if the sum of all their eligible itemized expenses is greater than the standard deduction allowed in a given tax year.

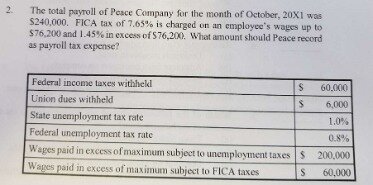

The marriage penalty refers to the increased tax burden for married couples compared to filing separate tax returns as singles. “Tax reform brought significant changes to itemized deductions.” Accessed Dec. 11, 2020. If you didn’t keep track of all your purchases and have no idea how much you might have spent on sales tax, the IRS has a solution for you. The agency provides optional state sales tax tables based on each state’s sales tax rate, your family size and your income level. You can’t deduct the 7.65% of pay that’s siphoned off for Social Security and Medicare.