Content

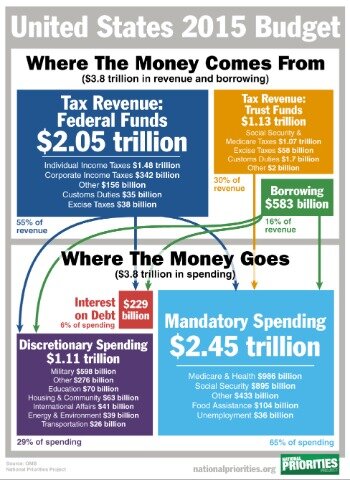

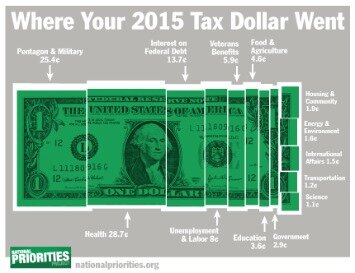

At 15 percent of the federal budget, defense spending is the last major category of federal spending and has been falling as a percent of the budget for the last decade. These are the big programs that are funded by mandatory spending. While some of the money for these programs comes out of your check automatically, some comes from taxes on your earned income and things like capital gains. These are Social Security, Medicare, Medicaid, and Veterans Affairs benefits and services. They’re called entitlements because the government takes money out of your paycheck to fund them, so you’re entitled to these benefits once you meet certain conditions. Most of your tax dollars go to taking care of other Americans, followed by paying for defense.

Discount is off course materials in states where applicable. Discount must be used on initial purchase only. Not valid on subsequent payments. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc.

See Where Your Tax Dollars Go With Your Federal Taxpayer Receipt

Promotional period 11/9/2020 – 1/9/2021. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. OBTP# B13696 ©2020 HRB Tax Group, Inc. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated.

When government leaders get greedy, property taxes go up. Unethical practices by people in power are a financial drain on the community and can result in years or decades of increasing property taxes as the only way to pay for the malfeasance. Credit.com receives compensation for the financial products and services advertised on this site if our users apply for and sign up for any of them. Compensation is not a factor in the substantive evaluation of any product. The children are our future—but you might not know it by looking at how federal funds are spent.

Use of for Balance is governed by the H&R Block Mobile and Online Banking Online Bill Payment Agreement and Disclosure. Once activated, you can view your card balance on the login screen with a tap of your finger. You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance.

Deficits, Debt, And Interest

Most state programs available in January; release dates vary by state. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. File with a tax Pro At an office, at home, or both, we’ll do the work. Try Your Federal Taxpayer Receipt now to see where your tax dollars went. Interested in finding out how your hard-earned tax dollars are spent?

But as your accountant will tell you, the tax code offers hundreds of ways to reduce that liability with deductions, exemptions, credits and other IRS voodoo. Southern New Hampshire University is a registered trademark in the United State and/or other countries. H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit. Additional feed may apply from SNHU.

See your Cardholder or Account Agreement for details. Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details. Enrolled Agents do not provide legal representation; signed Power of Attorney required.

National Defense

Others believe defense and corporate subsidies dominate the budget. Last month rapper Cardi B asked a slightly more profane version of the same question many Americans ask when they file their taxes. A handful of states don’t have any state income taxes. But many, many more states do have them.

Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only.

Growing government spending threatens higher taxes on current and future taxpayers. Without serious spending reforms, taxes will go back up.

How Are Our Tax Dollars Spent?

E-file fees do not apply to NY state returns. Looking at the graphic, you can see half of all spending goes for Social Security benefits and Medicare, while another 20% is for defense and military benefits. Fringe expenses include education, food stamps, refundable credits, transportation, and SSI. Tax Day shows how your individual income taxes were spent.

Fees for other optional products or product features may apply. Limited time offer at participating locations. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return.

- Washington already takes too much of the money that Americans work hard to earn.

- Again, this tool is entirely free, and we mention that frequently in our articles, because we think that it’s a good thing for users to have access to data like this.

- he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

- You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

- Applies to individual tax returns only.

However, that was only around 16% of the total budget. Social Security accounts for the largest amount of mandatory spending. In 2019, the program accounted for 38% of all mandatory federal spending. That was around 23% of the total budget, or about a trillion dollars. For comparison, $4.4 trillion was around a fifth of the total national GDP for that year. GDP, or gross domestic product, is the value of all the goods and services provided or made within the country during that year.

If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan.

Education Credit & Deduction Finder

Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. How long do you keep my filed tax information on file? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office.