Content

Filing taxes doesn’t have to be complicated for newcomers. The more you learn about the tax system, the less stress you’ll feel when filing your first tax forms. Click “File” in TurboTax, then click “Open.” Browse to the location of your tax return, then double-click it to view it. It includes questions to help determine whether or not you need to complete a tax return and assess eligibility for the relief funds. You can also choose whether you want to receive your stimulus funds by direct deposit to your bank account or via a mailed check. TaxAct is more sophisticated and provides more support than e-File, but it still doesn’t offer the level of polish or support that TurboTax offers with its priciest options.

Once connected, TurboTax will automatically upload any relevant tax documents. It also allows users to upload relevant tax documents directly to the site. This can streamline entering information related to interest or capital gains. All users have access to TurboTax Assistant, a chatbot, or a contact form. Embedded links throughout the process offer tips, explainers and other resources. And help buttons can connect you to the searchable knowledge base, on-screen help and more.

If deductions are later questioned by the IRS, Reed says, deductions for which you have no supporting documentation will be disallowed. The need to account for deductible expenses is one requirement for which being a pack rat pays off.

Forms may be mailed to you or you may be able to access them online. If you haven’t received your W-2, check with your employer, online, or even with the IRS. TurboTax tax software can import your W-2 electronically and even notify you when your W-2 is available to begin your tax return.

Tips For Choosing A Tax

A favorite new feature may be the interest free refund advance loan. This loan is available to anyone expecting a refund in 2021. The loan ranges from $250-$2,000 , and can be funded as soon as December 3, 2020. Unlike lots of loans you’ll see at this time of year, the interest free loan is free from gotchas . If you don’t qualify for completely free pricing from TurboTax, check out H&R Block which is supporting free filing for people with education related expenses . We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

This year TurboTax has also expanded its free tier to include unemployment income (reported on a 1099-G form). NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions.

TurboTax and H&R Block are two of the most well-known tax-filing services. There are other great services to consider, though, so make sure to shop around. Check out our list of thebest tax filing software, as well as thebest free online tax software. Of course H&R Block and TurboTax are not the only two tax filing services. You may want to consider other options like TaxAct orTaxSlayerif you’re looking for a budget option.Credit Karmaalso allows you to file entirely for free.

TurboTax’s Premier option is the best choice for those with investments and real estate property. TurboTax Live Deluxe adds in CPA and EA assistance for $120 plus $55 per state return. The software lures you in at a cheaper level and often upsells you to a higher tier if you aren’t careful.

Featured Tax Reviews

All products, including TurboTax Free, let you view TurboTax’s extensive database of FAQs and tax-related articles to help you understand potentially confusing concepts. You can get free help from their online community of TurboTax specialists and customers, too. Customers may not always provide accurate information which could cause problems with your taxes. The desktop software includes five federal e-files with each purchase, which is a contrast from the online option. That means you can split the cost between multiple returns if you have a big family. All versions of TurboTax Desktop come with U.S.-based phone TurboTax product support. If you’re doing taxes for yourself, and only have one source of income, chances are high you can file for free.

That said, TaxAct’s pricing reflects this with overall lower prices when compared to TurboTax. However, H&R Block doesn’t offer as robust support options as TurboTax.

Even if you did earn a little money on the side but didn’t receive a Form 1099, that does not exempt you from reporting that income to the IRS. You must also consider filing status—such as single, married filing jointly or head of household. Most deductions require an invoice and proof of payment, such as a canceled check or credit card statement.

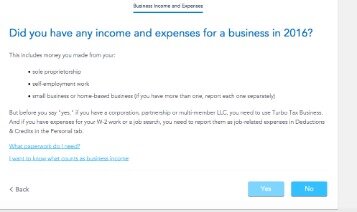

If you need assistance when completing your return, TurboTax’s support options provide a better experience. TurboTax Self-Employed is the version self-employed individuals need. If you’ve ever worked for yourself, you know how complicated and stressful tax time can be. TurboTax’s Self-Employed packaged helps take the stress out of the season. It includes all the features in the Premier option, as well as software-based guidance tailored to freelancers, contractors, and small business owners.

Income Above $72,000:

• NEW this year, connect with a dedicated expert who’ll do your taxes for you—start to finish. You can be 100% confident your return is done right, guaranteed. • Talk live on screen with a real tax expert for unlimited tax advice and an expert final review before you file with TurboTax Live. TurboTax is once again delivering an incredible user experience. It makes tax filing intuitive and relatively simple, even for people with complex filing situations. But such a premium product generally comes at a high price. If you don’t qualify for TurboTax’s free pricing tier, the price can be tough to swallow.

A percentage-based indicator of a user’s progress would be a welcome addition but could be difficult to implement due to each person’s situation being unique. All in all, the best feature of TurboTax is the user experience of the software. The interactive card-based design helps make the tax-filing process a bit less painful, and the quippy content doesn’t hurt.

Our team is dedicated to making constant improvements and preventing future challenges. While the price increase may seem like a challenge, upgrading your TurboTax product ensures that our service is better suiting your needs. Our mission is to provide you with the accuracy you deserve for every tax season. We value your data & that is why I ask you to reach out to TurboTax support on Facebook, Twitter or email us here at regarding your receipt for this purchase.

Turbotax Review Video

One of the first things to do is gather all of the forms you’ll need to file your tax return. Consider starting a folder for your tax return at the beginning of a tax year. Then, put any important tax information you receive in that folder until you’re ready to file your tax returns. TurboTax, which is owned by Intuit Inc., partnered with the IRS to create a stimulus registration product to make it easy for those people to fill out a simple tax return. For most individuals, whether they qualify will be based on their adjusted gross income on tax returns for 2019. If they have not submitted those returns yet, their 2018 information will be used. TurboTax’s free version is the best and most cost-effective option for those with the simplest tax situations.

There are three paid plans that run from $60 to $120 for federal filing. H&R Block has provided consumer tax filing service since 1955. It’s become one of the most popular filing services since then, because it combines simple tools and helpful guidance. That’s useful whether you’ve never filed taxes or whether you’ve been filing for decades. To file your back tax returns, you will need the W-2s or 1099 forms you received for those tax years to report your income. If you are eligible for deductions and credits, you must also gather any receipts or other supporting records that prove your eligibility to claim them.

- The text in the bill codifying the Free File program has long been sought by lobbyists for Intuit.

- In order to file Schedule C with H&R Block, you’ll need to upgrade to the Self-Employed option, which costs $104.99 for a federal filing.

- Comparable to Credit Karma Tax, FreeTaxUSA is mostly free — except you’ll need to pay to file state taxes.

- Tax Calculator by Chris Hutchison Estimate how much you’ll owe in federal taxes, using your income, deductions and credits — all in just a few steps.

TurboTax 2021 is one of the best options for most filers in terms of features and ease of use. It offers a wide range of products and services, including free filing through small business, and it also offers tax refund advances. People who have those situations will pay $0 to file Federal taxes and $0 to file your state return. As an added bonus, filers who qualify for the free tier can have their returns reviewed by a tax expert for free if they file by February 15th. This is the only free offer that we’ve seen where a person reviews taxes. Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free.

The text in the bill codifying the Free File program has long been sought by lobbyists for Intuit. It’s not exactly a secret that this Free File program isn’t working well. While the orange “See If You Qualify” link did take us to the real Free File program, the blue “Start for Free” link brought us back to the version of TurboTax where we ended up having to pay.

Click “View your returns from prior years” on the Welcome Back screen. If you don’t see this link, click “Tools” and “View Past Returns.” Save the TurboTax software to your desktop, then double-click it to install it on the computer. Double-click TurboTax to launch it when installation completes. Don’t open your return first; this may cause undesirable results. Enter your TurboTax username and password, then click “Log In.” TurboTax displays your return from the prior year only.

What Happens If I Miss The Tax Deadline?

However, as many as 10 million Americans do not file tax returns, often because they have little to no taxable income. TurboTax’s online series of products offers one-on-one support with TurboTax specialists. These professionals can draw on your screen to help you fix any issues you have, but they’re not certified tax experts, such as CPAs or EAs. If you need to file a state tax return, you can expect to pay $45 per state, and e-filing a state tax return will cost you an extra $25 . Some desktop packages come with one state tax software but not e-filing. TurboTax offers four tiers of pricing in three different sets of options. The level of tax-related services and bonus features you get access to depends on which option you select.