Content

However, state tax filing is not free, and the cost of using TurboTax to file state returns is not presented to the user until they’ve already completed entering their information for federal returns. While TurboTax lets you prepare different types of basic tax returns and includes a series of special tools to help you obtain the highest refund possible, there is a fee required to actually file. This applies to both federal and state returns separately, unfortunately. If you did 1099 contract work or have other, more complicated forms to file, you’ll either need to upgrade to TurboTax’s Deluxe version or file that particular paperwork on your own. It does everything that the Premier version does, but it also maximizes business tax deductions and depreciation.

Laws concerning the use of this software vary from country to country. We do not encourage or condone the use of this program if it is in violation of these laws. But Turbo Tax also allows efiling of Federal returns which are then rejected by the IRS. Such Fed returns must be mailed, not efiled, but Turbo Tax does not tell you this. For users who just have basic paperwork to file and want an easy interface on which to do it, give TurboTax a try.

Turbotax Editors Picks

TurboTax offers support in many ways depending on the product you use to file your return. All products, including TurboTax Free, let you view TurboTax’s extensive database of FAQs and tax-related articles to help you understand potentially confusing concepts. You can get free help from their online community of TurboTax specialists and customers, too. Customers may not always provide accurate information which could cause problems with your taxes. TurboTax Free is the cheapest option, but it’s only for people with the simplest tax situations.

You choose the right pro for your tax situation, upload your documents, and the tax expert will prepare and file your taxes for you, online of course. Additional fees will apply, presumably based on the complexity of your return. You can also stay connected to your pro year-round for answers to any tax questions you may have. Read on for our review of TurboTax and see what’s new for those filing their 2014 tax returns. These companies websites do the same exact thing for free, and if you do need the “Deluxe” features, there are numerous prompts to upgrade as you fill out your information.

I’m Glen Craig – I used to live paycheck-to-paycheck, drowning in credit card debt. Free Audit Support – This includes free one-on-one phone consultations to determine next steps, answers to audit questions all year, and free advice about what to expect during your audit. Accurate Calculations – TurboTax offers to pay for any interest and penalties you face if you receive notice from the IRS that your return was inaccurate due to a calculation error. ItsDeductible – This app helps you keep track of everything you donate throughout the year, so that you can import the total into TurboTax at tax time. Glen’s Note – This could be useful if you have recurring Subscribe and Save items through Amazon. This way the gift card is going towards items you would already buy rather than going on a spending spree. This feature was included in our 2013 TurboTax review, so it isn’t completely new.

TurboTax’s Premier option is the best choice for those with investments and real estate property. TurboTax Live Deluxe adds in CPA and EA assistance for $120 plus $55 per state return.

It uses the same card-based design, except you can tap and swipe instead of clicking. TurboTax’s Live lineup of products offers assistance from CPAs or EAs. These tax professionals have certifications that prove their tax knowledge. This should make you feel comfortable that you’re getting the right answers when you ask detailed questions about your tax situation.

You should always save your return both ways as the .tax2015 file and the pdf file. The most important reason is there are new tax laws every year and the software has to be programmed to accurately reflect new tax laws. QuickBooks Pro “Small business accounting software that makes accounting easy with tools to organize your finances all in one place.” We’d like to highlight that from time to time, we may miss a potentially malicious software program.

Please note that by clicking on this link, you will leave the IRS web site and enter a privately owned web site created, operated and maintained by a private business. The advantage to using a credit card is that money doesn’t come out of your account when you make a purchase, so you don’t have to appeal to the bank to get your money back if fraud occurs. Several red flags should have stopped him from making the purchase. Blvdsoftware.com claimed it had been in business since 2005, but a check of the site’s WHOIS registration records showed it was created in late October 2011. The site said that Blvdsoftware was a company in Beverly Hills, Calif., but the California Secretary of State had no record of the firm, and Google Maps knew nothing of the business at its stated address. TurboTax only allows you to view your 2010 Free Edition return until mid-October of 2012.

- This edition is specifically designed for investments and rental property.

- It is one of the largest players in the tax preparation software industry.

- If you have a simple tax return , TurboTax Free is unbeatable for e-filing your federal return, both in ease and price.

- TaxAct even offers a free option, including free state tax preparation.

- States are accepting e-file on 1/30 in conjunction with the IRS open date.

- Scott Henry scoured the Web for a good deal on buying tax preparation software.

TurboTax is great for the millennial crowd or anyone who enjoys a smooth user experience and immediate gratification. It provides quick support wait times and a running tally of your expected tax refund or tax owed amount, too. However, H&R Block doesn’t offer as robust support options as TurboTax. That’s likely because H&R Block offers in-person preparation for customers who prefer more help. TurboTax’s online series of products offers one-on-one support with TurboTax specialists.

Tax Tools

It likely includes new features, and seems to consolidate several mobile apps into a single app. Amazon has the “Deluxe” federal for $25.95….so both of these sites are cheaper than the fake site….

Save the TurboTax software to your desktop, then double-click it to install it on the computer. Enter your TurboTax username and password, then click “Log In.” TurboTax displays your return from the prior year only. If you need to view earlier returns, you’ll need to request them from the IRS . If you don’t have the right version, you must convert it to a PDF to view it. Right-click the file, then click “Open file location” or “Open folder location.” Note the location of your return. In its 2012 Form 10-K, Intuit said that “We anticipate that governmental encroachment at both the federal and state levels may present a continued competitive threat to our business for the foreseeable future.”

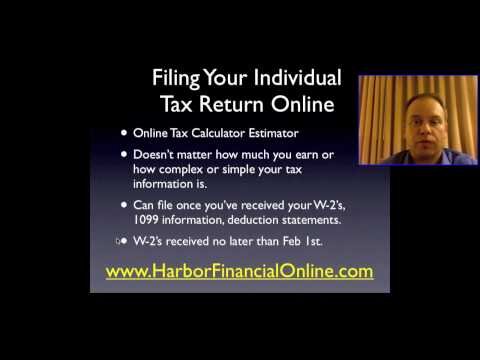

In 2003, Intuit faced vocal criticism for its TurboTax activation scheme. The company responded by removing the product activation scheme from its product. In 2005 TurboTax extended its offering by allowing any taxpayer to use a basic version of its federal product for free as part of the Free File Alliance. By 2006 that offer has been limited to free federal online tax preparation and e-file for taxpayers whose adjusted gross income is $28,500 or less (or $52,000 for those in the military) and those 50 or under. TurboTax has received a number of complaints regarding its advertising of the free version. For filers who use this basic version of the software, federal filing is free.

Turbotax 2012 Is Up To Date: You Can Start Your Taxes Today!

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can share your screen with these professionals so they can guide you to solutions faster or see what may be causing problems with your return. It’s also worth noting that the desktop version of the software randomly closed during testing, citing a connection error. While this wasn’t a major issue during the review process, it would have been a very different story at 10 p.m. TurboTax Live Premier costs $170 plus $55 per state return and adds the help of a CPA or EA professional. People with these situations who don’t feel comfortable with the tax impacts may want to consider upgrading to Live Premier for help from a CPA or EA. These options are best for those who own a home and have children or dependents, prefer a bit more CPA or EA help, or even those who have experienced some sort of major life change and have questions.

It also guarantees the largest refund or smallest tax amount due based on your circumstances, and it offers audit support from tax professionals all year long. While you’ll usually need to input your tax forms on a desktop or laptop, certain versions of TurboTax may allow you to input your tax forms by using your smartphone. You just snap a photo of your W-2 and the information automatically populates. If you’re confused when it comes to doing your taxes, even if they’re fairly straightforward, then using TurboTax is a solid DIY option. It is one of the largest players in the tax preparation software industry. However, you may still be able to download any updates to the 2012 software once installed and the state software may also be available for install. But this is not guaranteed since the software is no longer supported.

Tax-Rates.org has reviewed some of the best income tax software available in order to help you choose the tools that are right for you. A well-known name in online tax preparation, TurboTax lets you enter all of your basic tax information from your W-2 form online in preparation for federal filing. Similar to other online tax preparation services like TaxAct and H&R Block, TurboTax features all the tools you need to prepare your federal tax return. It’s specifically designed for those who file Forms 1040A and 1040EZ.

© 2021 Tax

If you’ve ever worked for yourself, you know how complicated and stressful tax time can be. TurboTax’s Self-Employed packaged helps take the stress out of the season. It includes all the features in the Premier option, as well as software-based guidance tailored to freelancers, contractors, and small business owners. Many tax preparation services and software claim to get you the maximum refund. Every service should, in theory, prepare your tax return optimally based on your situation.

States are accepting e-file on 1/30 in conjunction with the IRS open date. You can file with TurboTax today so your taxes are the first in line to be filed. Plus, highly qualified TurboTax tax experts are available year-round for free so you can get answers to your tax questions, even before starting your returns. And only TurboTax lets you talk to certified public accountants, IRS enrolled agents or tax attorneys as often as you like while you’re preparing your tax return, free. We have scanned the file and URLs associated with this software program in more than 50 of the world’s leading antivirus services; no possible threat has been detected.

Taking Tax Software For A Walk

Filing your taxes with TurboTax feels more like a conversation with an understanding financial advisor. The blows of disclosing your income and digging through your home filing cabinet looking for misplaced W-2s are softened a bit by the software’s penchant for a great user experience and a bit of snarky humor.