Content

If you aren’t eligible again, your excess contribution in 2012 stayed as excess contribution for 2013 again because the deadline to remove it passed on 12/31/2013. This triggers another 6% excise tax. If you are eligible to contribute to Roth for 2013 and you already contributed, you can withdraw 2013 contribution down to $500. Last April I opened a traditional IRA with an after-tax contribution of $5000. Soon after I instructed my broker to convert it to a Roth IRA, attempting a “backdoor” Roth to avoid penalties based on income limitations.

I don’t know why TurboTax does it that way. Maybe that’s just how the IRS wanted and TurboTax is simply following the instructions. Hi Harry – thank you so much for the visual explanations! I have some questions regards to 1099R forms. Sorry in advance for a long comment.

All my contributions to Trad IRA from tax years 2011 to 2015 are 100% non- deductible. I’ll be honest though, I’m having a very hard time following what you’re doing. Perhaps if you list out year by year what you contributed and when, whether it was deductible or not, whether you converted it, and your year end balances someone can assist you. Otherwise, you may want to consider hiring a pro to help you sort through all this. For my wife, she contributed in for 2014 and 5500 for 2015 contributions. The whole amount was rolled out into Roth in 2015.

How To Enter Mega Backdoor Roth In Turbotax: A Walkthrough

Continue answering the questions thrown at you. One of them will ask you about your total Roth contributions in all years. If that number is larger than your withdrawal, the meter will come back down.

The deadline to contribute for 2013 was April 15, 2014. Not sure why your IRA custodian accepted your contribution for 2013 in May 2014.

A Roth conversion is not a rollover. Plus, since you contribute after-tax dollars, you are able to withdraw your contributions at any time, tax-free and penalty-free. If you participate in a workplace-based retirement plan, you can still make tax-deductible contributions to an IRA if you are single and your income is less than $65,000 in 2020. If your business is not incorporated, you can kick in 20% of your self-employment income (which is total business income minus half of your self-employment tax) up to the same limit. And, if you are 50 or older, you are eligible for an additional $6,500 in catch-up contributions for a total of $63,500. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

I called Wells Fargo and told them to move my trad IRA contribution to a newly opened Roth IRA on Feb 2012. I thought I have taken care of this… I also told my tax accountant of this.

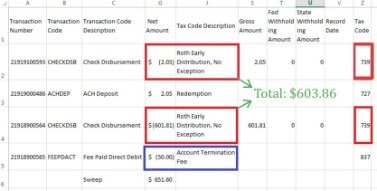

Shouldn’t Box 2 be only $20, the actual gain? If you input the full $5520 on Box 2, Line 15b on the 1040 will show the full $5520 as taxable, not just the $20. After quite a bit of trial and error I found that another, unrelated 1099-R form that I had previously entered was messing things up.

I’m just concerned because of the larger discrepancy of income over the ROTH income limitations via the front door method if we filed MFS. Harry, You are the go-to man every year for reporting this!

Where Can I Get Help For My Turbotax Questions?

This is essentially the free version but with on-demand video access to a tax pro for help, advice and a final review. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Here is a list of our partners and here’s how we make money.

Not sure if this was something specific to my situation or what. Strangely, TT used to have a screen telling you it was keeping track of your nondeductible IRA contributions but that screen is nowhere to be found in the 2012 version. Lars, my financial advisor told me to use “contribution” instead of “conversion” for the Roth IRA. That, plus the screen shots in this article, helped me finish my return without the tax penalty.

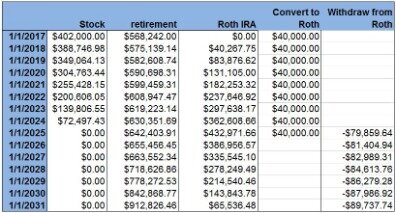

I also open a second traditional IRA to receive rollover funds from 2 former employers’ 401Ks. At the end of the year, account A had zero and account B has a $200K balance. If I put $200K as the total year-end balance, TT taxes my $5,500 contribution. It works only if I put zero like you said, but is that being misleading or incorrect?

I think it was internally computing Worksheet 1-1 of Publication 590-B to get Lines 13, 15, 17 and 18 of Form 8606. Tough to tell because TT does not include that Worksheet even in the “All Forms” version of the return but that is my best guess. Sam – I don’t know what triggered your screen. If you follow the same sequence as I showed here you don’t see that screen at all. The “Tell Us the Value of Your Traditional IRA” screen has three boxes.

Ways To Pay The Tax

If you did your previous year’s tax return wrong, fix your previous return first. Make sure your entry matches your 1099-R exactly. In our example, we assume by the time you converted, the money in the Traditional IRA had grown from $6,000 to $6,200. Employers are allowed to offer a Roth option for their 401 plans.

Fidelity cannot guarantee that the information and content supplied is accurate, complete, or timely, or that the software products provided produce accurate and/or complete results. Fidelity does not make any warranties with regard to the information, content or software products or the results obtained by their use.

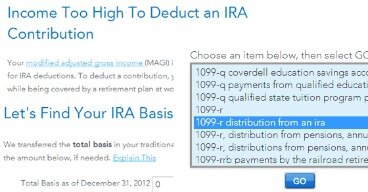

Now I’m confused how I designate the IRA contribution as non-deductible (even though it figured out I couldn’t have the deduction due to my income anyways). You can choose to split your contributions between a traditional and a Roth 401 as long as your combined contributions do not exceed the annual limits. If these nondeductible contributions represent your only IRA money, then you will just owe taxes on the earnings when you convert to a Roth IRA. However, you will not receive a tax deduction for these contributions.

(I’m not overly confident that I’ve done 2012 amended properly). I thought I’d have to go to an accountant to figure this out – you saved me a trip and a few bucks, which I’ll be happy to contribute to the tip jar. According to this article on TurboTax community, all conversions are rollover. I can only tell you what I would do if I run into the same situation. John – You enter it similarly to the first part in this article.

The one filed for tax year 2014 was wrong because the CPA did not report non-deductible contribution for 2014 ($5500) on line 1 of 8606. Hence the amount on line 14 is wrong. I need to report that non deductible Trad IRA contribution of $5500 for tax year 2014. Reading WCI I kind of have a sense of what the corrected 8606 for 2014 should be, but as I look at form 1040X, I do not see a line where I can report that $5500 for 2014 (line 1- line 30). It would be extremely helpful if you could tell me where (which line)that amount goes to.

- It would be rare to have two mistakes on top of each other and end up matching the reality.

- The use of the TaxAct branded tax preparation software and web-based products is governed by TaxAct’s applicable license agreements.

- If you participate in a workplace-based retirement plan, you can still make tax-deductible contributions to an IRA if you are single and your income is less than $65,000 in 2020.

- This 1099R from IRA provider looks exactly like the one you would get by doing backdoor Roth as shown in your post “How To Report Backdoor Roth In TurboTax”.

Instant feedback from that running meter isn’t always good. Harry, I used this primer last year and it was a huge help. So, thanks for updating it for this year as this is my second time converting. Prior to these two conversions, I’ve never held a Traditional IRA. I just finished entering all of my information, but have a couple of questions.

Turbotax’s Ease Of Use

We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you. You have the option of paying for the software out of your refund. But there’s a $40 charge to do that. Other options include applying the refund to next year’s taxes and directing the IRS to buy U.S. If you want someone to represent you in front of the IRS, you’ll need TurboTax’s audit defense product, called MAX. It runs an extra $60 and includes features such as identity theft monitoring, loss insurance and restoration help.

Your line 13 is still wrong if you didn’t take any distribution in 2012. Find where you originally entered it and delete it. If you can’t find it, contact TurboTax support.

@Fhickson – It’s basically asking you whether you filed a form 8606 before. ‘Yes’ is the right answer because you did. The basis number it’s looking for is the number on line 14. If yours is 0 then enter 0, as I showed in the screenshots. Some people contribute for the previous year and then convert. The ‘Total Distribution’ box doesn’t matter. Turbo Tax should handle this properly.