Content

The merchants and information and service providers offering merchandise, information and services through the Site set their own prices and may change prices or institute new prices at any time. You agree to pay all charges incurred by users of your account and credit card or other payment mechanism at the prices in effect when such charges are incurred. You also will be responsible for paying any applicable taxes relating to purchases through the Site. Comparison pricing and features of other online tax products were obtained directly from the TurboTax®, H&R Block®, TaxAct®, Jackson Hewitt®, and Liberty Tax® websites on March 1, 2021. Filing with all forms, including self-employed.

- EY is a global leader in assurance, consulting, strategy and transactions, and tax services.

- That’s no problem with our complimentary email and live phone support!

- On the same theory, teeth whitening is out too – sorry.

- The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled.

- H&R Block tax software and online prices are ultimately determined at the time of print or e-file.

- Or do your own with expert, on-demand help.

2.@tstucsonaz suggested going to forms and entering each value again. I just pressed enter for each box and went down into the supporting details where they existed and did the same there.

Box 2890, Sacramento, CA ; or at Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings® account.

The Ultimate Medical Expense Deductions Checklist

We simplify the process by calculating your estimated taxes and providing quarterly estimated tax forms to assist you in paying your income taxes, including your self-employment tax. You don’t need to know all of the medical expense deduction rules. TurboTax will walk you though all of the medical expense deductions you are eligible for.

We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

In other words, if your insurance company pays for your expense , such expenses are not deductible. It must be genuinely “out of pocket” in order for you to have a tax deductible medical expense. If you pay part and your insurer pays part, the portion you pay is deductible. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice. Yes, as long as the total medical expenses exceed 7.5% of your total income. Remember you cannot take the standard deduction if you itemize your deductions.

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. See Peace of Mind® Terms for details. One personal state program and unlimited business state program downloads are included with the purchase of this software.

Simple Tax Returns Only See Offer Details.

You want to safeguard your tax return, just in case. In the event of an IRS audit, TaxSlayer will help you resolve the matter as quickly as possible.

And don’t forget that you can claim a deduction for the mileage driven to every doctor appointment, dentist, eye doctor, and each trip to pick up your prescriptions. If you paid the insurance premiums with money that has already been taxed then benefits are tax-free.

TaxSlayer has no obligation to monitor the Site. TaxSlayer will not intentionally monitor or disclose any private electronic-mail message unless required by law. You may not download and/or save a copy of any of the screens except as otherwise provided in these Terms of Service, for any purpose. However, you may print a copy of the information on this Site for your personal use or records. If you make other use of this Site, except as otherwise provided above, you may violate copyright and other laws of the United States, other countries, as well as applicable state laws and may be subject to penalties. Self-Employed Best for contractors, 1099ers, side hustlers, and the self-employed.

Medical Expense Deductions Checklist

Enrollment restrictions apply. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. State restrictions may apply. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only.

States have varying tax residency rules, which are crucial to understand to avoid unexpected state taxes and filing requirements. Self-employed individuals are required to pay income taxes throughout the year.

Medical costs are deductible only after they exceed 7.5% of your Adjusted Gross Income in 2020. So, if your AGI is $50,000, the first $3,750 ($50,000 x 0.075) of unreimbursed medical expenses doesn’t count. The resulting amount on line 4 will be added to any other itemized deductions and subtracted from your adjusted gross income to reduce your taxable income for the year. Additionally, as a result of the Tax Cuts and Jobs Act of 2017, the standard deduction has nearly doubled from where it was in 2016.

To get started, create an account either at or by using the mobile app, which is available for download from the Apple App or Google Play stores. How will I know the cost to prepare my return? During the registration process, you will be prompted to answer some questions about your 2020 tax year. For example, did you have a mortgage or dependents, or did you have investment income? Based on your answers to these questions, EY TaxChat gives you a fixed-fee quote for preparing your taxes. Please note that this quote may change if we learn that your returns involve additional complexity or filings.

Enter your income and we’ll guide you through the rest of your return to maximize your refund. Price is a huge advantage for TaxSlayer. People who need advanced tax software, which can run $100 or more elsewhere, can especially benefit from the price difference, particularly when adding a state return. We’ll guide you through the entire filing process to help you file quickly and maximize your refund.

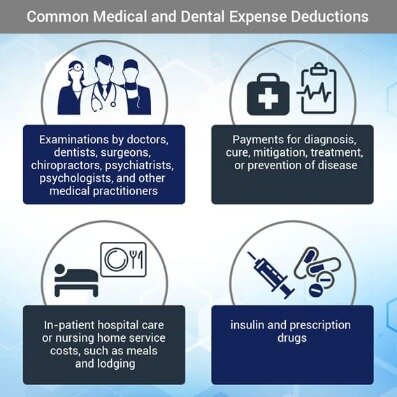

EY tax professionals consistently work with multistate filers, to submit the proper forms, credits and state tax returns. Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. TurboTax can help you with determine how much, if any, of your medical expenses are deductible, and will fill in all the right forms to claim the deduction. As you may expect, these are all legitimate medical expenses for which you can claim a deduction. Deductible medical expenses include payments necessary in order to diagnose, prevent, or treat illness. Obvious deductible expenses include visits to the doctor, dental exams, and X-rays. Also deductible are birth control pills prescribed by a doctor.

Store all of your tax info and docs for up to six years. Jump to the front of the line with priority support via email, live chat, or phone. Please check the contact us link in your my account for the support center hours of operation. Usually, email responses can be expected within 24 to 48 hours. TaxSlayer makes it easy to prepare and e-file your state return.

Intuit may, but has no obligation to, monitor comments. Comments that include profanity or abusive language will not be posted. Click here to read full Terms of Use. You cannot claim deductions for any expenses that you were reimbursed for – either by your insurance or your employer. If you’re using a medical pre-payment plan, or some other medical reimbursement plan to help with expenses, you can’t claim those expenses as deductions. If your medical procedures cost you more than 7.5% of your income, follow the next five rules to maximize your tax refund.

Premium Skip-the-line phone & email support. Plus live chat and Ask a Tax Pro. Skip-the-line phone & email support. We guarantee you will receive the maximum refund you are entitled, or we will refund you the applicable TaxSlayer purchase price paid. You may withdraw your consent to cookies at any time once you have entered the website through a link in the privacy policy, which you can find at the bottom of each page on the website.

You typically can’t deduct the cost of nonprescription drugs or other purchases for general health, such as toothpaste, health club dues, vitamins, diet food and nonprescription nicotine products. You also can’t deduct medical expenses paid in a different year. For example, if you have an AGI of $45,000 and $5,475 of medical expenses, you would multiply $45,000 by 0.075 (7.5%) to find that only expenses exceeding $3,375 can be included as an itemized deduction. This leaves you with a medical expense deduction of $2,100 ($5,475 minus $3,375). The IRS allows you to deduct unreimbursed expenses for preventative care, treatment, surgeries, and dental and vision care as qualifying medical expenses. You can also deduct unreimbursed expenses for visits to psychologists and psychiatrists. Unreimbursed payments for prescription medications and appliances such as glasses, contacts, false teeth and hearing aids are also deductible.

To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. This option requires you to provide a valid phone number, email address and bank account information in your return.

You Can Deduct Medical Expenses If You Itemize Your Tax Deductions

One state program can be downloaded at no additional cost from within the program. Additional state programs extra. Most state programs available in January; release dates vary by state. Our 60,000 tax pros have an average of 10 years’ experience. We’re here for you when you need us. We’ll find the tax prep option for you.