H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file.

Many tax preparers are happy to file amended returns as well. If you owe taxes as a result of your amendment, you should file your amendment and make your tax payment as soon as possibleto avoid further penalties and interest. If you owe taxes, you should file an amended return even if 3 years have passed. Refunds are forfeit after 3 years, but tax debts stay on the IRS books for a minimum of 10 years. What if you’ve sent in your income tax return and then discover you made a mistake?

The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Step 2: Get The Right Forms

Sometimes you need to file an amended return for something that is not your fault. For example, your employer may send a corrected form, which means the amounts you used when you filed your return need to be corrected. It’s nice if amending your return results in a refund, but, unfortunately, that’s not always the case. If you owe the government money as a result of filing an amended return, pay the tax right away to avoid additional interest and penalties. And sometimes you don’t even realize your errors until well after they’re made. But what if you suddenly realize there’s a mistake on a tax return that you filed months ago?

If there are any retroactive tax laws enacted that include new or expanded tax breaks, you’ll want to check your previous tax returns to see if you can take advantage of the new law. For example, a “tax extenders” law was passed in December 2019 that will trigger a lot of amended returns.

Check cashing not available in NJ, NY, RI, VT and WY. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. When you use an ATM, we charge a $3 withdrawal fee.

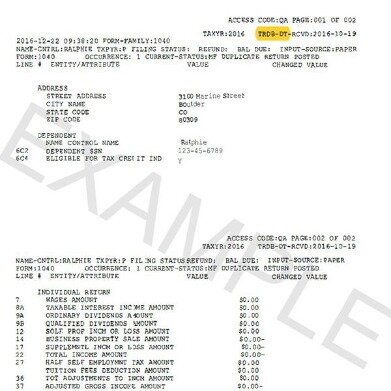

Form 1040-X will be the taxpayer’s new tax return, changing the original entries to include new information. Taxpayers should explain what they are changing and why on the second page of Form 1040-X in Part III. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. Enrollment restrictions apply. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. State restrictions may apply.

Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

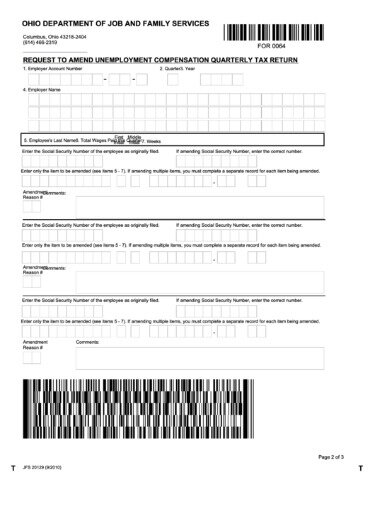

If you amend your federal income tax return, you’ll likely also need to file an amended tax return with your state. Each state has its own form to amend a tax return. TurboTax will select the right form for you when you prepare your federal amended return and supply instructions for mailing the correct forms to your state’s department of revenue. Mistakes happen and tax returns are no exception. Filing an amended tax return corrects information that changes tax calculations. This includes making changes to filing status and dependents, or correcting income credits or deductions. Don’t file an amended return to fix math errors because the IRS will correct those.

When To File An Amended Tax Return

Additional fees may apply from WGU. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year.

- For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas.

- One state program can be downloaded at no additional cost from within the program.

- Price varies based on complexity.

- Attach a statement with your amended return, and specifically ask for an “abatement” of any penalty.

- So be sure to check that, too.

Sometimes you need to make a change on your tax return after you’ve filed it. When that happens, you need to file an amended tax return. Here are some situations in which you might have to amend your tax return. The most important thing to know about filing an amended return is that you should not start over and file Form 1040 and all the attached forms again.

Tax Bracket Calculator

The IRS reports changes to federal returns to Virginia Tax. However, this can happen years after you receive your IRS notice, and interest will continue to accrue on any additional balance due starting from the original due date. To avoid additional interest on any tax due, file your amended Virginia return as soon as you are notified of a change to your federal income tax return by the IRS – don’t wait for us to notify you. And while we’re talking about state tax returns, remember that a change made to your federal return may very well affect your state tax liability, too. So, if you’ve already filed your state return, check to see whether filing an amended federal return means you’ll have to file an amended state return as well.

Attach a copy of the forms or schedules being revised. For examples, see the answer to Question 4. Trina Hargrove has managed tax, consulting and payroll accounting businesses for more than a decade. A seasoned tax professional, she’s performed individual and corporate tax preparation… Read more. If you use software or an online service to prepare your 1040X, you’ll have to print a copy to mail. It’s probably a good idea to print a second copy to keep for your records. The credit is worth up to $2,000 per qualifying child.

Should I submit a complete copy of my original and amended federal income tax returns and my original Wisconsin income tax return with my amended Wisconsin income tax return? You should submit only the amended forms or schedules that have been changed. The Internal Revenue Service has adjusted my federal income tax return. What should I do for Wisconsin? The adjustments must be reported on an amended Wisconsin income tax return.

If you realize you neglected to claim one of these tax breaks on your return, that’s a good reason to file an amendment. While the IRS will correct math errors on your behalf, it won’t sign you up for credits or deductions you didn’t ask for yourself. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office.

To claim a refund, you typically have up to three years from the time you filed your original return, or within two years from the date you paid the tax — whichever is later — to go back and amend it. For more information, see the instructions for the individual income tax return you need to amend. Don’t automatically assume you have to pay a penalty. If you amend your return before it is due , then your amendment is timely, and no interest or penalty will accrue. Also, the IRS can be quite reasonable, especially for a first-time mistake. Attach a statement with your amended return, and specifically ask for an “abatement” of any penalty. You can also the progress of your amended tax return by calling the IRS.

Make sure that you enter the correct Tax Year at the top of each 1040-X form. Sign each amended return and mail each one in a separate envelope to the IRS. If you have more questions about tax amendments, please contact eFile.com.

Unless you committed fraud or tax evasion, they won’t hold it against you. All they really want is the money. The answer to this question comes down to whether your stimulus check increases your “provisional income.”

You’ll need to reference the original tax return when filing your amended version. You’ll also need to use any new documents related to your amendment, such as a W-2 form that you didn’t have access to when filing the first time. Like the IRS, states typically use a special form for an amended return. Many states also use the X suffix for the form number. Some states allow you to e-file amended returns while others require that you file a paper return. Beginning with the 2019 tax year, you can e-file amended tax returns.

It might not be worth the effort if it’s only going to reduce your taxes for that year by a few bucks, but you do have the option. Generally, you must file an amended return within three years from the date you filed your original return or within two years from the date you paid any tax due, whichever is later. If you filed your original return before the due date , it’s considered filed on the due date.

If you file electronically, follow the instructions for your software provider. Don’t hang on to your unfiled return too long, however, because you’re afraid it’s not perfect.