Content

If taxpayers are not the child’s parents, the one with the highest AGI can claim the dependent on their tax return. Finally, the child may not file a joint tax return unless to claim a refund for taxes withheld. However, the child tax credit is phased out at higher income levels. The credit is reduced to zero in stages as income rises above $400,000 on joint returns, and above $200,000 on single and head of household returns.

This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Timing is based on an e-filed return with direct deposit to your Card Account. Vanilla Reload is provided by ITC Financial Licenses, Inc.

Sometimes if there is more than one child, the court will divide the children between the parents for deduction purposes. It is important to look at the paperwork from the divorce or custody action to see what has been determined. A court, can, however, order that the non-custodial parent be allowed to claim the child for tax purposes. The court will order the custodial parent to sign the proper IRS forms to allow the non-custodial parent to claim the child for tax purposes. The custodial parent signs IRS Form 8332 , Release of Claim to Exemption for Child of Divorced or Separated Parents, and provides it to the noncustodial parent who attaches it to his or her return. Often, the court will allow the non-custodial parent to claim the child for tax purposes only if that parent is current on his or her child support payments. In addition to filing for the purpose of claiming a refund, a dependent might opt to file to claim credits like the earned income credit.

Tax Policy Center Briefing Book

Here’s a look at where parents could score some breaks and how to avoid some common, and potentially expensive, pitfalls when filing federal income taxes this year. You can also claim a qualifying relative as a dependent if they’re too old to qualify as your dependent child. Some relatives must live with you in your home for the full year, but exceptions exist for close relatives like your parent, grandparent, sibling, niece, or nephew. You can’t claim anyone as your dependent if you’re someone else’s dependent. Likewise, no one else can claim you as a dependent if you claim a dependent. For example, if you live with your parents and have a child, you can’t claim your child as a dependent if your parents claim you.

You may file your income tax return without claiming your daughter as a dependent. After you receive her SSN, you may then amend your return on Form 1040-X, Amended U.S. Individual Income Tax Return and claim your daughter as a dependent.

What Are The Benefits Of Claiming A Child On Your Taxes?

And you can claim descendants of any of these qualifying people—such as your nieces, nephews and grandchildren—if they meet all the other tests. To qualify, a child must have been under age 17 (i.e., 16 years old or younger) at the end of the tax year for which you claim the credit.

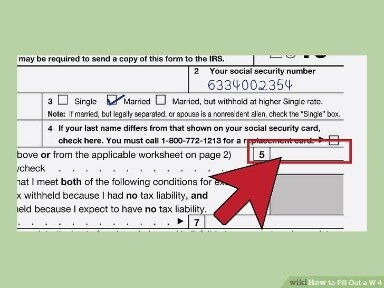

To obtain an ITIN, use Form W-7, Application for IRS Individual Taxpayer Identification Number. For more information, refer to Individual Taxpayer Identification Number . In addition to the type and amount of a dependent’s income, a dependent’s age and disability can also play a role. Earned income is all of the taxable income and wages you received from working . You can get earned income by working for someone else or for yourself. The child lived with you for more than half the year . They must have received more than half their total support from you during the tax year.

When You Can Include A Dependents Income On Your Tax Return

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The dependent must be a U.S citizen, U.S. national, or resident of the U.S. The dependent also have a valid identification number . The child also must be living with you for more than six months during the year unless divorce or separation prevents it. The birth or death of a child during the year may be exempt from this condition. your spouse must not have lived in your home for the last 6 months of the year.

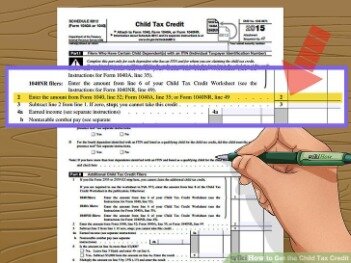

- However, you may be able to claim a refundable Additional Child Tax Credit for the unused balance.

- There is a $500 nonrefundable credit for qualifying dependents other than children.

- Similarly, you may not claim your child as a qualifying child for the CTC/ACTC if your child doesn’t have an SSN before the due date of your return , even if your child later gets an SSN.

- To be a qualifying child for the EITC, your child must not have filed a joint return with another person to claim any credits such as the EITC.

- Spouses and other dependents don’t have an age requirement, but IRS rules say they must have been physically or mentally incapable of self-care and must have lived with you for more than half the year.

The percentage you can deduct ranges from 20% up to 35%, depending on your income level. The more you earn, the less you can deduct. One of the biggest pitfalls new parents make is not claiming all the tax benefits that they’re entitled to, says Robert Tobey, a CPA based in New York with Grassi & Co. Thankfully, the IRS has quite a few breaks for parents that could help put extra money back in your pocket.

Is Child Support Taxable Income?

You cannot claim anyone as a dependent if that person also files a tax form and takes the personal exemption on it or claims dependents. Anyone who is married and filing a joint return may not be claimed as a dependent. Only one person can claim a child as a dependent during the same tax year, which means both parents cannot do so, including those who are divorced. In the case of divorce, the parent with whom the child resided for the majority of the tax year can make the claim. If both parents get equal time during the tax year, the parent with the highest adjusted gross income can make the claim.

If you’re married and filing jointly, having a child won’t change your filing status. If you use child care, check with your employer to see if they offer a child care flexible spending account. Similar to a health FSA, these accounts allow you contribute money tax-free toward your child care expenses. For someone in the 28% federal tax bracket, this income reduction means saving $280 in federal taxes for every $1,000 spent on dependent care with an FSA, Tobey says. You can indicate the year or years for which you’re agreeing to release your claim.

The proportion of families with children receiving a credit drops to 88 percent in the highest income group because of the income limits . For the most part, the CTC is not indexed for inflation. The exception to this is the amount of the credit families with children under 17 can receive as a refund. This amount (which was set at $1,400 in 2018) will increase annually with inflation until it becomes equal to the full value of the credit ($2,000). In 2020, the refundable portion of the credit remains at $1,400. Inflation has been insufficient to bump the refundable portion up to $1,500, the lowest increment allowed, by law.

Our partners cannot pay us to guarantee favorable reviews of their products or services. An adopted child is a child who is lawfully placed with you for legal adoption. Any age and permanently and totally disabled at any time during the year. For more information, see Disability and Earned Income Tax Credit. The article below is accurate for tax years prior to 2018. Some tax information has changed for tax years after 2017. have provided no more than half his or her own support for the year.

The child tax credit provides a credit of up to $2,000 per child under age 17. If the credit exceeds taxes owed, families may receive up to $1,400 per child as a refund. Other dependents—including children ages 17–18 and full-time college students ages 19–24—can receive a nonrefundable credit of up to $500 each.

you must identify the care provider’s tax identification number on your return. “You may be subject to household employee taxes, where you would have to pay some of the employment taxes for them,” Greene-Lewis says. That includes Social Security, Medicare and unemployment. “You will be amazed at how much that account grows by the time your child goes to college,” he says. He opened one for his daughter and put away $500 a month, plus some extra contributions from grandparents over the years. “My daughter is now a junior in college and she has plenty of money in her 529 plan to cover her remaining expenses with enough left over if she wants to go to graduate school,” Pon says.