Content

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. “Florida Information Locator” and “It’s Your Florida!” are registered servicemarks in the State of Florida. Doing Business in Florida — All types of business registration, licensing & permitting concerns.

- Total corrections expenditures approximate $55 billion per year nationwide, or about 5 percent of state budgets.

- Further, states levy use taxes in addition to sales taxes.

- Many states also exempt prescription and nonprescription drugs, textbooks, and clothing from general sales taxes.

- Most tax authorities have appeals procedures for audits, and all states permit taxpayers to go to court in disputes with the tax authorities.

- In addition to state prison costs, corrections expenses include juvenile justice programs and parole programs.

Medicare tax rates are 1.45% for the employee or 2.35% . An honorably discharged veteran who is totally and permanently disabled or requires a wheelchair for mobility due to their service can be exempt from all property taxes. In some circumstances, this benefit can be transferred to a surviving spouse. Total and Permanent Disability Exemptions are available for homeowners who have a total and permanent disability. Quadriplegics who use their property as a homestead are exempt from all property taxes. Others who must use a wheelchair for mobility or are legally blind and have a gross income below $14,500 in 1991 dollars, adjusted for inflation, can be exempt from all property taxes as well.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. There is a constant argument in politics about whether taxes should be higher or lower. However, despite what politicians say, there really isn’t one right answer.

State And Local Finance Initiative Subscribe To Rss

Individual income taxes are a major source of revenue for states, but they provide relatively little revenue for local governments. State governments collected $352 billion from individual income taxes in 2017, while local governments collected $33 billion . Alaska – no individual tax but has a state corporate income tax. Like New Hampshire, Alaska has no state sales tax, but unlike New Hampshire, Alaska allows local governments to collect their own sales taxes. Alaska has an annual Permanent Fund Dividend, derived from oil revenues, for all citizens living in Alaska after one calendar year, except for some convicted of criminal offenses. The United States has a multi-tiered income tax system under which taxes are imposed by federal, state, and sometimes local governments.

While we adhere to stricteditorial integrity, this post may contain references to products from our partners. We are an independent, advertising-supported comparison service.

The reason is the lowest earners in the state devote the lion’s share of their take-home pay to buying things that are subject to sales taxes. The wealthy, who can save a chunk of their income in their 401s and other investments, have a much smaller proportional exposure to the sales tax.

A tax rate is the percentage at which an individual or corporation is taxed. As mentioned above, states and the federal government differ in terms of the types of income they tax and the deductions and credits they allow. Pension and Social Security income, for example, are taxable under the federal rules, while a number of states exempt it from taxation. Unfortunately, this also includes funding for federal student loans.

Some states use a single factor formula based on sales. South Dakota – no individual income tax but has a state franchise income tax on financial institutions. States with no state individual income tax are in red; states taxing only dividend and interest income are in yellow.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Some states tax pension and Social Security income, while others do not. Take back your hard-earned cash and pay the IRS only what you have to.

property taxes, sales taxes or other taxes and fees might be higher in those states. tax software packagesincludes preparation and filing for only one state. Filing multiple state income tax returns often means paying extra. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. As of January 2020, 38 states and the District of Columbia had marketplace facilitator collection provisions.

State Income Tax Rates In 2021: What They Are And How They Work

These are the big programs that are funded by mandatory spending. While some of the money for these programs comes out of your check automatically, some comes from taxes on your earned income and things like capital gains. Let’s break it down and see where your money really ends up.

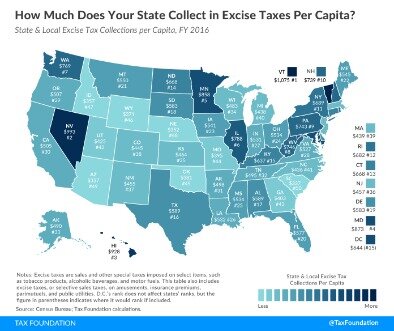

State and local governments also increasingly—21 states and the District of Columbia in 2020—tax e-cigarettes and vaping products. Colorado has the lowest state general sales tax rate (2.9 percent). No other state with a general sales tax has a rate below 4.0 percent, but the state general sales tax rate is below 5.0 percent in 10 other states .

Whether at the federal, state, or local levels, elected officials determine how taxes are spent. If you don’t like how your money is being spent, or if you’re willing to give up services to pay lower taxes, then contact your representatives and let them know. Some cities charge stadium and business license fees, supplying 2% to the total local revenue base. Other cities also charge income taxes, providing 2% to the total. States with state-level and local-level individual income taxes are in red. States with state-level individual income tax on interest and dividends only but no local-level individual income taxes are in light green. States without state-level or local-level individual income taxes are in green.

Charges and fees for state universities, public hospitals, and toll roads added another 19%. States received 5% of their income from license fees, estate taxes and severance taxes. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting for companies such as Forbes and Credit Karma. Puerto Rico is not a U.S. state but residents pay federal taxes; however, most are not required to pay federal income tax.

Information regarding these and additional taxes can be located from the list below. Circuit breaker programs provide relief for elderly and low-income residents with property tax liabilities above a specified percentage of their income. Although relief is based on property tax payments, it is typically provided via an individual income tax credit. Unlike the other approaches described here, circuit breakers can benefit renters as well as homeowners in some jurisdictions. Thirty-three states and the District of Columbia offered some form of circuit breaker program in 2018. In 22 of these states and the District of Columbia, renters were eligible for the circuit breaker program .

Forty-three states and many localities in the United States may impose an income tax on individuals. Forty-seven states and many localities impose a tax on the income of corporations. Property taxes provide the chief source of income for local governments today. Taxes are levied on land, buildings, and personal dwellings. Property must be assessed for its value, and most cities employ tax assessors for that job. Property taxes are controversial because other types of property, such as stocks, bonds, and bank accounts, generally are not taxed.

Will You Pay Taxes During Retirement?

New Hampshire was the most reliant on property tax revenue in 2017, as the tax accounted for 39 percent of its combined state and local general revenues. The next most reliant states were New Jersey and Connecticut . Overall, 10 states received 20 percent or more of their state and local general revenues from property taxes in 2017. States generally follow the federal definition of taxable income. Most begin their tax income tax calculations with federal adjusted gross income but a few use federal taxable income.

In addition to California, which has the highest state general sales tax rate (7.25 percent), four states have rates at or above 7.0 percent. Alaska, Delaware, Montana, New Hampshire, and Oregon do not have a state general sales tax. These taxes place an unfair burden on the poor, according to research from the Institute on Taxation and Economic Policy.

Nearly all of Vermont’s education spending is financed at the state level, and the state property tax is the largest source of that funding. The next-highest percentage was in New Hampshire, where property taxes were 9 percent of state own-source general revenue. The remaining local government property tax revenue is collected by “special districts,” which are specific-purpose units such as water and sewer authorities. In New Jersey, the top tax rate (10.75 percent) begins at $5 million of taxable income, and the District of Columbia and New York also have top tax rates beginning at $1 million or more in taxable income. In 2020, 41 states and the District of Columbia levied a broad-based individual income tax.

However, the Supreme Court revisited this issue in 2018 in South Dakota v. Wayfair, Inc., overturned Quill, and gave states broad authority to collect the tax. The Supreme Court upheld a South Dakota law requiring any entity with sales of $100,000 or more or with at least 200 transactions in South Dakota to collect and remit the state’s sales tax. As of March 2020, Florida and Missouri were the only states with a general sales tax but not a law requiring remote sellers to collect tax. The taxation of services (e.g., dry cleaning, carpentry work, barbershops) is more complicated. All states tax some services, but exemptions are common. Very few states tax professional services, such as doctors and lawyers.

Armed Forces personnel stationed overseas, U.S. territories other than Puerto Rico, and U.S. citizens and legal residents living abroad, even though they may be required to pay federal taxes. Most states impose a tax on income of corporations having sufficient connection (“nexus”) with the state. Such taxes apply to U.S. and foreign corporations, and are not subject to tax treaties. Such tax is generally based on business income of the corporation apportioned to the state plus nonbusiness income only of resident corporations. Most state corporate income taxes are imposed at a flat rate and have a minimum amount of tax. Business taxable income in most states is defined, at least in part, by reference to federal taxable income. States with state-level individual income tax and local-level individual income taxes on payroll only are in dark yellow/light orange.

This is a table of the total federal tax revenue by state, federal district, and territory collected by the U.S. Massachusetts taxes certain types of gains at a flat 12%; a subset of those allow a 50% deduction, producing an effective rate of 6%.

State Income Tax

Hawaii and New Mexico are exceptions to that rule, taxing nearly all services. According to the Center on Budget and Policy Priorities, an average of about 25 percent of state spending goes towards public K-12 education, about $308 billion for 2015.