Content

Budget saw abolishment of DDT and the dividend income being taxed in the hands of investor according to income tax slab rates. Certain dividends known as qualified dividends are subject to the same tax rates as long-term capital gains, which are lower than rates for ordinary income. Most dividends paid by domestic companies and many dividends paid by foreign companies are qualified and taxed at the preferred tax rate. However, distributions paid by real estate investment trusts, master limited partnerships, and other similar “pass-through” entities might not qualify for favored tax status.

The portions of the profit passed on to investors are dividends, unless the assets were held long enough for the profits to be considered capital gains. A tax rate is the percentage at which an individual or corporation is taxed.

Intuit is solely responsible for the information, content and software products provided by Intuit. Fidelity disclaims any liability arising out of your use of these Intuit software products or the information or content furnished by Intuit.

Any adjustments included on Lines 2, 3, 4, 7, 8, and/or 9, of PA-40 Schedule B, regardless of the amount, triggers the requirement for including the schedule. For tax years beginning on or after Jan. 1, 2014, dividend income reporting on PA Schedule B will begin by reporting the amount of dividend income taxable for federal income tax purposes.

This rule applies if the dividends result from time periods of 367 days or more. William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification. You must give your correct social security number to the payer of your dividend income. If you don’t, you may be subject to a penalty and/or backup withholding.

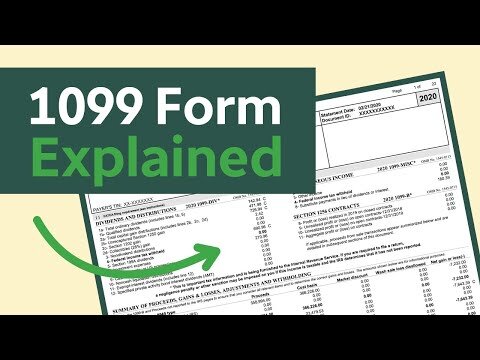

This type of income is usually reported on Form 1099-DIV to the IRS and you. You will typically receive this form if you receive dividends totaling $10 or more during a tax year. The form reports the dividends from a given financial institution, any applicable capital gains distributions, and taxes withheld, if any. Corporate dividend policy is a very important issue for shareholders, as most countries treat dividends and capital gains differently in income tax. In many countries, ordinary income tax rates are applied for dividends, while far lower tax rates apply for capital gains. This means that the tax authorities are imposing some sort of dividend penalty on the payment of dividends, so shareholders prefer a relatively light tax burden to an in-house reservation. Despite this existence of dividend penalties, many companies have chosen a significantly higher dividend rate, which is contradictory to their theoretical expectations .

Types Of Dividends And Tax Rates

What kind of retirement account you use will depend on your personal needs. Two common options are a 401 plan and a Roth IRA. A 401 is sponsored by your employer and takes pre-tax money; you pay income tax when you withdraw funds. A Roth IRA takes post-tax money; you don’t get to deduct the money you put in, but once it’s in, your money grows tax-free and then can be withdrawn as tax-free income.

- In Austria the KeSt is used as dividend tax rate, which is 27.5% on dividends.

- If you’re a partner in a partnership or a beneficiary of an estate or trust, you may be required to report your share of any dividends received by the entity, whether or not the dividend is paid out to you.

- Dividend income taxable for Pennsylvania personal income tax purposes will then be ascertained by determining if any adjustments must be made to the federal dividend income amount.

- It can be argued that it is unfair and economically unproductive, to tax income generated through active work at a higher rate than income generated through less active means.

- TurboTax can fill out the proper forms for you by asking questions about dividends you receive throughout the tax year.

- For certain preferred stock, the security must be held for 91 days out of the 181-day period beginning 90 days before the ex-dividend date.

You may not receive a 1099-DIV if you had less than $10 in dividends. If that’s the case, you should still report that income on your tax form. If you have more than $1,500 in ordinary dividends, you will need to report those on Schedule B. Then you will attach Schedule B to your 1040. For the 2021 tax year (which you’ll file in early 2022) the dividend tax rates are as follows.

Dividends Reported On Pa

Consequently, Pennsylvania law does not permit the deduction of any expenses that a taxpayer incurs to realize dividend income. However, income that can reasonably be classified either as dividend income or as another taxable class of income may in certain situations be classified into that other class of income. The dividend and DRIP taxes mentioned above apply to taxable accounts. However, tax deferred accounts such as IRAs, 401s, 403s, and 457s are exempt from immediate dividend taxation. These types of stocks are primarily owned for their income and typically have relatively slow dividend growth. Fortunately, there is a way to minimize your dividend and dividend reinvestment taxes.

For example, if NOK 100,000 has been invested in a company stock that gave a dividend of NOK 4,000, the shelter deduction is NOK 1,100 (1.1% of NOK 100,000) and the remaining NOK 2,900 is taxed at 27%. These parts can be realized and taxed at the shareholders level when dividends are paid or stock trade yields capital gains. However, when owners take dividends from their shares their cash portfolio grows but the value of their stock portfolio shrinks by the same amount, resulting in no net comprehensive income. Instead, the earlier growth of stock values gets legally recognized and taxed. However, this also includes growth that reflects previously taxed corporate income, resulting in double taxation. This was to avoid the double taxation of income as there was a 1% corporate tax as well. After 1936, dividends were again subject to the ordinary income tax, but from there were various exemptions and credits, taxing dividends at a lower rate.

Entering Dividends On Your Tax Return

The amount of the distributions should be reported as dividend income on Line 7 of PA-40 Schedule B, PA-Taxable Dividend and Capital Gains Distributions Income. Do not report any dividends from undistributed capital gains made by a regulated investment company. It should also be noted that any gain derived from the sale, exchange or disposition of the underlying shares in the fund or trust will be a taxable gain for Pennsylvania personal income tax purposes. Any loss incurred from the sale, exchange or disposition of the underlying shares is recognized but may only be offset against a shareholder’s taxable gain for the taxable year. Dividend income is a gross taxable income class under Pennsylvania law.

In the United Kingdom, companies pay UK corporation tax on their profits and the remainder can be paid to shareholders as dividends. In Finland, there is a tax of 25,5% or 27,2% on dividends (85% of dividend is taxable capital income and capital gain tax rate is 30% for capital gains lower than and 34% for the part that exceeds ). However, effective tax rates are 45.5% or 47.2% for private person. That’s because corporate earnings have already been taxed, which means that dividends are taxed twice. Dividend income received by domestic companies until 31 March 1997 carried a deduction in computing the taxable income but the provision was removed with the advent of the dividend distribution tax. However the budget for 2008–2009 proposes to remove the double taxation for the specific case of dividends received by a domestic holding company from a subsidiary that is in turn distributed to its shareholders.

For more information on backup withholding, refer to Topic No. 307. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. The IRS states you must also use this form to report dividends if you are a signer on an account in a foreign country, or if you grant, transfer, or receive any funds to or from a foreign trust.

However, the income thresholds for each bracket will be adjusted for tax year 2021 to account for inflation. Similarly, capital gains taxes, which you pay for qualified dividends, are at the same rates as 2018 but with income brackets changed slightly due to inflation. As of the 2019 tax year, individuals who make less than $39,375 in taxable income, and married couples who make less than $78,750, do not pay federal taxes on qualified dividends and long-term capital gains. State taxes may still apply, but even in states with higher tax rates, paying no federal taxes remains a huge benefit. They are especially useful in retirement because they provide a source of regular and predictable income.

Line 1a of the 1099-DIV will list the amount of ordinary dividends you have and line 1b will list your qualified dividends. This form is for people who receive dividends from a trust, estate, partnership, LLC or S corporation. It’s also possible you get a Schedule K-1 if you invest in a fund or exchange-traded fund that operates as a partnership. However, even if you get a Schedule K-1, you will get a 1099-DIV reporting the dividends you received. Use our Free Tax Tools, including our Tax Calculator, to estimate your taxes or determine eligibility for tax credits. Get your taxes done with eFile.com; the app will help select and complete any applicable tax forms, report information, determine any tax deductions, and report dividends and gains properly. A mutual fund is an investment company that buys and sells assets to earn profit for itself and its investors.

Effective tax rates on dividends will now range from negative to over 30% depending on income level and different provincial tax rates and credits. Starting 2006, the Government introduced the concept of eligible dividends.

Stocks are a good long-term investment even during periods of market volatility. Complete the form below and NerdWallet will share your information with Facet Wealth so they can contact you. Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. A foreign company’s stock that can be easily traded on a major U.S. stock market. Therefore, the income thresholds for 2020 were slightly lower, as you can see here. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

For certain preferred stock, the security must be held for 91 days out of the 181-day period beginning 90 days before the ex-dividend date. They replace the old 1040, Form 1040-EZ, and Form 1040-A. These lines and entries refer to the 2019 tax form that you’ll file in 2020.

Non-dividend distributionscan reduce your cost basis in the stock by the amount of the distribution. Ordinary dividends are more common, and they should be clearly designated as such. This tactic also helps move money out of your estate, so that future appreciation on those shares won’t be subject to the estate tax limits when you die.

If you receive over $1,500 of taxable ordinary dividends, you must report these dividends on Schedule B , Interest and Ordinary Dividends. Your employer withholds taxes from your paycheck and sends them to the IRS on your behalf — but there’s usually nobody doing the same with your dividends. Your tax software or a qualifiedtax procan help calculate how much that is and when to pay.

If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Your consent to receive calls/texts is not a condition of purchase.

In Belgium there is a tax of 30% on dividends, known as “roerende voorheffing” or “précompte mobilier” . In 2003, President George W. Bush proposed the elimination of the U.S. dividend tax saying that “double taxation is bad for our economy and falls especially hard on retired people”. He also argued that while “it’s fair to tax a company’s profits, it’s not fair to double-tax by taxing the shareholder on the same profits.”

Fidelity does not make any warranties with regard to the information, content or software products or the results obtained by their use. Fidelity disclaims any liability arising out of your use of these TaxAct software products or the information or content furnished by TaxAct. The use of the TurboTax branded tax preparation software and web-based products is governed by Intuit’s applicable license agreements. Intuit, the Intuit logo, TurboTax and TurboTax Online, among others, are registered trademarks and/or service marks of Intuit Inc. in the United States and other countries and are used with permission. Intuit is not affiliated with Fidelity Brokerage Services or their affiliates.

The most common dividends are the distributions of profit that a corporation pays to its shareholders. Dividends are most frequently distributed as cash, but they may also come in the form of stocks, stock options, debt payments, property, or even services.

Ordinary dividends are the most common type of dividend and are usually paid out from the earnings of a corporation. Generally, any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated. Depending on the type of account that holds your dividend-paying stocks, you might pay taxes on your dividend income. Below, we’ll go into the details on how that income gets taxed and some of the preferential tax treatment that’s often available for dividends.