Content

But it is important to know about this filing status, because it comes with some great tax benefits for those who qualify. For example, this is a great filing status for single parents! Alot of folks think that you can file for this status if you are married and this is not the case. You have to be single, or unmarried, with a dependent child or children to qualify.

Again, they cannot have gross incomes in excess of $4,200. Second, you need to have paid more than half the costs of keeping up a home for the year. That includes your rent or mortgage payment, property taxes, utilities, repairs, maintenance and groceries. You can’t include things like clothing, life insurance or transportation. Receiving child support or alimony doesn’t prevent you from claiming head of household as long as you’re paying more than 50% of your household costs from your own income or savings.

The head of household filing status allows you to choose the standard deduction even if your spouse chooses to itemize deductions. See Head of Household, later, for more information. Under the rules explained earlier for children of divorced or separated parents , your son is treated as the qualifying child of his father, who can claim the child tax credit for him. Because of this, you can’t claim the child tax credit for your son. except you and your son’s father both claim your son as a qualifying child.

For 2019 and 2020, he can file as a qualifying widower. After 2020, he can file as head of household if he qualifies. You may be eligible to file as head of household even if the child who is your qualifying person has been kidnapped. You can claim head of household filing status if all the following statements are true. Your mother, who you claim as a dependent, lived in an apartment by herself.

If these people work for you, you can’t claim them as dependents. The person either must be related to you in one of the ways listed under Relatives who don’t have to live with you, or must live with you all year as a member of your household2 . The child must not have provided more than half of his or her own support for the year. All the requirements for claiming a dependent are summarized in Table 5. See Table 4 to see who is a qualifying person.

Your unmarried son lived with you all year and was 18 years old at the end of the year. He didn’t provide more than half of his own support and doesn’t meet the tests to be a qualifying child of anyone else. As a result, he is your qualifying child and, because he is single, your qualifying person for head of household purposes. You can generally change to a joint return any time within 3 years from the due date of the separate return or returns. A separate return includes a return filed by you or your spouse claiming married filing separately, single, or head of household filing status.

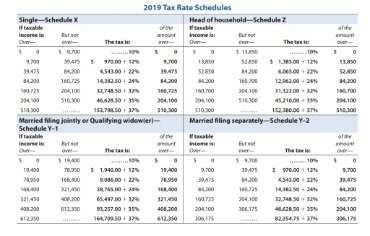

Head Of Household Tax Rates

The other parent lives in your home with your son for 10 consecutive days while you are in the hospital. Your son is treated as living with you during this 10-day period because he was living in your home. If a child is emancipated under state law, the child is treated as not living with either parent. In the company of the parent, when the child doesn’t sleep at a parent’s home .

Also, the person doesn’t need to be related to the spouse who provides support. Your 2-year-old son lives with your parents and meets all the tests to be their qualifying child.

If one itemizes deductions, the other should itemize because he or she won’t qualify for the standard deduction. See Persons not eligible for the standard deduction, earlier. Even if your itemized deductions are less than your standard deduction, you can elect to itemize deductions on your federal return rather than take the standard deduction.

(They can still be your Qualifying Person if the only reason you cannot claim them is that you can be claimed as a dependent on someone else’s return). A Qualifying Person is someone who qualifies you to file as Head of Household if they lived with you in your home for more than half the year, not counting temporary absences.

The statement should include the form number of the return you are filing, the tax year, and the reason your spouse can’t sign, and it should state that your spouse has agreed to your signing for him or her. Both of you may be held responsible, jointly and individually, for the tax and any interest or penalty due on your joint return. This means that if one spouse doesn’t pay the tax due, the other may have to.

An HOH must pay for more than one-half of the cost of a qualifying person’s support and housing costs. The HOH must also pay more than one-half of the rent or mortgage, utilities, repairs, insurance, taxes, and other costs of maintaining the home where the qualifying person lives for more than half the year. The home must be the taxpayer’s own home unless the qualifying person is the taxpayer’s parent and the home is the property of that parent. It is easy to file as Head of Household on eFile.com.

Head Of Household

A child isn’t your qualifying relative if the child is your qualifying child or the qualifying child of any other taxpayer. The facts are the same as in Example 1 except your AGI is $25,000 and your mother’s AGI is $21,000. Your mother can’t claim your son as a qualifying child for any purpose because her AGI isn’t higher than yours. If only one of the persons is the child’s parent, the child is treated as the qualifying child of the parent. The other person can’t take any of these benefits based on this qualifying child. In other words, you and the other person can’t agree to divide these tax benefits between you. You don’t meet the support test for this person to be either your qualifying child or your qualifying relative.

You don’t want to be responsible for any taxes due if your spouse doesn’t have enough tax withheld or doesn’t pay enough estimated tax. Both you and your spouse must include all of your income and deductions on your joint return. Your child is required to file a return for 2020 unless you make this election.

If you support your mother or father, but they lived in a home for the elderly, you may still be able to claim them as a Qualifying Person for the Head of Household filing status. You must have paid more than half the cost of keeping up the home in which they lived for the entire year. If your parent lived in a nursing home for example, you are considered to have kept up their main home, if you paid more than half of the cost of them living there. First, you have to be unmarried or considered unmarried on the last day of the tax year.

You provided more than half of their total support for the year. There are three specific guidelines the IRS expects you to meet to qualify as a head of household . A breadwinner is the primary or sole income earner in a household. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Considered Unmarried

If you do this, your child won’t have to file a return. To make this election, all of the following conditions must be met. If you had income from Guam, the Commonwealth of the Northern Mariana Islands, American Samoa, or the U.S. Virgin Islands, special rules may apply when determining whether you must file a U.S. federal income tax return. In addition, you may have to file a return with the individual possession government. If you are a bona fide resident of Puerto Rico for the whole year, your U.S. gross income doesn’t include income from sources within Puerto Rico. It does, however, include any income you received for your services as an employee of the United States or any U.S. agency.

Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. Based in the Kansas City area, Mike specializes in personal finance and business topics. He has been writing since 2009 and has been published by “Quicken,” “TurboTax,” and “The Motley Fool.” In 2017, heads of household were entitled to a $9,350 standard deduction. Of course, if you itemize your deductions, the standard deduction increase won’t matter.

- You must have paid more than half the cost of keeping up the home in which they lived for the entire year.

- You can claim each of them as dependents if all the other tests to do so are met.

- If you file a separate return, you generally report only your own income, credits, and deductions.

- Qualifying costs include expenses like rent or mortgage interest payments—although not the principal portion of your mortgage payments because that’s paying back your loan.

- A dependent must also file if one of the situations described in Table 3 applies.

except you are only 18 years old and didn’t provide more than half of your own support for the year. This means you are your mother’s qualifying child. If she can claim you as a dependent, then you can’t claim your daughter as a dependent because of the Dependent Taxpayer Test, explained earlier. If no parent can claim the child as a qualifying child, the child is treated as the qualifying child of the person who had the highest AGI for the year. The custodial parent can revoke a release of claim to an exemption. You can’t claim any dependents if you, or your spouse if filing jointly, could be claimed as a dependent by another taxpayer. You may be eligible to file as a qualifying widow even if the child who qualifies you for this filing status has been kidnapped.

The IRS considers you unmarried if you are single, divorced or legally separated. Your spouse can’t have live with you during the last six months of the tax year and you need to file separate tax returns. A temporary separation won’t count towards Head of Household status.

The Qualifying Dependent Test

Go to IRS.gov/IdentityTheft, the IRS Identity Theft Central webpage, for information on identity theft and data security protection for taxpayers, tax professionals, and businesses. If your SSN has been lost or stolen or you suspect you’re a victim of tax-related identity theft, you can learn what steps you should take. Go to IRS.gov/Forms to view, download, or print all of the forms, instructions, and publications you may need. You can also download and view popular tax publications and instructions (including the Instructions for Forms 1040 and 1040-SR) on mobile devices as an eBook at IRS.gov/eBooks. Or you can go to IRS.gov/OrderForms to place an order. You may also be able to access tax law information in your electronic filing software.

Your gross income was at least $5 and your spouse files a separate return and itemizes deductions. You must file an income tax return for a decedent if both of the following are true.

TAS works to resolve large-scale problems that affect many taxpayers. If you know of one of these broad issues, please report it to them at IRS.gov/SAMS. TAS is an independent organization within the IRS that helps taxpayers and protects taxpayer rights. Their job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. Apply for an online payment agreement (IRS.gov/OPA) to meet your tax obligation in monthly installments if you can’t pay your taxes in full today. Once you complete the online process, you will receive immediate notification of whether your agreement has been approved. Download the official IRS2Go app to your mobile device to check your refund status.