Content

The restaurant must distribute the service charge to the servers, report it as wages, and withhold income and Social Security taxes. Employees receive allocated tips from their employers if the business gets less than 8 percent of gross sales from tips.

Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. As a result, it’s possible that the hourly wages on your paycheck might not cover the taxes you owe on the tips you already took home. If that happens, you can make a tax payment through your employer or have your employer take it out of your next paycheck.

- H&R Block Audit Representation constitutes tax advice only.

- E-file fees do not apply to NY state returns.

- he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

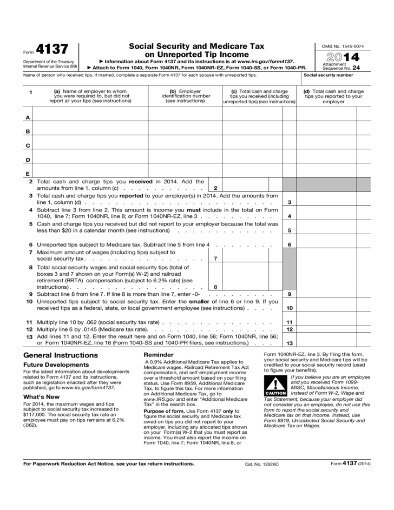

- First, you must report all unreported tips—even if under $20—which are subject to the Medicare tax.

This $20 limit is calculated for each employer separately if you work for more than one employer. You wouldn’t have to report your tips to either employer if you earned $19 from one job and $15 from another because neither amount exceeds $20. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU.

What Is The Average Pay For A Bartender At A Restaurant?

These additional charges your employer adds to a customer’s bill do not constitute tips as they are service charges. These service charges are non-tip wages and are subject to social security tax, Medicare tax, and federal income tax withholding.

The only issue for the appeals court was whether the IRS could use the aggregate method to assess the employer’s share of FICA taxes. The taxpayer contended that the IRS first had to individually determine the tips each employee had underreported. In limited circumstances, some employers that have either a Gaming Industry Tip Compliance Agreement or a Tip Rate Determination Agreement may receive an extension beyond January 1, 2014. The IRS determined that employers participating in the GITCA Program or participating in a TRDA related to gaming may request one additional GITCA or TRDA contract term before the IRS applies Q&A 1 of Revenue Ruling . Voluntary tip compliance agreements have been established by the IRS for industries where tipping is customary such as the restaurant industry and casinos.

Other tips not reported to the employer must also be reported on Form 4137. However, you do not need to report tips allocated to you by your employer on your federal income tax return if you have adequate records to show that you received less tips in the year than the allocated amount. Likewise, if box 8 on your W-2 shows allocated tips, you must also file a Form 4137.

Treatment Of Amounts As Service Charges

All cash and non-cash tips an received by an employee are income and are subject to Federal income taxes. All cash tips received by an employee in any calendar month are subject to social security and Medicare taxes and must be reported to the employer. If the total tips received by the employee during a single calendar month by a single employer are less than $20, then these tips are not required to be reported and taxes are not required to be withheld. Tips also include tips received by both directly and indirectly tipped employees. If the total tips reported by all employees at a large food or beverage establishment are less than 8 percent of the gross receipts , then employer must allocate the difference among the employees who receive tips.

An employer may distribute service charges (sometimes referred to as “auto-gratuities”) collected from customers as it chooses and to any employee it chooses. The employer also has the option of retaining all or part of the service charges. Regardless of whether the service charges are distributed to employees, these amounts are gross income to the employer. In an examination, the IRS may ask the employer to demonstrate how sales subject to service charges are distinguished from sales subject to tipping. Examiners may ask for Point of Sale records, such as their summary reports regarding their sales transactions.

These tips will appear in box 8 of your Form W-2. Your employer must assume that you made at least 8% in tips and report this income to the IRS. They should report the difference if you’ve reported less than 8%, or the entire 8% if you’ve reported no tip income at all. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Offer valid for tax preparation fees for new clients only.

This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting.

Tips are not gross income to the employer. Tips reported to the employer by the employee must be included in Box 1 , Box 5 , and Box 7 of the employee’s Form W-2, Wage and Tax Statement. Enter the amount of any uncollected social security tax and Medicare tax in Box 12 of Form W-2. For more information, see the General Instructions for Forms W-2 and W-3. Satisfaction Guaranteed — or you don’t pay.

Employees who receive tips of less than $20 in a calendar month aren’t required to report their tips to employers, but are still required to report the amounts as income on their tax returns. IRS rules require the reporting of tips to your employer no less frequently than once a month. The employer is supposed to withhold income, Medicare and Social Security taxes from the amount, and include the amount in the W-2 that you receive in January of the next year. If you don’t make enough in wages for the employer to withhold the correct amount, then you are supposed to give the employer a portion of the tips so he can do the withholding.

You can use your daily log instead of the amount reported as allocated tips if your allocated tips are more than what’s recorded in your daily log, but be prepared for a lot of mail from the IRS and a tip audit. Keep your daily record of tips with your tax return so you’re ready when and if an IRS auditor asks to see your records.

How Do I Add The Tip Income To My Total Income Amount?

Servers in the restaurant industry depend on tips as a large part of their compensation for a tiring and often thankless job. Of course, the Internal Revenue Service is always watching for any signs of taxable income — and expects full disclosure of cash tips on the part of restaurant employees, as well as employers. The paperwork can be tedious and paying taxes is no fun, but the alternative approach — hiding your tip income — carries some dangerous risks.

Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account.

You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. OBTP# B13696 ©2020 HRB Tax Group, Inc.

A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period.

By entering some basic information about your employer and the amount of tips received, the program will automatically fill in this form and calculate your taxes for you. First, you should understand what is considered a tip and keep a daily log of these tips. Discretionary payments determined by a customer and received from those customers are tips. You don’t have to report service charges as tips, and you only need to report your portion of any pooled tips.

Looking For More Information?

Fees apply if you have us file a corrected or amended return. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge.

Audit services constitute tax advice only. Consult an attorney for legal advice. Find out if pension income, which is a source of retirement income from an employer, is taxed in this post from H&R Block. NerdWallet strives to keep its information accurate and up to date.

They must be reported for Social Security and Medicare tax deductions. Ask your employer how they calculated your allocated tips if you didn’t keep a record of your tip income. Ask to see computer records, daily or weekly sales reports, or other information that would show your sales and your tips. You’ll have to proceed very carefully and start keeping your own daily records to protect yourself if your employer refuses to share this information with you.

Learn more about the capital gains tax exemption on the sale of a home with the experts at H&R Block. If you report less than your share, you should be prepared to answer questions about it. File with a tax Pro At an office, at home, or both, we’ll do the work. Tipped workers typically make money via both a set hourly wage and tips. If you have to share or pool your tips, keep daily records of what you actually net.

Employers are also required to withhold taxes (including income taxes and the employee’s share of social security tax and Medicare tax) based upon wages and tip income received by the employee and to deposit this tax. In addition, employers are required to pay the employer share of social security and Medicare taxes based on the total wages paid to tipped employees as well as the reported tip income. This information and tax is finally reported to the IRS on the appropriate forms by the employer. Employees who receive cash tips of $20 or more in a calendar month are required to report the total to their employers. These employees must provide written reports by the tenth of the following month.

Tax Bracket Calculator

Revenue Ruling was effective immediately upon publication and was applicable retroactively. To the extent that Q&A 1 is applied without retroactive effect, an employer will not be required to pay any additional taxes. Employees must keep a daily record of tips received. You can use Form 4070A, Employee’s Daily Record of Tips, included in Publication 1244. In addition to the information asked for on Form 4070A, you also need to keep a record of the date and value of any noncash tips you get, such as tickets, passes, or other items of value. Although you do not report these tips to your employer, you must report them on your tax return. For tips that employees do not report to the employer, the employer’s liability for the its share of FICA taxes doesn’t arise until the IRS issues a “Section 3121 Notice and Demand.”

All prices are subject to change without notice. H&R Block tax software and online prices are ultimately determined at the time of print or e-file.