Content

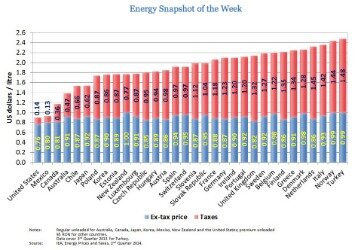

The countywide miles were then distributed amongst the licensed drivers in the county, which gave us the miles driven per licensed driver. Using the nationwide average fuel economy, we calculated the average gallons of gas used per driver in each county and multiplied that by the fuel tax. SmartAsset’s interactive map highlights the counties with the lowest tax burden. Scroll over any county in the state to learn about taxes in that specific area. You’ll notice that the brackets vary depending on whether you are single, married or a head of household.

Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. One state program can be downloaded at no additional cost from within the program.

Here’s why you need a W-2 and how it is used. Deciding on the exact number can be tricky. If you’re using last year’s tax software or IRS forms, make sure there haven’t been significant changes to the rules or the tax rates that would affect your situation. What you may not know is that it’s not a one-time thing. You can submit a revised W-4 form to your employer whenever you want. Managing how much your employer withholds through your W-4 form will give you a better shot at owing no taxes come April.

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. For example, if you fall into the 25% tax bracket, a $1,000 deduction saves you $250. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office.

Education Credit & Deduction Finder

That continues for each tax bracket up to the top of your taxable income. Find yours with our helpfultax bracket calculator. For tax purposes, your adjusted gross income or AGI is essentially your total or gross income minus eligible deductions.

That means you’re probably not getting a tax refund, and will instead owe the government money when you file your tax return. If your gross income was less than $10,000, you may not have to file a federal income tax return. But you may still want to file if you worked during 2020 and your employer withheld tax from your paycheck. Filing a tax return — even if you’re not required to do so — is the only way to get any tax you’re owed refunded to you. There are multiple ways to reduce the amount of tax you owe, such as taking deductions or credits that reduce the amount of income on which you’ll pay federal income tax. Historically, Americans who met income requirements have been able to lower their adjusted gross income — which helps determine taxable income — by taking personal exemptions. Estimating a tax bill starts with estimating taxable income.

What Are Tax Exemptions?

The tax resolution companies referenced herein are not law firms nor are such representations being made. They may or may not have a specialized degree in taxation or be individually licensed in your particular state. Tax Defense Network is a MoneySolver company. We help solve tax problems and get life back on track.

- If you don’t have enough tax withheld, you could be subject to underpayment penalties.

- All the lower tax brackets also apply to the portions of your income that fall within those brackets – the 10% rate applies to the first $9,875 of your taxable income, 12% to the next $30,249 and so on.

- A financial advisor can help you understand how taxes fit into your overall financial goals.

- There are multipletax breaks for parents, including the child tax credit.

- You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance.

- If you just barely avoided entering a higher tax bracket this year and think you might be a borderline case next year, make sure to follow the IRS’s inflation adjustment announcements closely.

Learn everything you need to know about how filing status impacts your tax return and refund. Your tax filing status makes a big difference in your tax return when you file. For example, if during 2020 you decide to prepare your 2017 tax return; then you must use 2017 tax forms, schedules and instructions.

Financial Services

This transcript will only cover a single tax year and might not include any tax penalties, interest, or additional charges. ” Use one of these four easy methods to find out.

If you mistakenly file using the forms for a different tax year, the IRS is likely to notify you of the error. Deciding how to take your deductions — that is, how much to subtract from your adjusted gross income, thus reducing your taxable income — can make a huge difference in your tax bill. But making that decision isn’t always easy. Dependents can make you eligible for a variety of tax breaks, such as the Child Tax Credit, Head of Household filing status and other deductions or credits. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials.

But if you receive unemployment benefits from a private fund that you voluntarily contribute to, it’s only federally taxable if the benefits you receive exceed the amount you paid into the fund. How much you can deduct depends on a number of factors, including when you took out your mortgage, and you must itemize deductions on Schedule A to take this deduction. A number of deductions and credits are available and each has its own eligibility requirement.

The tools are also useful if you just want to know how much you will owe or receive in 2021 when you file or e-file your your 2020 Tax Return. This will help us estimate how much you’ve already paid in taxes this year. If you don’t have a paystub, we can still give you an estimate. Generally, unemployment income is taxable as income at the federal level and may be at the state level, too, depending on where you live.

Find tax calculators and other information by tax year below to prepare for current, future, or past tax years. Use these to plan for future tax returns or prepare a past tax return. File a previous year return to reduce or pay off and tax penalties you may have accrued. See a high-level overview of many different tax deductions that might save you money or even increase your tax refund! Additionally, find ways to save money during the year or save directly on taxes.

The higher the income you report on your tax return, the higher your tax rate. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. Calculating your penalties and interest will provide you with a more accurate estimate of what you need to pay. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

You can calculate what you owe in back taxes fairly accurately without even contacting the IRS. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. You probably noticed your tax refund changing based on the life events you selected from the tax calculator. Different life events from getting married, going back to school, or growing your family can increase or decrease your taxes. If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return. Check or money order payments may take up to 3 weeks to appear in your account.

The Electronic Federal Tax Payment System

Description of benefits and details at hrblock.com/guarantees. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Small Business Small business tax prep File yourself or with a small business certified tax professional.

All prices are subject to change without notice. Our free tax calculator is a great way to learn about your tax situation and plan ahead. But we can also help you understand some of the key factors that affect your tax return estimate in 2021. We then added the dollar amount for income, sales, property and fuel taxes to calculate a total tax burden. Finally, each county was ranked and indexed, on a scale of 0 to100. The county with the lowest tax burden received a score of 100 and the remaining counties in the study were scored based on how closely their tax burden compares.

However, that taxpayer would not pay that rate on all $50,000. The rate on the first $9,875 of taxable income would be 10%, then 12% on the next $30,250, then 22% on the final $9,875 falling in the third bracket. This is because marginal tax rates only apply to income that falls within that specific bracket.

H&R Block employees, including Tax Professionals, are excluded from participating. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only.

Don’t take that completed tax return and your debt at face value, at least not if you prepared your return yourself. You can get an automatic extension to file your tax return by submitting Form 4868 to the IRS. This gives you until Oct. 15 to thoroughly review and double check your return. You do not need in-depth tax knowledge to use our free tax calculator.