Content

The cost of medical treatment that affects any part of the body is also considered a qualified expense. Several tax incentives are available for you to save money on medical care costs. If you make additional contributions to your account for 2020, a new 5498-SA form will be generated within a few days and will be available online for you to utilize with your tax return. And what happens when you make a post-tax contribution to your HSA? Don’t worry you will receive those tax benefits at tax time when you file your income taxes.

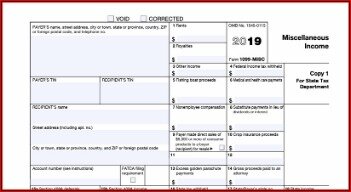

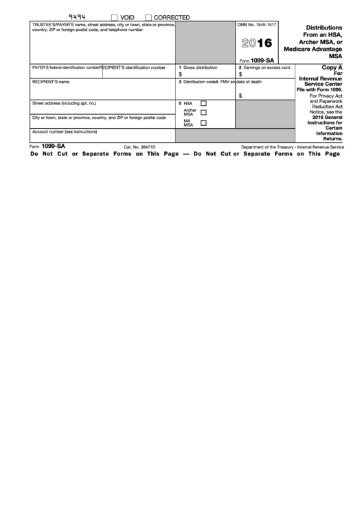

The IRS requires Form 1099-SA to be issued to an HSA beneficiary who took out a distribution from his health or medical savings account in the past year. You receive a 1099-SA form if you must report distributions from health savings, medical savings, and Medicare Advantage accounts. If you get a distribution code No. 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. That means you must report some of the distribution on your tax return.

If you are 65 or older or enrolled in Medicare, you can use your HSA for nonmedical expenses without incurring a tax penalty. Those distributions will be treated like retirement income and will be subject to normal income tax. Please use the information in your 1099-SA form, available online, to fill out IRS tax form 8889.

If you made excess contributions to an HSA or Archer MSA and had earnings on those contributions, taxes will apply. Furthermore, a 6% excise tax for each year is imposed on you for excess individual and employer contributions that remain in the account. Receiving Form 1099-SA means that depending on which distributions you received from which accounts, there are certain tax forms you will have to file. Fortunately, if you have an HSA, Archer MSA, or MA MSA, it probably saved you taxes. Distributions from these accounts are reported to you on Form 1099-SA. The form also provides reporting information on the inheritance of accounts by spouses, non-spouses, and estates.

A. If you contribute more than the allowable amount, you will have to count the extra amount as taxable income, and the IRS may have you pay a 6 percent excise tax on the excess contributions. This tax applies to each tax year the excess contribution remains in the account. Certain scenarios, such as distributions of excess contributions, will generate a second 1099 form for the account. Please note this form is informational only and does not need to be filed with your income tax return.

1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4/1/19 through 4/17/19. 93% of TaxSlayer Pro respondents reported that they continue to use TaxSlayer Pro software after switching.

The plan provider selects a financial institution that holds the savings account, where Medicare deposits the funds. The financial institution, the payer, will issue a 1099-SA at the end of the year listing the total MSA distribution amount. Health savings accounts are individuals accounts offered or administered by Optum BankÒ, Member FDIC, and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties. This communication is not intended as legal or tax advice. It’s actually pretty easy you basically need to know about 3 IRS Forms, linked to health savings accounts. This box shows the earnings on any excess contributions distributed from an HSA or Archer MSA by the due date of the income tax return.

Get More With These Free Tax Calculators And Money

Flexible spending accounts and health reimbursement accounts are administered by OptumHealth Financial Services and are subject to eligibility and restrictions. The content on this website is not intended as legal or tax advice. Federal and state laws and regulations are subject to change. If you do make excess contributions, you can prevent being penalized by completing an Excess Contribution and Deposit Correction Request Form to have excess funds returned to you. This and other account forms are available after you sign in. A. In addition to the forms noted above, keep track of your spending in case you have to prove you used funds for qualified medical expenses.

For more information, please visit our IRS Guidelines and Eligible Expenses page. Form 1099-LTC is used by individual taxpayers to report long-term care benefits to the IRS, including accelerated death benefits. The financial institution that manages the account is responsible for sending you a copy of Form 1099-SA. If you haven’t received one and believe you should have, contact it. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund.

Distributions from these medical savings accounts that are used to pay for qualifying health expenses are generally tax-free. Archer MSA is a tax-free trust or custodial health savings account held at a financial institution or an insurance company.

It’s up to you to keep track of your expenses and report any funds you use for nonqualified medical expenses. When distributions have been used for allowed medical expenses, no tax penalty is incurred and the amount of distribution is simply recorded. Keeping careful records of HSA fund usage throughout the year can be helpful to ensure that money is spent on qualified charges. If you inherited the account from someone who wasn’t your spouse, you must report as income on your tax return the fair market value of the account as of the date of death. Report the amount on your tax return for the year the account owner died, even if you received the distribution from the account in a later year.

Related Documents Available From The Irs Website

If you make contributions to one of these accounts, you stand to save a significant amount of money in taxes both in the short and long term. Not only can you deduct contributions you make to your account in the year made, but the unspent balances can rollover indefinitely from year to year.

Health Savings Accounts help individuals put tax-free money aside to cover their health insurance deductibles and other medical expenses, such as co-pays, prescriptions and medical bills. At the end of the year, the institution that holds the HSA will send Form 1099-SA to the beneficiary. The IRS requires HSA to be set up with a qualified trustee, such as a bank, an insurance company or anyone who is approved by the IRS to be a trustee of IRAs and HSAs. Form 1099-SA, Distributions from HSA, Archer MSA, or Medicare Advantage MSA, will list the institution that keeps the recipient’s health savings account as payer. IRS form 1099-SA reports distributions from health savings accounts and medical savings accounts .

While health savings accounts were created by the federal government, states can choose to follow the federal tax treatment guidelines or establish their own. HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-free with very few exceptions. Please consult a tax advisor regarding your state’s specific rules. Form 1099-Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or 529 plan. None of the money received from these plans is taxable if it is spent on “qualified” medical expenses. If the money you withdraw exceeds your qualified medical expenses, however, the excess is subject to income tax.

Hsa Tax Resources And Information

You can still contribute the prorated IRS contribution limit until the IRS contribution deadline. Once you enroll in Medicare, you can keep the account open and continue to use funds already in the account. Please consult with a qualified tax or legal professional if advice is needed regarding your specific situation. Individual accountholders age 55 and older can make an additional $1,000 catch-up contribution. Eligible spouses over 55 can only make catch-up contributions to his/her account. IRS contribution limits for individual and family plans typically increase every year. Plus, individual accountholders age 55 and older can make an additional $1,000 catch-up contribution.

You won’t receive a 5498-SA form if you didn’t have contributions and your balance was zero dollars at the end of the year. IRS Form 8889 is used to report HSA contributions, distributions and your tax deductions.

Occasionally, there may be accidental use of HSA or MSA funds on ineligible expenses. While those expenses may, in fact, be medical in nature, they may not be covered due to specific coverage exclusions.

Eligibility Requirements For Company Hsa Plans

A. The money you contribute to your HSA is tax-deductible up to the annual contribution limit. For example, if you are in the 28 percent tax bracket and deposit $3,000 into your HSA, you could save $840 in federal income taxes. Money you take out of your HSA to pay for qualified medical expenses is tax-free. The 2020 tax forms that you may need for your health savings account are now available online. Sign in to your account to easily view and download your forms.

- When it comes time to file your end-of-year income tax return, your HSA provider will send you a 1099-SA listing the amount you spent, so you can include that information with your tax return.

- According to the last-month rule, if you are an eligible individual on the first day of the last month of your tax year (Dec. 1 for most taxpayers), you are considered an eligible individual for the entire year.

- If you elected to receive paper documents, you will receive this form in the mail.

- Please consult with a qualified tax or legal professional if advice is needed regarding your specific situation.

As an HR Advisor at Zenefits, Lauren provides guidance and best practices to companies of all sizes with any HR and compliance questions. In her spare time, she enjoys reading and chasing her three dogs around. According to the last-month rule, if you are an eligible individual on the first day of the last month of your tax year (Dec. 1 for most taxpayers), you are considered an eligible individual for the entire year. Therefore, you are treated as having the same HDHP coverage for the entire year as you had on the first day of that last month. If you should lose your health insurance, you are required to prorate the contribution limits for the months in which you had insurance. Please contact your tax professional with any tax-related questions.

If you elected to receive paper documents, you will receive this form in the mail. IRS Form 1099-SA is provided for each HSA distribution you made in the current tax year. You will receive a separate 1099-SA for each type of distribution made during the tax year. The five distribution types are 1) normal; 2) excess contribution removal; 3) death; 4) disability; and 5) prohibited transaction. You will receive the IRS Form 1099-SA and IRS Form 5498-SA either by mail or electronically . These IRS tax forms are also available in the Member Website. Only certain individuals are eligible to contribute to an HSA or MSA.

A 1099-SA is a U.S. tax form that reports distributions made from a health savings account , Archer medical savings account , or Medicare Advantage medical savings account . Its purpose is to show you how much money you spent from your account. For example, if you were to fall and break your wrist, you might use money from your HSA to pay for your medical bills. When it comes time to file your end-of-year income tax return, your HSA provider will send you a 1099-SA listing the amount you spent, so you can include that information with your tax return.

The distribution may have been paid directly to a medical service provider or to the account holder. File Form 8889 or Form 8853 with your Form 1040 or 1040-SR to report a distribution from these accounts even if the distribution isn’t taxable. The payer isn’t required to compute the taxable amount of any distribution. A. You can get copies of your most recent tax forms by signing in to your account online and viewing the “Statements and Docs” section.

If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. If you have forgotten your username or password to access your account, go toiu.nyhart.comand click on the respective “Forgot username” link or “Forgot password” link. From there enter the email address associated with your online Nyhart account, then clickContinue. Nyhart will email you a link to a page where you can create a new password.

These receipts and records do not need to be sent to Nyhart or to the IRS with your tax return. Gusto’s mission is to create a world where work empowers a better life. By making the most complicated business tasks simple and personal, Gusto is reimagining payroll, benefits and HR for modern companies.

The financial institution managing the account files Copy A with the IRS, sends you Copy B, and retains Copy C. You should receive Form 1099-SA in the mail. You do not need to submit it when you file your tax return, but you should hold onto it for your records. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.