If your tax situation is more complex, you will need to provide information on dependents, your spouse’s earnings, additional income, and any tax credits and deductions you plan to claim. A withholding tax is a tax that is withheld from employees’ wages and paid directly to the government by the employer. You’ll save time (and stress!) if you gather and organize all the supporting documents required to file your taxes. This means your W-2 or 1099s, student loan interest information, and a slew of other documents, depending on your financial situation.

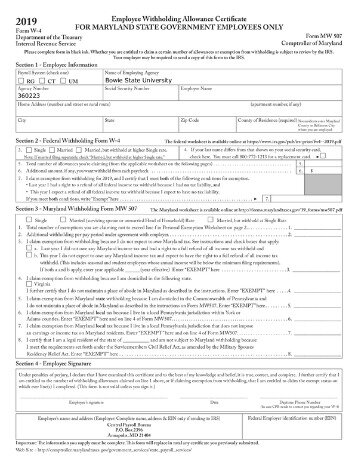

Your employer also withholds additional money to pay your Federal Insurance Contributions Act taxes, which covers Social Security and Medicare. Social Security and Medicare taxes are statutory percentages , however, and aren’t impacted by the information you include on the W-4. If your situation is a little more complicated that what’s included on this worksheet, complete the additional worksheets on page 2 of the form W-4 . You’ll want to complete these worksheets if you itemize your tax return, claim certain credits, or if you have a family with two wage earners or if you have more than one job.

If you were to have claimed zero allowances, your employer would have withheld the maximum amount possible. Although tax allowances were an essential aspect of helping people increase or reduce the size of their paychecks, that option was removed from the 2020 W-4 form. However, you can still adjust your paycheck by claiming extra deductions or withholding. The 2020 W-4 form won’t use allowances, but you can complete other steps for withholding accuracy. If you happen to have a second job, you’ll need to complete the additional steps.

File with a tax Pro At an office, at home, or both, we’ll do the work. The answer to this question comes down to whether your stimulus check increases your “provisional income.” Don’t be surprised by an unexpected tax bill on your unemployment benefits. Know where unemployment compensation is taxable and where it isn’t. For deductions, it’s important to note that you should only enter deductions other than the basic standard deduction on Line 4. So, you can include itemized deductions on this line. If you take the standard deduction, you can also include other deductions, such as those for student loan interest and IRAs.

Taxes On Unemployment Benefits: A State

Allowances were previously loosely tied to personal and dependent exemptions claimed on your tax form. Although the standard deduction was doubled as a result of the TCJA, personal and dependent exemptions were eliminated. You want to complete the form accurately so the correct amount of income tax is withheld from your paychecks; otherwise, you might end up owing the IRS when you file your taxes.

These graphs are separated out by filing status, so you’ll need to select the correct graph based on how you file your taxes. The left column lists dollar amounts for the higher-earning spouse, and the top row lists dollar amounts for the lower-earning spouse. The 2020 version of the W-4 form eliminates the ability to claim personal allowances. It was the first major revamp of the form since the Tax Cuts and Jobs Act was signed in December 2017; TCJA made major changes to withholding for employees. That’s the tax form called a W-4 Employee’s Withholding Certificate that your employer hands you when you start a new job. A tax refund is a state or federal reimbursement to a taxpayer who overpaid taxes.

If you have dependents, fill out step three to determine your eligibility for the Child Tax Credit and credit for other dependents. Single taxpayers who make less than $200,000 or those married filing jointly who make less than $400,000 are eligible for the Child Tax Credit. If you have three or more jobs combined, between yourself and your spouse, you will need to fill out the second part of the Multiple Jobs Worksheet. First, select your highest paying job and second highest paying job. Use the graphs on page 4 to figure the amount to add to line 2a on page 3. This step is the same as the example above, except you’re using the second-highest paying job as the “lower-paying job.” In order to accurately fill in line 1, you’ll need to use the graphs provided on page four of Form W-4.

Step 5: Sign The Form

This section allows you to have any additional tax you want withheld from your pay each pay period, including any amounts from the Multiple Jobs Worksheet, above, if this applies to you. In this section, the IRS wants to know if you want an additional amount withheld from your paycheck.

Nonetheless, you should note that you still need to settle the tax liability by filing your tax return at the end of the tax year. That helps the IRS understand the amount of tax owed compared to the amount of tax you’ve paid throughout the year. The IRS also offers an interactive W-4 withholding calculator on its website. The calculator automatically makes adjustments if it appears that you’re eligible for tax credits, and it accommodates more than one income if you’re married and planning to file a joint return. If you receive government payments, such as social security or unemployment income, you can use this voluntary form to ask the payer to withhold federal income tax.

Fill out this section if you expect to claim deductions other than the standard deduction and want to reduce your withholding. To estimate your 2020 deductions use the Deductions Worksheet provided on page three of the W-4 form.

We think it’s important for you to understand how we make money. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Knowing how many W-4 allowances to claim isn’t necessarily as simple as tallying up how many people you’re supporting. And the number of allowances you claim has a big impact on whether you’ll owe on Tax Day or can expect a refund.

However, do not include the standard deduction amount itself. It could be “a source of error if folks just put in their full amount,” warns Isberg. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries.

It has five sections to fill out versus the seven sections from the pre-2020 version. A W-4 form is completed by employees to let employers know how much tax to withhold from their paycheck. A mistake some people often make is assuming they can only claim as many allowances as the number of children they have.

Tax & Business Services

Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. Available at participating offices and if your employer participate in the W-2 Early AccessSM program. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

However, there are much easier and more accurate ways to fill out the form.

Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Fees apply if you have us file a corrected or amended return. In 2020, each withholding allowance you claim reduces your taxable income by $4,300. If you claim more allowances than you have a reasonable basis for, the IRS can penalize you.

- The IRS hopes that the new form will be easier for employees to understand.

- Like previous income tax withholding tables, there are two methods for calculating federal income tax withholding—percentage and wage bracket methods.

- This document is used to report the necessary information related to your tax situation, and employers use this to calculate how much federal income tax to withhold from each of your paychecks.

- Know where unemployment compensation is taxable and where it isn’t.

- Previously, you could think of an allowance as a person.

- Born and raised in metro Atlanta, Amanda currently lives in Brooklyn.

Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. No cash value and void if transferred or where prohibited. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. With other retirement plans, you might need to file a form with the payer to stop required withholding.

As of 2020, all you have to do is provide your name, address, Social Security number, filing status, and sign and date the form. You complete a W-4 form so that your employer will withhold the correct amount of income tax from your paychecks. You must file a new Form W-4 with your employer whenever your personal or financial situation changes (e.g., you get married, you have a baby, or your spouse enters or leaves the workplace). The new withholding allowances go into effect no later than the first payroll period ending 30 days after you give the revised form to your employer. The more tax allowances you claim, the less income tax will be withheld from a paycheck, and vice versa. A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee’s paycheck.

To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. Since your circumstances might change from time to time, it’s important to review your tax withholding allowances on a regular basis. What if I receive another tax form after I’ve filed my return?