Content

Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns. State e-file available for $19.95.

Small Business Small business tax prep File yourself or with a small business certified tax professional. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely.

Tax Law Changes

Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit.

All tax situations are different. Fees apply if you have us file a corrected or amended return. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers.

Over 10 Million Federal And State Returns Filed This Year

Additional feed may apply from SNHU. Timing is based on an e-filed return with direct deposit to your Card Account. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings® account.

There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. State restrictions may apply. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable.

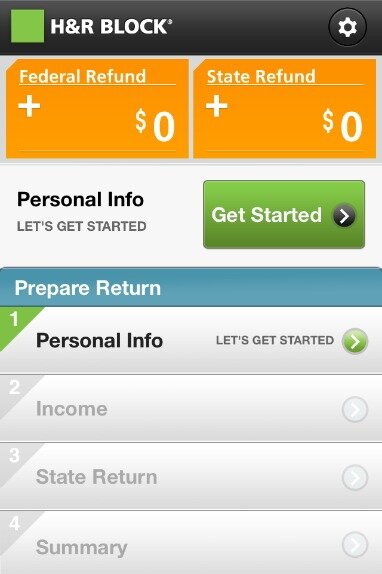

That is why our helpful online tax preparation program works with you to make the filling process as pain-free as possible. Many filers can use our online tax software to electronically file their taxes in less than 15 minutes.

- You don’t need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.

- Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

- Mass.gov® is a registered service mark of the Commonwealth of Massachusetts.

- Offer valid for tax preparation fees for new clients only.

- It makes preparation a breeze and its an easy format to follow for beginners.

- The Internal Revenue Service will open the IIT 2020 e-file season on February 12, 2021.

Students will need to contact WGU to request matriculation of credit. Additional fees may apply from WGU. A listing of additional requirements to register as a tax preparer may be obtained by contacting CTEC at P.O. Box 2890, Sacramento, CA ; or at Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000.

Why Efile Com?

CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. The Check-to-Card service is provided by Sunrise Banks, N.A.

For those with a simple tax situation. We take security seriously. Protecting your tax information when you’re filing and when you’re finished is our top priority, always. Skip-the-line phone & email support. Southern New Hampshire University is a registered trademark in the United State and/or other countries. H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit.

Several software companies offer FREE e-file services to qualified Michigan taxpayers. If you do not qualify to file for FREE, you may also e-file for a small fee. Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations.

H&R Block’s Free Online tax filing service gives you more for free than TurboTax Free Edition. Parents, employees, and students, in particular will appreciate all of the fast, easy features that make doing taxes a breeze. Taxes can be confusing, overwhelming, and even intimidating – but selecting an online tax preparation service shouldn’t be. Compare eFile.com vs. H&R Block® vs. TurboTax®. We’ll review your tax return and search 350+ tax deductions and credits to make sure you get every dollar you deserve, guaranteed, based on your unique situation. Use commercial tax prep software to prepare and file your taxes. Four electronic filing options for individual taxpayers are listed below.

If you have a driver’s license or state issued identification card, please provide the requested information from it. Your return will not be rejected if you do not have a driver’s license or state-issued identification.

Max Refund Guarantee¹

We offer full featured online tax software at a significant discount to other programs. Free federal and MA tax preparation & e-file for all who live in MA with an Adjusted Gross Income of $32,000 or less. This offer is limited to three free tax returns per computer. Massachusetts taxpayers have many e-file options available to choose from – including free filing options . Check below to see if you qualify to file your federal and state returns for free. It’s important that you use the links on this page to connect you to the free software options.

See Online and Mobile Banking Agreement for details. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation.