Content

Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment.

If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. If you were entitled to claim your son as a dependent, but chose not to, he can claim the nonrefundable portion of the education credits. However, he can’t claim the tuition and fees since you were entitled to claim it. Outside of the tuition and fees tax break, there are several solid tax breaks you can take if you’re either a college student or the parents of a college student looking for a tax break or two before filing with the IRS.

Looking For More Information?

You are an accountant and you have met the minimum educational requirements of your employer. Your employer later changes the minimum educational requirements and requires you to take college courses to keep your job. These additional courses can be qualifying work-related education because you have already satisfied the minimum requirements that were in effect when you were hired.

- You can deduct only 50% of the cost of your meals while traveling away from home to obtain qualifying work-related education.

- After you filed your return, you received a refund of $4,000.

- The following expenses must be required for enrollment or attendance of a designated beneficiary at an eligible postsecondary school.

- The excise tax doesn’t apply if excess contributions made during are distributed before the first day of the sixth month of the following tax year .

This means that if the minimum requirements change after you were hired, any education you need to meet the new requirements can be qualifying education. If you stop working for a year or less in order to get education to maintain or improve skills needed in your present work and then return to the same general type of work, your absence is considered temporary. Education that you get during a temporary absence is qualifying work-related education if it maintains or improves skills needed in your present work. If your education isn’t required by your employer or the law, it can be qualifying work-related education only if it maintains or improves skills needed in your present work. This could include refresher courses, courses on current developments, and academic or vocational courses. You are a teacher who has satisfied the minimum requirements for teaching.

However, she did receive an account statement from the lender that showed the following 2020 payments on her outstanding loan of $10,625 ($10,000 principal + $625 accrued but unpaid interest). An eligible student is a student who was enrolled at least half-time in a program leading to a degree, certificate, or other recognized educational credential. Qualified education expenses generally don’t include expenses that relate to any course of instruction or other education that involves sports, games, or hobbies, or any noncredit course. However, if the course of instruction or other education is part of the student’s degree program or is taken by the student to acquire or improve job skills, these expenses can qualify. Certain educational institutions located outside the United States also participate in the U.S.

If Judy excludes the scholarship from income, she will be deemed to have applied the scholarship to pay for tuition, required fees, and course materials. Only $3,000 of the $4,500 tuition she paid in 2020 could be used when figuring her 2020 lifetime learning credit. Her lifetime learning credit would be reduced to $600 and her tax liability after credits would be $1,006.

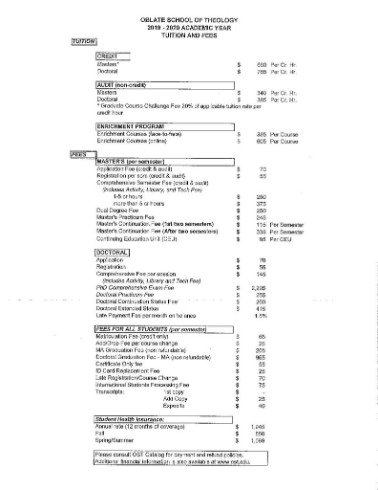

Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. The tax credit limit is $2,500 paid out for typical college costs like tuition, administrative fees, and textbooks, among other qualified costs. Claim the tax credit using IRS Form 8863, and make sure to include the college or university’s employer identification number when you complete your tax forms. This deduction is available to taxpayers who paid tuition and other required fees for attending college or another post-secondary school.

Beatrice knows that tax-free treatment will be available if she applies her $800 Coverdell ESA distribution toward her $1,000 of qualified education expenses for high school. The qualified expenses are greater than the distribution, making the $800 Coverdell ESA distribution tax free. A Coverdell ESA is a trust or custodial account created or organized in the United States only for the purpose of paying the qualified education expenses of the Designated beneficiary of the account.

Tax Tips For Parents Who Send Children To Private School

Glenda enrolls on a full-time basis in a degree program for the 2021 spring semester, which begins in January 2021. Glenda pays her tuition for the 2021 spring semester in December 2020.

This means your expenses must be allowed under the rules for qualifying work-related education explained earlier. You can’t deduct the cost of travel as a form of education even if it is directly related to your duties in your work or business. Whether a trip’s purpose is mainly personal or educational depends upon the facts and circumstances. An important factor is the comparison of time spent on personal activities with time spent on educational activities.

$2,000 for each designated beneficiary.What if more than one Coverdell ESA has been opened for the same designated beneficiary? The annual contribution limit is $2,000 for each beneficiary, no matter how many Coverdell ESAs are set up for that beneficiary.What if more than one individual makes contributions for the same designated beneficiary? The annual contribution limit is $2,000 per beneficiary, no matter how many individuals contribute.Can contributions other than cash be made to a Coverdell ESA? No contributions can be made to a beneficiary’s Coverdell ESA after he or she reaches age 18, unless the beneficiary is a special needs beneficiary. The actual amount charged if the student is residing in housing owned or operated by the school. The allowance for room and board, as determined by the school, that was included in the cost of attendance for a particular academic period and living arrangement of the student.

How To Claim Education Deductions And Credits On Efile Com

The interest (5% simple) on this loan accrued while she completed her senior year and for 6 months after she graduated. The loan is payable over 60 months, with a payment of $200.51 due on the first of each month, beginning November 2020. U.S. savings bond interest that you exclude from income because it is used to pay qualified education expenses. An educational institution must meet the above criteria only during the academic period for which the student loan was incurred.

Independent students and parents can qualify for the American Opportunity Tax Credit if they paid for qualified education expenses used for undergraduate courses. But the amount you’re allowed to claim depends on your modified adjusted gross income . In order to get the full $2,500 credit, your MAGI cannot be higher than $90,000 (or over $180,000 if you’re filing a joint tax return. No tax is due on a distribution from a QTP unless the amount distributed is greater than the beneficiary’s adjusted qualified education expenses. Someone who is at least a half-time student, room and board may also qualify. States may establish and maintain programs that allow you to either prepay or contribute to an account for paying a student’s qualified education expenses at a postsecondary institution. Eligible educational institutions may establish and maintain programs that allow you to prepay a student’s qualified education expenses.

Information Menu

For most taxpayers, MAGI is the adjusted gross income as figured on their federal income tax return. In 2020, Jackie paid $3,000 for tuition and $5,000 for room and board at University X. The university didn’t require her to pay any fees in addition to her tuition in order to enroll in or attend classes.

In this example, your reduced student loan interest deduction is $1,250 ($2,500 − $1,250). Your reduced student loan interest deduction is $400 ($800 − $400). Table 4-2 shows how the amount of your MAGI can affect your student loan interest deduction.

Documents, such as transcripts, course descriptions, catalogs, etc., showing periods of enrollment in educational institutions, principal subjects studied, and descriptions of educational activity. If you are a qualified performing artist, or a state government official who is paid in whole or in part on a fee basis, you can deduct the cost of your qualifying work-related education as an adjustment to gross income. Under an accountable plan, if your expenses equal your reimbursement, you don’t complete Form 2106. Because your expenses and reimbursements are equal, you don’t have unreimbursed work-related education expenses. While on sabbatical leave granted for travel, you traveled through France to improve your knowledge of the French language. You chose your itinerary and most of your activities to improve your French language skills.

Jackie doesn’t report any portion of the scholarship as income on her tax return. Ethan obtained a qualified student loan to attend college. After graduating from college, the first monthly payment on his loan was due in December.