As a business owner, you have many options for paying yourself, but each comes with tax implications. A business entity formed under a Federal or State statute if the statute describes or refers to the entity as a joint stock association. A few types of businesses generally cannot be LLCs, such as banks and insurance companies. Check your state’s requirements and the federal tax regulations for further information.

However, before making a decision, it’s important to understand the basics of an S corp and what changes may be in store for your business if you decide tochoose this status. You’ll use this information to file your Schedule C on your personal tax return. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan.

Federal Llc Taxes

If you decide to make a corporate tax election for the LLC, the IRS will treat your business as a separate taxpayer in the same way you are a separate taxpayer from your friend. As a result, the business is solely responsible for reporting all income and deductions on Form 1120 each year and paying the appropriate income tax by the deadline. LLCs benefit from pass-through taxation by default, meaning that the LLC’s profits pass directly to the members and are reported on the members’ tax returns. Multi-member LLCs with no business activity do not have to file a partnership return unless the LLC wishes to claim any expenses. An S corporation allows the member of a company to save on taxes. It is a tax classification with specific rules that can be beneficial to your company if your business earnings are significant.

Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Offer valid for tax preparation fees for new clients only.

Bplans is owned and operated by Palo Alto Software, Inc., as a free resource to help entrepreneurs start and run better businesses. Write your business plan with the #1 online business planning tool. We are not a law firm, or a substitute for an attorney or law firm.

Open An Llc

The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office.

- After you hit the “pause” button on your business, it might seem counterintuitive to file a business tax return.

- Find out what you need to look for in an applicant tracking system.

- Contact The Doyle Law Offices at or fill out the form below.

- However, if it did not receive any income during the year AND did not have any expenses that it will claim as deductions, then it is not required to file a return.

Use of our products and services are governed by ourTerms of Use andPrivacy Policy. One of the biggest issues a small business owner must face is whether to incorporate and if so, when. Your choice will likely come down to cost and the level of liability protection you need. You aren’t required to use any particular title, but you do need to make sure that the title you choose is appropriate and doesn’t mislead anyone. Don’t confuse S corporations with an LLC. On your Form 1040, you’ll include the information from your K-1 on Schedule E, supplemental income. A Limited Liability Company is a business structure allowed by state statute.

A state-chartered business entity conducting banking activities if any of its deposits are insured by the FDIC. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities. Most states also permit “single-member” LLCs, those having only one owner. While I make every effort to furnish accurate and updated information, I do not guarantee that any information contained in this website is accurate, complete, reliable, current or error-free. I assume no liability or responsibility for any errors or omissions in its content.

Pay

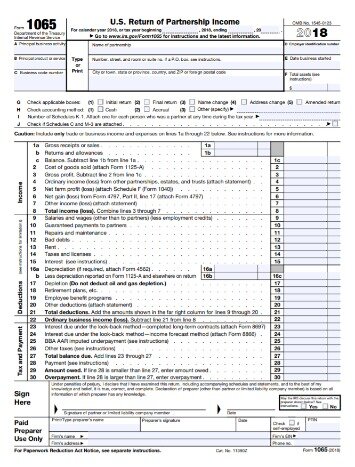

It will also need to submit form K-1 for each member of the LLC, which includes each partner’s share of income, deductions, and credits. If you don’t make a choice, by default your LLC will be taxed as a sole proprietorship or partnership. But not to worry, the below section covers the income tax requirements for all three types. For additional information on the kinds of tax returns to file, how to handle employment taxes and possible pitfalls, refer to Publication 3402, Tax Issues for Limited Liability Companies. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Thus, an LLC with multiple owners can either accept its default classification as a partnership, or file Form 8832 to elect to be classified as an association taxable as a corporation.

Check out these alternative options for popular software solutions. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses.

However, if you are the sole owner of the LLC, then you must pay tax on business profits as if you were a sole proprietor. Both designations have different tax filing rules. If you prefer the tax filing rules of a corporation, then you have the option to elect corporate tax treatment by filing IRS Form 8832. Once you make this election, you cannot change the LLC designation again for five years. If you operate your business using a limited liability company , then you have more flexibility in choosing how the IRS taxes your business earnings.

Paying Self

This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. Plan, fund, and grow your business Achieve your business funding goals with a proven plan format.

Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. File with a tax Pro At an office, at home, or both, we’ll do the work.

The penalty for late filing of the partnership return is $195 per partner per month or part of a month for which the partnership information return is filed late, with the penalty capped at 12 months. However, LLCs can elect to be taxed as a corporation to avoid self-employment tax, receive potential tax deductions, and look overall more appealing to investors. Single-member LLCs with no business activity do not have to file their LLC income on Schedule C, but may have to report any other non-LLC self-employment income on Schedule C. As a business, you are able to deduct certain expenses from your taxes.

A limited liability company is a form of business organization recognized by all states. Forming an LLC provides limited liability protection for owners (called “members”), who are taxed at their personal tax rates.

estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit. Use of for Balance is governed by the H&R Block Mobile and Online Banking Online Bill Payment Agreement and Disclosure.